Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2423

Pages:87

Published On:October 2025

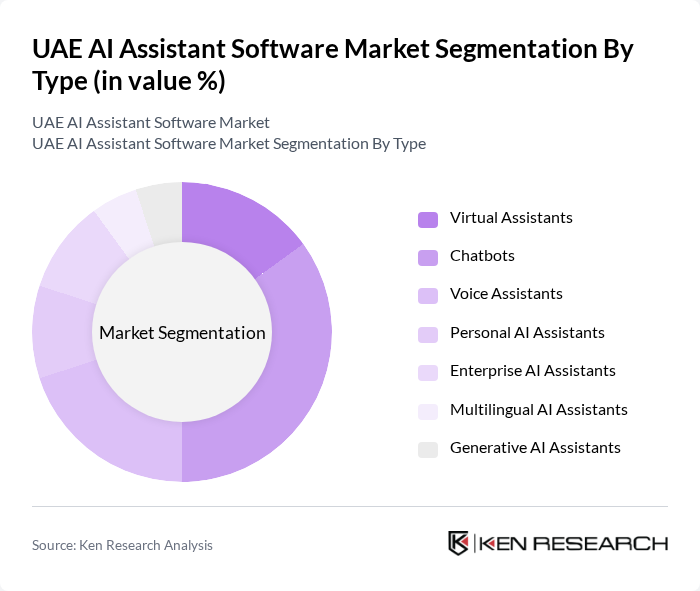

By Type:The segmentation by type includes subsegments such as Virtual Assistants, Chatbots, Voice Assistants, Personal AI Assistants, Enterprise AI Assistants, Multilingual AI Assistants, and Generative AI Assistants. Among these, Chatbots are currently dominating the market due to their widespread adoption in customer service, banking, and e-commerce applications. Businesses are increasingly utilizing chatbots to enhance customer interactions, streamline operations, and reduce costs. The growing trend of digital communication, the need for 24/7 customer support, and the integration of advanced natural language processing have further solidified the position of chatbots as a preferred solution .

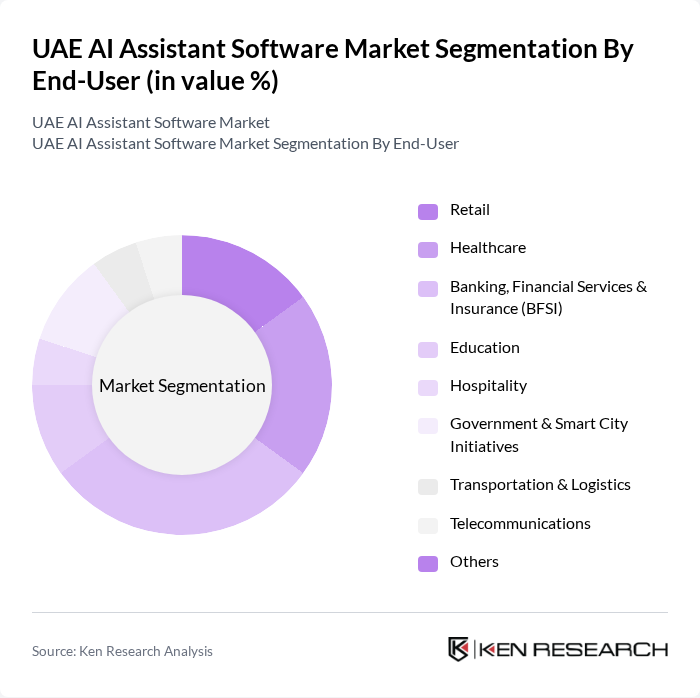

By End-User:The end-user segmentation includes Retail, Healthcare, Banking, Financial Services & Insurance (BFSI), Education, Hospitality, Government & Smart City Initiatives, Transportation & Logistics, Telecommunications, and Others. The BFSI sector is leading the market due to the increasing need for efficient customer service, fraud detection, and regulatory compliance. Financial institutions are leveraging AI assistants to provide personalized services, enhance customer experience, and streamline operations, making them a critical component in the digital transformation of the industry. Healthcare and retail are also rapidly adopting AI assistants for patient engagement and omnichannel customer support, respectively .

