Region:Europe

Author(s):Geetanshi

Product Code:KRAA0210

Pages:100

Published On:August 2025

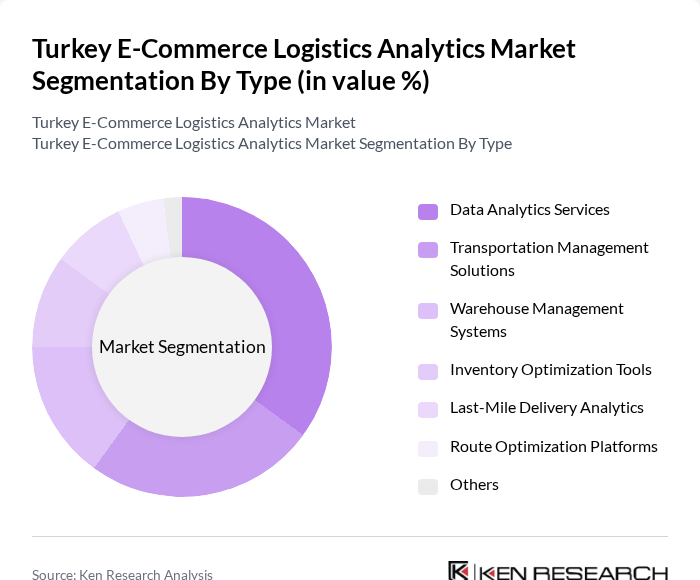

By Type:The market is segmented into various types, including Data Analytics Services, Transportation Management Solutions, Warehouse Management Systems, Inventory Optimization Tools, Last-Mile Delivery Analytics, Route Optimization Platforms, and Others. Among these, Data Analytics Services are leading due to the increasing need for data-driven decision-making in logistics. Companies are leveraging analytics to optimize their supply chains, enhance customer experiences, and reduce operational costs. The adoption of automated warehousing, AI-powered inventory management, and real-time route optimization platforms is accelerating, reflecting the sector’s focus on efficiency and customer-centricity .

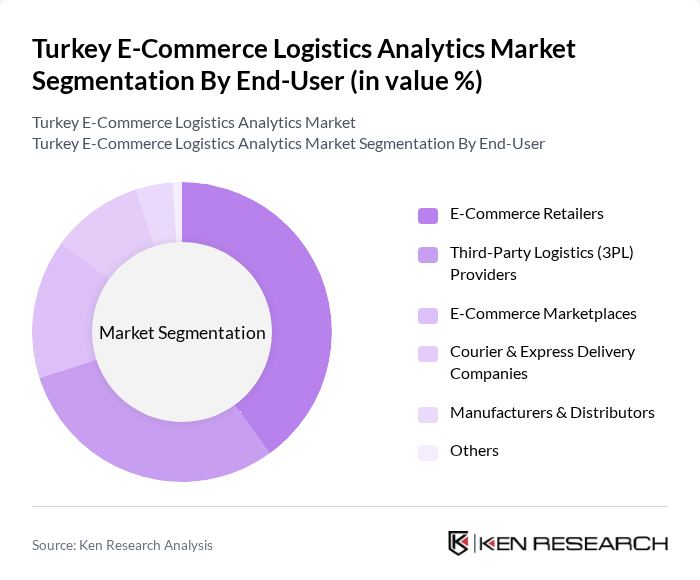

By End-User:The end-user segmentation includes E-Commerce Retailers, Third-Party Logistics (3PL) Providers, E-Commerce Marketplaces, Courier & Express Delivery Companies, Manufacturers & Distributors, and Others. E-Commerce Retailers dominate this segment as they increasingly rely on logistics analytics to enhance their supply chain efficiency and customer satisfaction. The growing trend of online shopping has led retailers to invest in analytics solutions to streamline their operations. Third-party logistics providers and courier companies are also rapidly adopting analytics platforms to optimize delivery routes and improve service reliability .

The Turkey E-Commerce Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trendyol, Hepsiburada, N11, PTT Kargo, Aras Kargo, Yurtiçi Kargo, MNG Kargo, Sürat Kargo, Getir, Amazon Turkey, DHL Express Turkey, UPS Turkey, FedEx Turkey, DFDS Turkey, Ekol Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The Turkey e-commerce logistics analytics market is poised for significant transformation as businesses increasingly adopt advanced technologies. The integration of AI and machine learning will enhance predictive analytics capabilities, allowing companies to optimize inventory management and improve delivery times. Additionally, the focus on sustainability will drive innovations in green logistics solutions, aligning with consumer preferences for environmentally friendly practices. These trends will shape the competitive landscape, fostering a more efficient and responsive logistics ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Analytics Services Transportation Management Solutions Warehouse Management Systems Inventory Optimization Tools Last-Mile Delivery Analytics Route Optimization Platforms Others |

| By End-User | E-Commerce Retailers Third-Party Logistics (3PL) Providers E-Commerce Marketplaces Courier & Express Delivery Companies Manufacturers & Distributors Others |

| By Delivery Model | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery Cross-Border Delivery Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT-Enabled Devices & Sensors Artificial Intelligence & Machine Learning Blockchain Platforms Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas International Markets Others |

| By Customer Segment | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) Government & Public Sector Others |

| By Service Type | Fulfillment Services Last-Mile Delivery Services Freight & Linehaul Services Returns Management Services Warehousing & Inventory Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 70 | Logistics Coordinators, Delivery Managers |

| E-commerce Fulfillment Strategies | 60 | Operations Directors, Supply Chain Analysts |

| Returns Management Processes | 50 | Customer Service Managers, Returns Analysts |

| Warehouse Automation Technologies | 40 | IT Managers, Warehouse Operations Heads |

| Consumer Behavior in E-commerce Logistics | 45 | Market Researchers, Consumer Insights Analysts |

The Turkey E-Commerce Logistics Analytics Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the expansion of the e-commerce sector, increased internet penetration, and the demand for efficient logistics solutions.