Region:Middle East

Author(s):Rebecca

Product Code:KRAB7983

Pages:91

Published On:October 2025

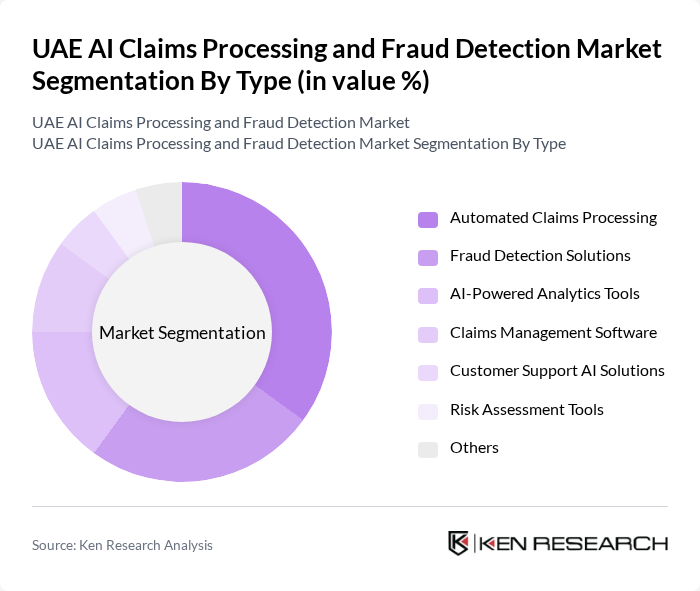

By Type:The market is segmented into various types, including Automated Claims Processing, Fraud Detection Solutions, AI-Powered Analytics Tools, Claims Management Software, Customer Support AI Solutions, Risk Assessment Tools, and Others. Among these, Automated Claims Processing is currently the leading sub-segment, driven by the increasing demand for efficiency and accuracy in claims handling. The trend towards digital transformation in the insurance sector has led to a significant uptake of automated solutions, which streamline workflows and reduce processing times.

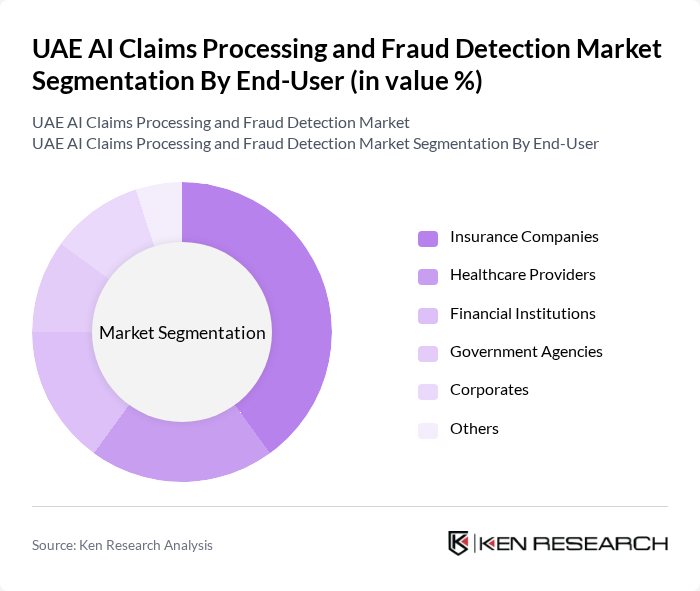

By End-User:This market is also segmented by end-users, which include Insurance Companies, Healthcare Providers, Financial Institutions, Government Agencies, Corporates, and Others. Insurance Companies are the dominant end-user segment, as they are the primary beneficiaries of AI claims processing and fraud detection technologies. The need for efficient claims management and fraud prevention in the insurance sector drives the adoption of AI solutions, making it a critical area for investment and innovation.

The UAE AI Claims Processing and Fraud Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM, SAP, Oracle, and Cognizant contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI claims processing and fraud detection market appears promising, driven by technological advancements and regulatory support. As insurers increasingly adopt machine learning and predictive analytics, operational efficiencies are expected to improve significantly. Furthermore, the integration of AI with IoT devices will enable real-time data analysis, enhancing fraud detection capabilities. The market is poised for growth as companies seek innovative solutions to meet evolving customer expectations and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Claims Processing Fraud Detection Solutions AI-Powered Analytics Tools Claims Management Software Customer Support AI Solutions Risk Assessment Tools Others |

| By End-User | Insurance Companies Healthcare Providers Financial Institutions Government Agencies Corporates Others |

| By Application | Personal Insurance Claims Commercial Insurance Claims Health Insurance Claims Property Insurance Claims Liability Insurance Claims Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Partners and Alliances |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Claims Processing | 100 | Claims Managers, Underwriting Directors |

| Auto Insurance Fraud Detection | 80 | Fraud Analysts, Risk Assessment Officers |

| Property Insurance Claims Management | 70 | Claims Adjusters, Operations Managers |

| AI Technology Providers for Insurance | 60 | Product Managers, Business Development Executives |

| Regulatory Compliance in AI Implementation | 50 | Compliance Officers, Legal Advisors |

The UAE AI Claims Processing and Fraud Detection Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in the insurance and healthcare sectors to enhance operational efficiency and reduce fraudulent claims.