Region:Europe

Author(s):Rebecca

Product Code:KRAB5372

Pages:88

Published On:October 2025

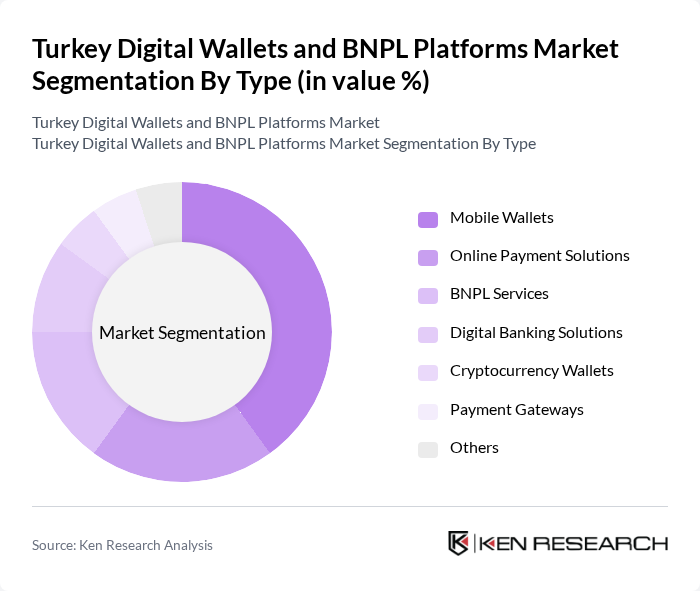

By Type:The market is segmented into various types, including Mobile Wallets, Online Payment Solutions, BNPL Services, Digital Banking Solutions, Cryptocurrency Wallets, Payment Gateways, and Others. Among these, Mobile Wallets have emerged as the leading sub-segment due to their convenience and widespread acceptance among consumers. The increasing smartphone penetration and the growing trend of contactless payments have further fueled the adoption of mobile wallets.

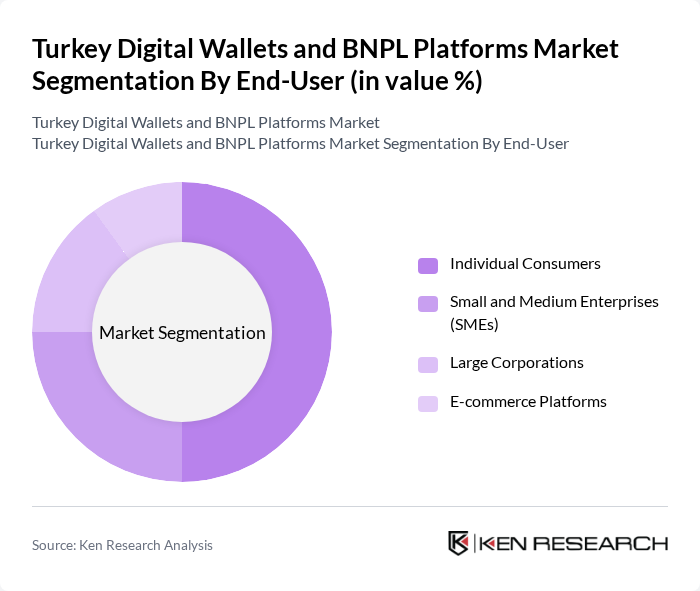

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and E-commerce Platforms. Individual Consumers dominate the market, driven by the increasing preference for digital payments and the convenience offered by BNPL services. The rise of e-commerce has also led to a significant increase in the number of consumers utilizing digital wallets for online purchases.

The Turkey Digital Wallets and BNPL Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayU, iyzico, Papara, BKM Express, Hepsipay, Garanti BBVA, Ziraat Bank, QNB Finansinvest, Turkcell, Vodafone Turkey, Akbank, ?? Bankas?, Yap? Kredi, DenizBank, TEB contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital wallets and BNPL platforms appears promising, driven by technological advancements and changing consumer behaviors. The integration of AI for enhanced security and personalized services is expected to gain traction, improving user experience. Additionally, as financial literacy initiatives expand, more consumers will likely embrace digital payment solutions. The market is poised for growth, with increasing partnerships between fintech companies and traditional retailers, enhancing accessibility and convenience for users across various demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Solutions BNPL Services Digital Banking Solutions Cryptocurrency Wallets Payment Gateways Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations E-commerce Platforms |

| By Payment Method | Credit Card Payments Debit Card Payments Bank Transfers Direct Carrier Billing |

| By Distribution Channel | Online Platforms Mobile Applications Retail Outlets Partner Networks |

| By Consumer Demographics | Age Groups Income Levels Urban vs Rural |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Consumer Protection Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Wallet Users | 150 | Consumers aged 18-45, frequent online shoppers |

| BNPL Service Users | 100 | Consumers who have utilized BNPL services in the last 12 months |

| Fintech Industry Experts | 50 | Analysts, consultants, and executives in the fintech sector |

| Retail Sector Stakeholders | 80 | Retail managers and e-commerce directors using digital payment solutions |

| Regulatory Bodies | 30 | Officials from financial regulatory authorities in Turkey |

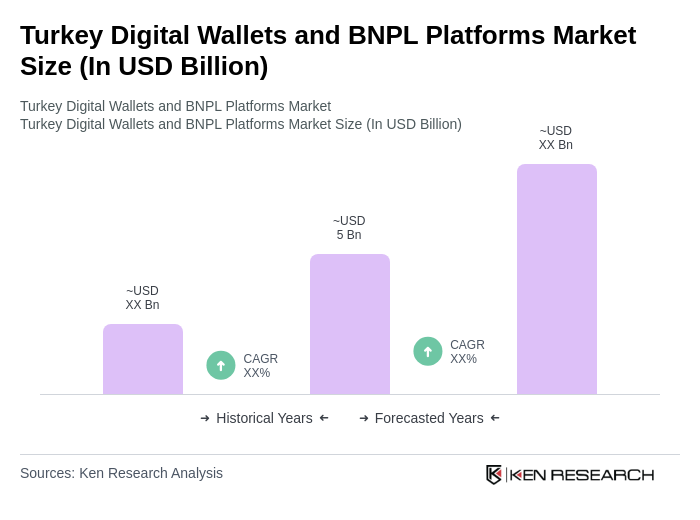

The Turkey Digital Wallets and BNPL Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a surge in e-commerce activities.