Region:Europe

Author(s):Rebecca

Product Code:KRAB2890

Pages:84

Published On:October 2025

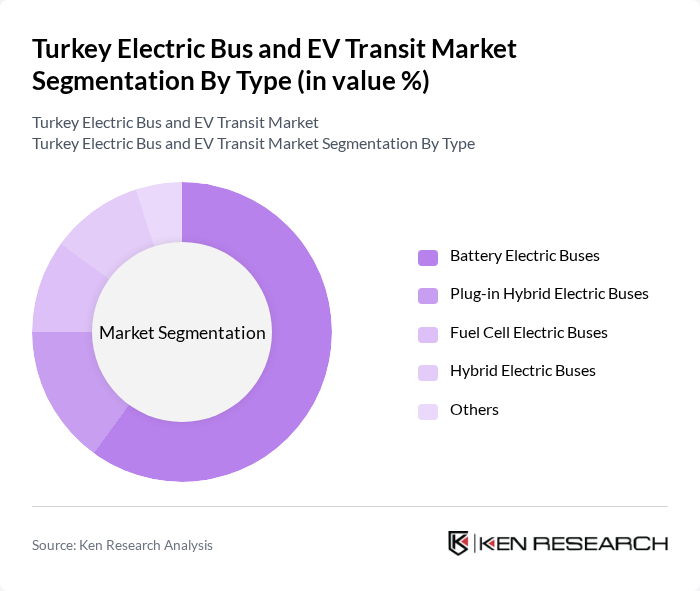

By Type:The market is segmented into Battery Electric Buses, Plug-in Hybrid Electric Buses, Fuel Cell Electric Buses, Hybrid Electric Buses, and Others. Battery Electric Buses lead the market, driven by their zero-emission operation, advancements in battery technology, and expanding charging infrastructure. Government incentives and the need for sustainable urban transit solutions are further accelerating their adoption .

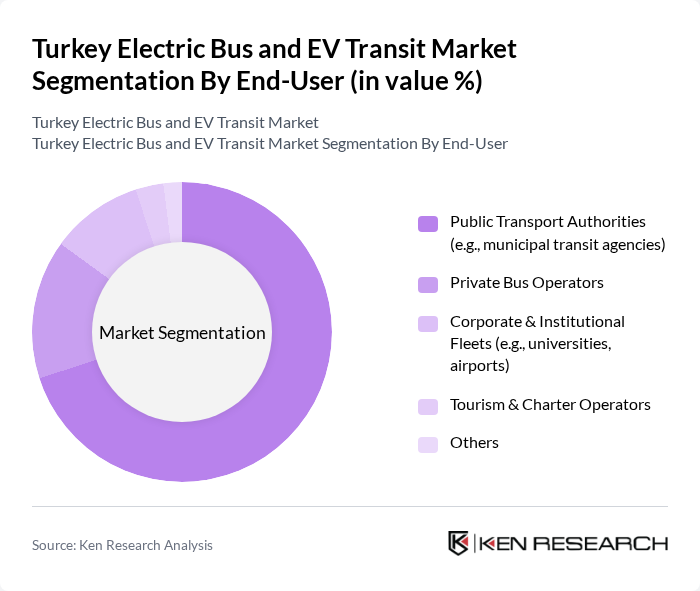

By End-User:The market is segmented by end-users, including Public Transport Authorities, Private Bus Operators, Corporate & Institutional Fleets, Tourism & Charter Operators, and Others. Public Transport Authorities are the primary end-users, as they operate the majority of urban transit systems and are leading the adoption of electric buses to achieve sustainability targets. Growing investments in electric bus fleets are also observed among private and institutional operators .

The Turkey Electric Bus and EV Transit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Karsan Otomotiv Sanayi ve Ticaret A.?., Otokar Otomotiv ve Savunma Sanayi A.?., TEMSA Global Sanayi ve Ticaret A.?., Anadolu Isuzu Otomotiv Sanayi ve Ticaret A.?., Bozankaya A.?., TCDD Ta??mac?l?k A.?., Mercedes-Benz Türk A.?., MAN Türkiye A.?., Volvo Bus Corporation, BYD Auto Co., Ltd., Yutong Bus Co., Ltd., Solaris Bus & Coach S.A., Scania AB, Iveco S.p.A., BMC Otomotiv Sanayi ve Ticaret A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric bus and EV transit market in Turkey appears promising, driven by increasing urbanization and government support. By future, the integration of smart technologies and renewable energy sources is expected to enhance operational efficiency. Additionally, the rise of autonomous electric buses could revolutionize public transport, offering cost-effective and sustainable solutions. As cities prioritize electrification, the market is likely to witness significant growth, fostering innovation and collaboration among stakeholders in the transportation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Buses Plug-in Hybrid Electric Buses Fuel Cell Electric Buses Hybrid Electric Buses Others |

| By End-User | Public Transport Authorities (e.g., municipal transit agencies) Private Bus Operators Corporate & Institutional Fleets (e.g., universities, airports) Tourism & Charter Operators Others |

| By Application | Urban Transit Intercity Transport School Transport Airport Shuttle Others |

| By Charging Infrastructure | Depot Charging (Overnight/Slow Charging) Opportunity Charging (Fast Charging) On-route Charging (Pantograph, Inductive, etc.) Others |

| By Fleet Size | Small Fleets (1-10 Buses) Medium Fleets (11-50 Buses) Large Fleets (51+ Buses) Others |

| By Region | Marmara Region Aegean Region Central Anatolia Region Eastern Anatolia Region Southeastern Anatolia Region Black Sea Region Mediterranean Region Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Local Content Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Transit Authorities | 100 | Transit Directors, Policy Makers |

| Electric Bus Manufacturers | 60 | Product Managers, Sales Executives |

| Fleet Operators | 50 | Operations Managers, Fleet Supervisors |

| Urban Planners | 40 | City Planners, Environmental Consultants |

| Government Regulatory Bodies | 40 | Regulatory Officers, Policy Analysts |

The Turkey Electric Bus and EV Transit Market is valued at approximately USD 700 million, driven by urbanization, government incentives for electric mobility, and increased environmental awareness among consumers, leading to a growing demand for sustainable public transport solutions.