Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3845

Pages:97

Published On:October 2025

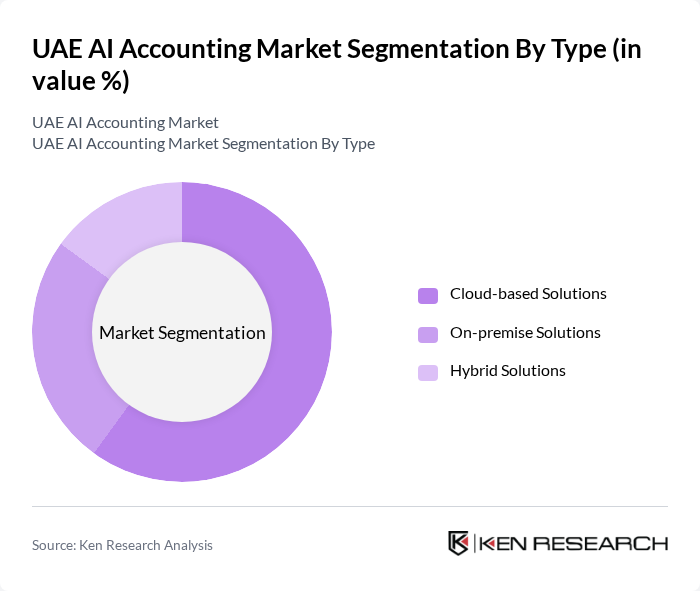

By Type:The market is segmented into three main types: Cloud-based Solutions, On-premise Solutions, and Hybrid Solutions. Cloud-based solutions are gaining substantial traction due to their scalability, cost-effectiveness, and ability to support remote work environments, making them the preferred choice for many businesses across the UAE. The shift toward cloud infrastructure enables continuous updates, easier deployment of AI tools, and seamless integration with other business systems. On-premise solutions, while still relevant for organizations with specific data security requirements or legacy system dependencies, are being overshadowed by the flexibility and real-time collaboration capabilities offered by cloud options. Hybrid solutions are also emerging as a popular choice, allowing businesses to leverage both cloud and on-premise capabilities while maintaining control over sensitive financial data and enjoying the benefits of cloud scalability.

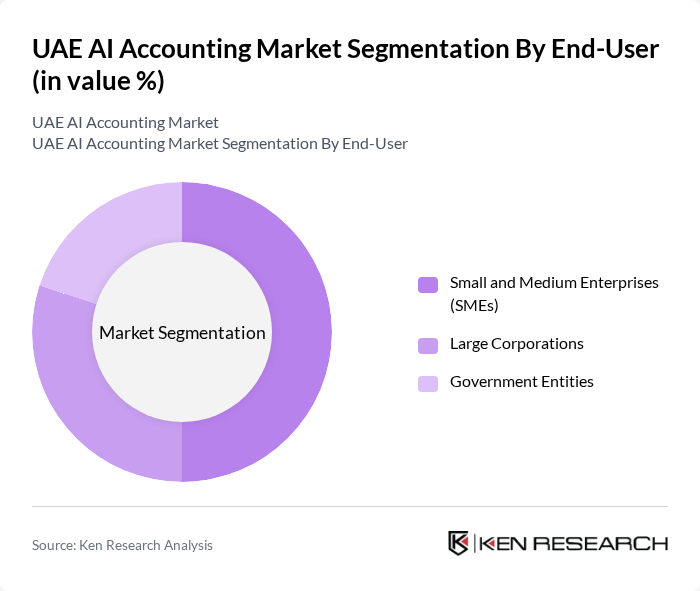

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. SMEs are increasingly adopting AI accounting solutions to enhance operational efficiency, reduce costs, and compete effectively in the digital economy. These enterprises benefit particularly from automated bookkeeping, invoice processing, and reconciliation features that minimize human error and free up resources for strategic activities. Large corporations leverage these technologies for complex financial management, advanced analytics, predictive forecasting, and multi-entity consolidation, requiring sophisticated AI capabilities to handle high transaction volumes and intricate compliance requirements. Government entities focus on compliance, transparency, and alignment with national digital transformation initiatives, utilizing AI accounting solutions to improve financial reporting accuracy and public accountability. SMEs currently dominate the market due to their rapid digital transformation efforts and the increasing availability of affordable, user-friendly cloud-based solutions tailored to their specific needs.

The UAE AI Accounting Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Intuit Inc. (QuickBooks), Xero Limited, Zoho Corporation, Sage Group plc, BlackLine, Inc., FreshBooks, Wave Financial Inc., Tally Solutions Pvt. Ltd., CCH Tagetik, FinancialForce, Aplos Software, Thomson Reuters (ONESOURCE), Infor (Infor CloudSuite Financials), Workday, Inc. (Workday Financial Management), NetSuite (Oracle NetSuite), Avalara (Avalara AvaTax), ADP (ADP GlobalView Payroll) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE AI accounting market is poised for significant evolution, driven by technological advancements and changing business needs. As companies increasingly prioritize automation and real-time insights, the integration of AI with existing financial systems will become essential. Furthermore, the ongoing regulatory changes will necessitate innovative solutions that ensure compliance. The market is expected to witness a surge in partnerships between AI providers and traditional accounting firms, enhancing service offerings and driving further adoption of AI technologies across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Solutions On-premise Solutions Hybrid Solutions |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Industry | Financial Services (including Banking, Insurance, Investment) Retail and E-commerce Healthcare Construction and Real Estate Logistics and Transportation Energy and Utilities |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Automated Bookkeeping Financial Reporting Tax Compliance and E-invoicing Audit and Risk Management Fraud Detection and Prevention |

| By Pricing Model | Subscription-based Pay-per-use One-time License Fee |

| By Customer Segment | Startups Established Businesses Non-profit Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Finance Departments | 100 | CFOs, Financial Analysts, Accounting Managers |

| AI Technology Providers | 60 | Product Managers, Sales Directors, Technical Consultants |

| Small and Medium Enterprises (SMEs) | 50 | Business Owners, Finance Officers, IT Managers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Compliance Officers, Industry Analysts |

| Academic Institutions and Research Organizations | 40 | Researchers, Professors, Graduate Students in Finance |

The UAE AI Accounting Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of AI technologies in financial processes, enhancing efficiency and accuracy in accounting practices.