The UAE AI Assistant Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Microsoft Corporation, Amazon Web Services, Inc., IBM Corporation, Nuance Communications, Inc., SAP SE, Oracle Corporation, Salesforce, Inc., Baidu, Inc., Alibaba Group Holding Limited, Cisco Systems, Inc., Zoho Corporation Pvt. Ltd., Freshworks Inc., ServiceNow, Inc., HubSpot, Inc., Cognigy GmbH, Kore.ai, Inc., Verloop.io, Gupshup Technology India Pvt. Ltd., Du (Emirates Integrated Telecommunications Company PJSC), Etisalat by e& (Emirates Telecommunications Group Company PJSC), Sestek, Rasa Technologies GmbH, Inbenta Technologies Inc., ChatFood FZ LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI assistant software market appears promising, driven by technological advancements and increasing digital transformation across sectors. As businesses prioritize automation and customer-centric solutions, the demand for AI assistants is expected to rise significantly. Furthermore, the integration of AI with emerging technologies like IoT will enhance functionality, creating new applications and use cases. The focus on ethical AI practices will also shape the regulatory landscape, ensuring responsible development and deployment of AI technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Assistants Chatbots Voice Assistants Personal AI Assistants Enterprise AI Assistants Multilingual AI Assistants Generative AI Assistants |

| By End-User | Retail Healthcare Banking, Financial Services & Insurance (BFSI) Education Hospitality Government & Smart City Initiatives Transportation & Logistics Telecommunications Others |

| By Application | Customer Service & Support Personal Assistance Sales & Marketing IT Service Management (ITSM) Human Resources & Talent Management Data Analysis & Insights Workflow Automation Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Telecommunications Transportation and Logistics Manufacturing Media and Entertainment Real Estate Energy & Utilities Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 85 | Healthcare IT Managers, Clinical Directors |

| Financial Services AI Integration | 75 | Risk Management Officers, IT Security Managers |

| Retail AI Customer Experience | 80 | Marketing Managers, Customer Experience Directors |

| Manufacturing AI Automation | 70 | Operations Managers, Production Supervisors |

| AI in Logistics and Supply Chain | 75 | Logistics Coordinators, Supply Chain Analysts |

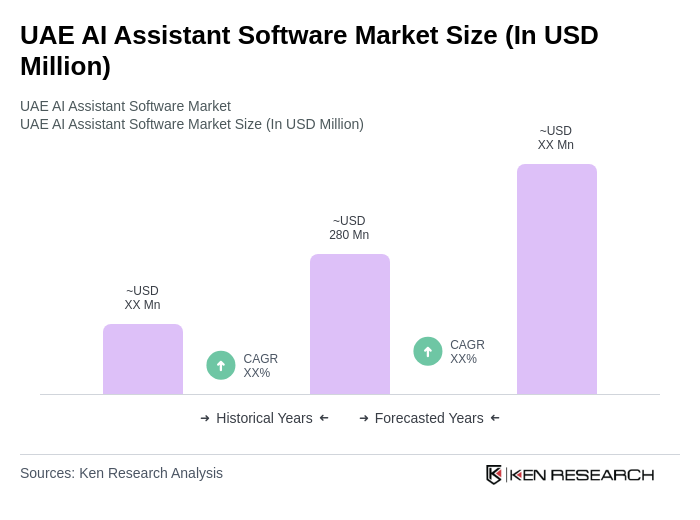

The UAE AI Assistant Software Market is valued at approximately USD 280 million, reflecting significant growth driven by the increasing adoption of AI technologies across various sectors, including retail, healthcare, and finance.