Region:Europe

Author(s):Shubham

Product Code:KRAA0888

Pages:86

Published On:August 2025

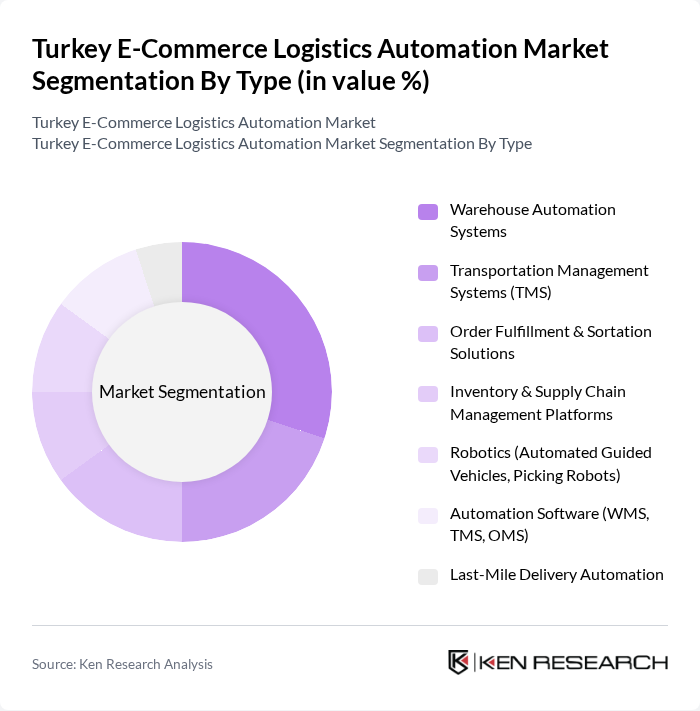

By Type:The market is segmented into various types, including Warehouse Automation Systems, Transportation Management Systems (TMS), Order Fulfillment & Sortation Solutions, Inventory & Supply Chain Management Platforms, Robotics (Automated Guided Vehicles, Picking Robots), Automation Software (WMS, TMS, OMS), and Last-Mile Delivery Automation. Among these, Warehouse Automation Systems are currently leading the market due to the increasing need for efficient inventory management, rapid order processing, and the integration of robotics and IoT technologies in e-commerce fulfillment centers .

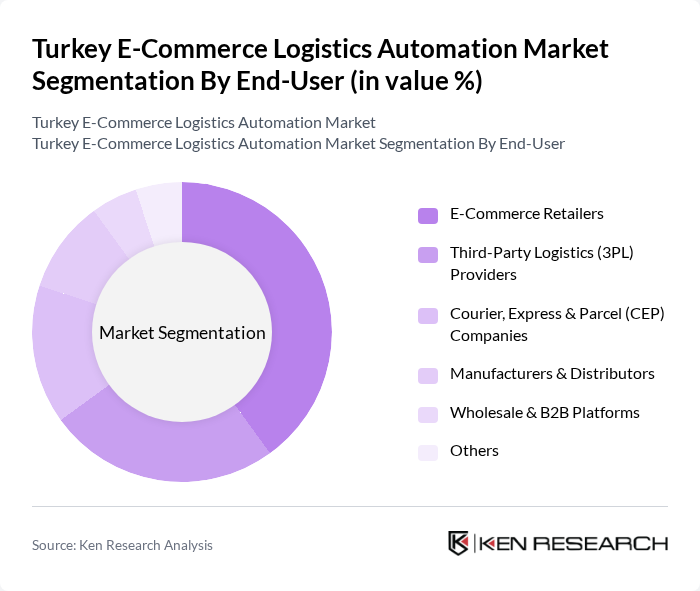

By End-User:The end-user segmentation includes E-Commerce Retailers, Third-Party Logistics (3PL) Providers, Courier, Express & Parcel (CEP) Companies, Manufacturers & Distributors, Wholesale & B2B Platforms, and Others. E-Commerce Retailers are the dominant end-users, driven by the need for efficient logistics solutions to meet the growing consumer demand for quick and reliable delivery services, as well as the increasing adoption of automation to handle high order volumes and optimize last-mile delivery .

The Turkey E-Commerce Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, Hepsijet, Trendyol Express, Getir, PTT Kargo, DHL Express Turkey, UPS Turkey, FedEx Turkey, Sürat Kargo, Ekol Logistics, Borusan Logistics, Netlog Logistics, Kargoist, Ceva Logistics Turkey, Horoz Logistics, LC Waikiki Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's e-commerce logistics automation market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI and machine learning, operational efficiencies will improve, enabling faster and more reliable delivery services. Additionally, the expansion of e-commerce platforms will further stimulate demand for automated logistics solutions. Companies that embrace these innovations will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Automation Systems Transportation Management Systems (TMS) Order Fulfillment & Sortation Solutions Inventory & Supply Chain Management Platforms Robotics (Automated Guided Vehicles, Picking Robots) Automation Software (WMS, TMS, OMS) Last-Mile Delivery Automation |

| By End-User | E-Commerce Retailers Third-Party Logistics (3PL) Providers Courier, Express & Parcel (CEP) Companies Manufacturers & Distributors Wholesale & B2B Platforms Others |

| By Sales Channel | Direct (Enterprise) Sales Online Solution Providers System Integrators & Distributors Retail Partnerships Others |

| By Distribution Mode | Road Transport Automation Rail Transport Automation Air Cargo Automation Sea Freight Automation Multimodal Logistics Automation |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions Others |

| By Application | B2C E-Commerce Logistics B2B E-Commerce Logistics C2C Logistics Cross-Border E-Commerce Logistics |

| By Technology | Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) AI-Powered Analytics & Optimization IoT & Real-Time Tracking Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Centers | 100 | Operations Managers, Logistics Coordinators |

| Last-Mile Delivery Services | 60 | Delivery Managers, Fleet Supervisors |

| Warehouse Automation Solutions | 50 | IT Managers, Automation Engineers |

| Returns Management in E-commerce | 40 | Customer Service Managers, Returns Analysts |

| Logistics Technology Providers | 45 | Product Managers, Business Development Executives |

The Turkey E-Commerce Logistics Automation Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the expansion of the e-commerce sector and the adoption of advanced logistics technologies.