Region:Europe

Author(s):Rebecca

Product Code:KRAA3842

Pages:96

Published On:September 2025

By Type:The market is segmented into various types of digital health wearables, including fitness trackers, smartwatches, medical wearables, smart clothing, wearable ECG monitors, sleep trackers, hearables, and others. Among these, fitness trackers and smartwatches are the most popular due to their multifunctionality and user-friendly interfaces. The increasing trend of health consciousness among consumers has led to a significant rise in the adoption of these devices. The market also reflects strong demand for medical wearables such as glucose monitors and pulse oximeters, driven by chronic disease management and preventive healthcare initiatives.

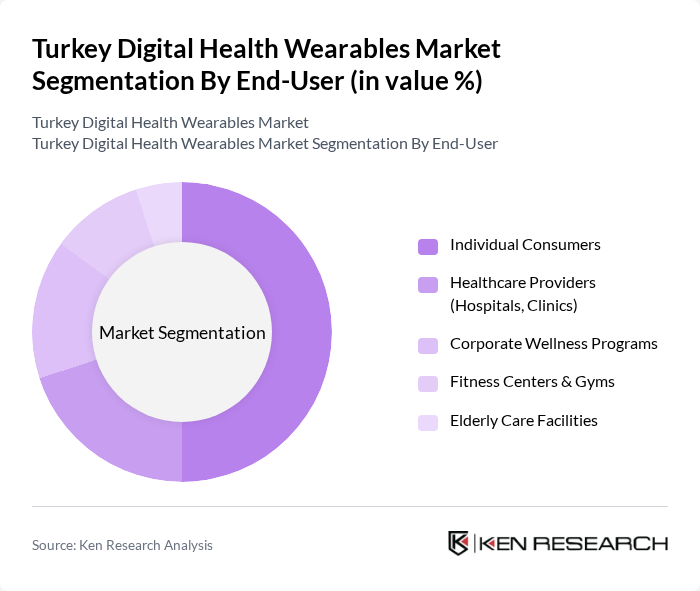

By End-User:The end-user segmentation includes individual consumers, healthcare providers, corporate wellness programs, fitness centers, and elderly care facilities. Individual consumers dominate the market as they increasingly seek personal health management solutions. The growing trend of fitness and wellness among the general population has led to a surge in demand for wearables that cater to personal health tracking. Healthcare providers are also expanding their use of wearables for remote patient monitoring and chronic disease management, supported by regulatory and infrastructure advancements.

The Turkey Digital Health Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitbit Inc., Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Withings S.A., Philips Healthcare, Medtronic plc, OMRON Corporation, Polar Electro Oy, Whoop Inc., Suunto, AliveCor, Inc., BioTelemetry, Inc., Vestel Elektronik Sanayi ve Ticaret A.?., Arçelik A.?., Biyomod Medical Devices, Tiga Healthcare Technologies, CardioID Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital health wearables market in Turkey appears promising, driven by technological advancements and increasing health awareness. As the government continues to support digital health initiatives, the integration of wearables with telehealth services is expected to enhance patient engagement. Furthermore, the growing emphasis on preventive healthcare will likely lead to a surge in demand for personalized health monitoring solutions, positioning Turkey as a key player in the digital health landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smartwatches Medical Wearables (e.g., glucose monitors, blood pressure monitors, pulse oximeters) Smart Clothing Wearable ECG Monitors Sleep Trackers Hearables (Ear-worn Devices) Others |

| By End-User | Individual Consumers Healthcare Providers (Hospitals, Clinics) Corporate Wellness Programs Fitness Centers & Gyms Elderly Care Facilities |

| By Application | Health Monitoring (vital signs, chronic disease management) Fitness & Activity Tracking Disease Management (diabetes, cardiovascular, respiratory, etc.) Emergency Response & Fall Detection Sleep & Stress Management |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (electronics stores, pharmacies) Direct Sales (B2B, healthcare procurement) B2B Sales (corporate, institutional) |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established International Brands Leading Turkish Brands Emerging Brands & Startups Private Labels |

| By User Demographics | Age Groups (children, adults, elderly) Gender Income Levels Urban vs. Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Wearables | 120 | Health-conscious Individuals, Fitness Enthusiasts |

| Healthcare Provider Insights | 60 | Doctors, Nurses, Health Technologists |

| Market Trends in Digital Health | 50 | Healthcare Analysts, Market Researchers |

| Fitness Industry Perspectives | 40 | Personal Trainers, Gym Owners |

| Regulatory Impact Assessment | 40 | Policy Makers, Health Regulators |

The Turkey Digital Health Wearables Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing health awareness, chronic disease prevalence, and technological integration in healthcare.