Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4545

Pages:84

Published On:September 2025

By Type:The market is segmented into Residential Solar Rooftop Systems, Commercial Solar Rooftop Systems, Industrial Solar Rooftop Systems, Hybrid Solar Systems, Off-Grid Solar Solutions, Solar Leasing Options, and Community Solar Projects. Among these, Residential Solar Rooftop Systems are currently leading the market, driven by simplified net metering, increased consumer awareness, and government incentives that make solar adoption more accessible for homeowners. The commercial segment is also expanding, as businesses seek to hedge against rising energy costs and comply with sustainability mandates. Hybrid and storage-integrated systems are gaining traction, particularly in regions with grid constraints or high self-consumption needs .

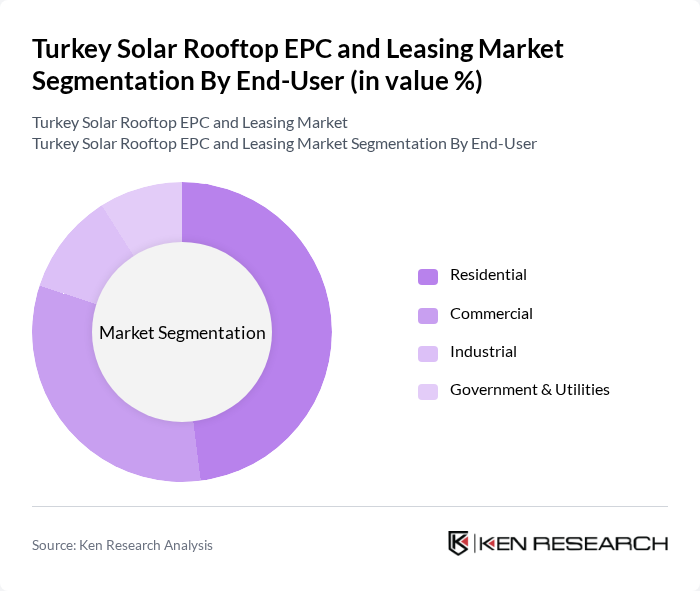

By End-User:End-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest contributor, reflecting the rapid uptake of rooftop solar among homeowners seeking energy independence and cost savings. The commercial segment is expanding, driven by businesses aiming to reduce operational expenses and comply with environmental standards. Industrial users are increasingly investing in rooftop and hybrid systems to mitigate energy price volatility, while government and utility initiatives focus on integrating distributed solar into broader energy strategies .

The Turkey Solar Rooftop EPC and Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kalyon PV, Fortis Energy, Europower Solar (Europower Enerji A.?.), Çal?k Enerji, Asunim Group, Eko Renewable Energy Inc., GO Enerji, Halk Enerji Yat?r?mlar? Üretim ?n?aat Taahhüt Ticaret ve Sanayi A.?., HT Solar Energy J.S.C., CW Enerji, Ankara Solar A.?., Alfa Solar Enerji, Solar Power Solutions Pvt Ltd, Zorlu Enerji Elektrik Üretim A.?., and Aksa Energy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey solar rooftop EPC and leasing market appears promising, driven by increasing energy demands and supportive government policies. As urban areas expand, the need for sustainable energy solutions will intensify, encouraging further investments in solar technologies. Additionally, the integration of smart technologies and energy storage solutions will enhance system efficiency and reliability, making solar energy more attractive. The market is poised for growth as stakeholders adapt to evolving consumer preferences and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Solar Rooftop Systems Commercial Solar Rooftop Systems Industrial Solar Rooftop Systems Hybrid Solar Systems Off-Grid Solar Solutions Solar Leasing Options Community Solar Projects |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Other Incentives |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Partnerships |

| By Price Range | Low Price Range Mid Price Range High Price Range Custom Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Installations | 120 | Homeowners, Property Managers |

| Commercial Solar Leasing Models | 80 | Facility Managers, CFOs of SMEs |

| Industrial Solar EPC Projects | 60 | Operations Directors, Energy Managers |

| Government Policy Impact on Solar Adoption | 40 | Policy Makers, Energy Consultants |

| Consumer Attitudes Towards Solar Leasing | 70 | General Public, Environmental Advocates |

The Turkey Solar Rooftop EPC and Leasing Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by increasing electricity demand, declining photovoltaic system costs, and supportive government policies promoting renewable energy adoption.