Region:Middle East

Author(s):Rebecca

Product Code:KRAA5337

Pages:98

Published On:September 2025

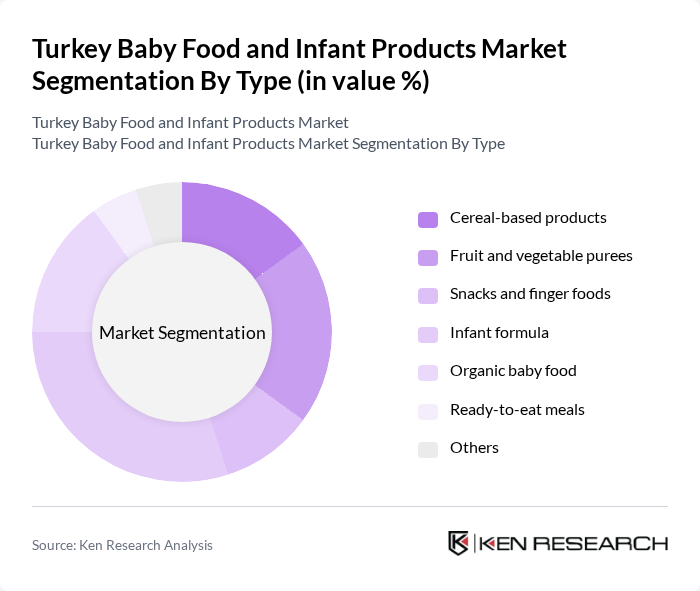

By Type:The market is segmented into various types of baby food products, including cereal-based products, fruit and vegetable purees, snacks and finger foods, infant formula, organic baby food, ready-to-eat meals, and others. Among these, infant formula is the leading sub-segment due to its essential role in infant nutrition, especially for working parents who prefer convenient feeding options. The increasing trend towards organic products is also notable, as health-conscious parents seek natural and chemical-free options for their children.

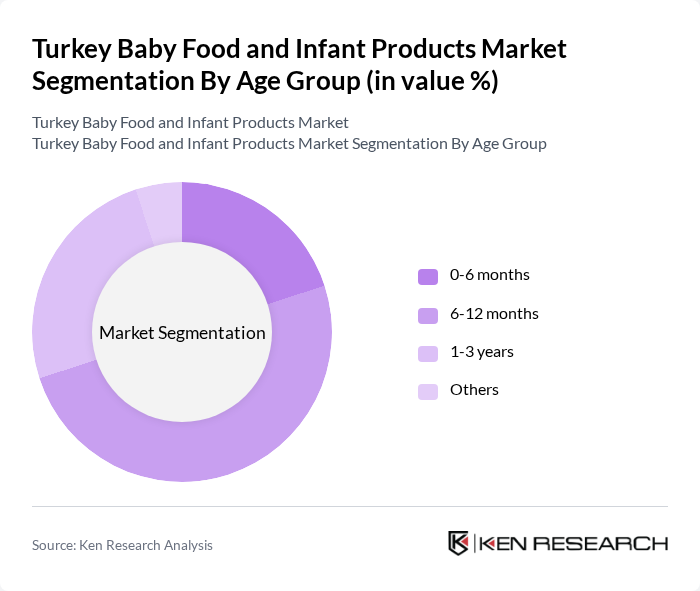

By Age Group:The market is also segmented by age group, including 0-6 months, 6-12 months, 1-3 years, and others. The 6-12 months age group dominates the market, as this is a critical period for introducing solid foods to infants. Parents are increasingly looking for nutritious and easy-to-digest options during this stage, leading to a higher demand for products tailored to this age group. The trend towards organic and natural ingredients is particularly strong among parents of children in this age range.

The Turkey Baby Food and Infant Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Türkiye A.?., Danone S.A., Abbot Laboratories, Hero Group, Bebem Mamas? A.?., P?nar Süt Mamülleri Sanayi A.?., Nutricia, HIPP GmbH & Co. Vertrieb KG, Organik Mama, Bebelac, Alete, Gerber Products Company, Tetra Pak, Unilever, Y?ld?z Holding A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey baby food and infant products market is poised for significant transformation driven by evolving consumer preferences and technological advancements. As parents increasingly seek organic and natural options, the demand for clean-label products is expected to rise. Additionally, the integration of e-commerce platforms will enhance accessibility, allowing brands to reach a broader audience. Innovations in packaging and product formulation will further cater to health-conscious consumers, ensuring that the market remains dynamic and responsive to changing trends in infant nutrition.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereal-based products Fruit and vegetable purees Snacks and finger foods Infant formula Organic baby food Ready-to-eat meals Others |

| By Age Group | 6 months 12 months 3 years Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pharmacies Specialty Stores Others |

| By Packaging Type | Jars Pouches Tetra Packs Cans Others |

| By Price Range | Economy Mid-range Premium Others |

| By Brand Loyalty | Brand loyal customers Price-sensitive customers First-time buyers Others |

| By Nutritional Content | High-protein Low-sugar Fortified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Food Sales | 150 | Store Managers, Category Buyers |

| Infant Product Manufacturers | 100 | Product Development Managers, Marketing Directors |

| Pediatric Health Professionals | 80 | Pediatricians, Nutritionists |

| Consumer Insights on Baby Food | 200 | Parents, Caregivers |

| Market Trends in Organic Baby Food | 70 | Health-conscious Parents, Organic Product Advocates |

The Turkey Baby Food and Infant Products Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and increased awareness of infant nutrition among parents.