Region:Europe

Author(s):Rebecca

Product Code:KRAC0257

Pages:85

Published On:August 2025

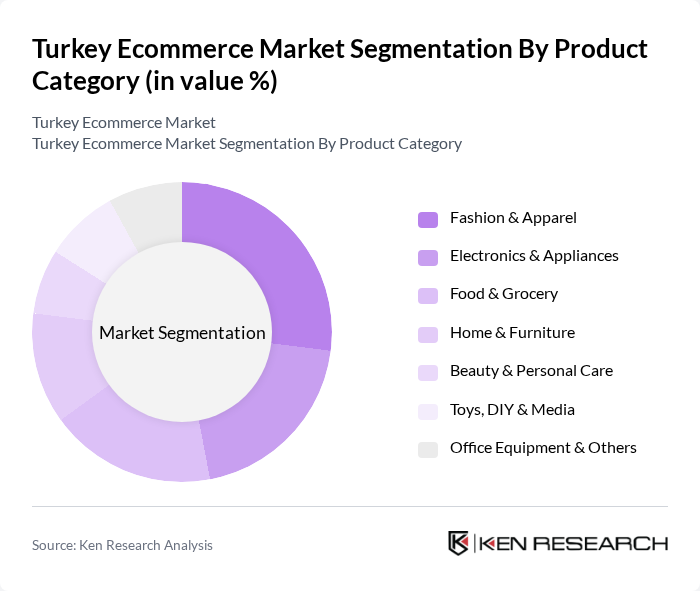

By Product Category:The product categories in the Turkey Ecommerce Market include Fashion & Apparel, Electronics & Appliances, Food & Grocery, Home & Furniture, Beauty & Personal Care, Toys, DIY & Media, and Office Equipment & Others. Among these, Fashion & Apparel is the leading segment, accounting for 27% of consumer turnover, driven by Turkey’s strong textile base and the increasing popularity of online shopping among younger consumers. Electronics & Appliances also hold a significant share, fueled by technological advancements and strong consumer demand for smart devices. Food & Grocery is the fastest-growing segment, propelled by quick-commerce delivery models and dark-store networks that enable rapid delivery of fresh produce.

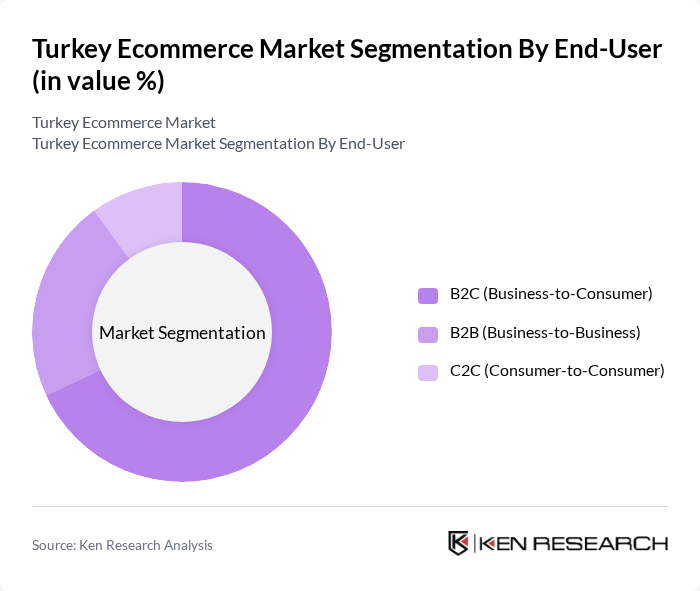

By End-User:The Turkey Ecommerce Market is segmented into B2C (Business-to-Consumer), B2B (Business-to-Business), and C2C (Consumer-to-Consumer). The B2C segment dominates the market, accounting for approximately 68% of total ecommerce activity, driven by the increasing number of consumers shopping online for convenience and variety. The B2B segment is expanding rapidly, reflecting enterprise digitization momentum and the adoption of online platforms for procurement and sales. C2C platforms, while smaller, continue to grow as peer-to-peer commerce gains traction.

The Turkey Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trendyol, Hepsiburada, N11, GittiGidiyor, Çiçeksepeti, PttAVM, Amazon Türkiye, eBay Türkiye, Modanisa, Vivense, Yemeksepeti, Getir, A101, CarrefourSA, B?M contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's ecommerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration continues to rise, more consumers are expected to engage in online shopping. The integration of AI and personalized shopping experiences will enhance customer satisfaction. Additionally, the growth of mobile commerce and innovative payment solutions will likely attract new entrants, fostering a competitive environment that encourages innovation and improved service delivery in the ecommerce sector.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion & Apparel Electronics & Appliances Food & Grocery Home & Furniture Beauty & Personal Care Toys, DIY & Media Office Equipment & Others |

| By End-User | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms |

| By Payment Method | Credit/Debit Cards Digital Wallets (incl. Troy scheme) Bank Transfers Buy Now, Pay Later (BNPL) Cash on Delivery |

| By Delivery Method | Standard Shipping Express Delivery Click and Collect |

| By Customer Demographics | Age Groups Income Levels Urban vs Rural |

| By Product Price Range | Low-End Products Mid-Range Products High-End Products |

| By Region | Istanbul Ankara Izmir East West North South |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers | 100 | E-commerce Managers, Marketing Directors |

| Consumer Electronics Purchases | 60 | End Consumers, Product Reviewers |

| Fashion E-commerce Trends | 50 | Brand Managers, Fashion Buyers |

| Logistics Providers for E-commerce | 40 | Operations Managers, Logistics Coordinators |

| Payment Solutions in E-commerce | 40 | Fintech Executives, Payment Processors |

The Turkey Ecommerce Market is valued at approximately USD 31 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping.