Region:Middle East

Author(s):Geetanshi

Product Code:KRAB3402

Pages:85

Published On:October 2025

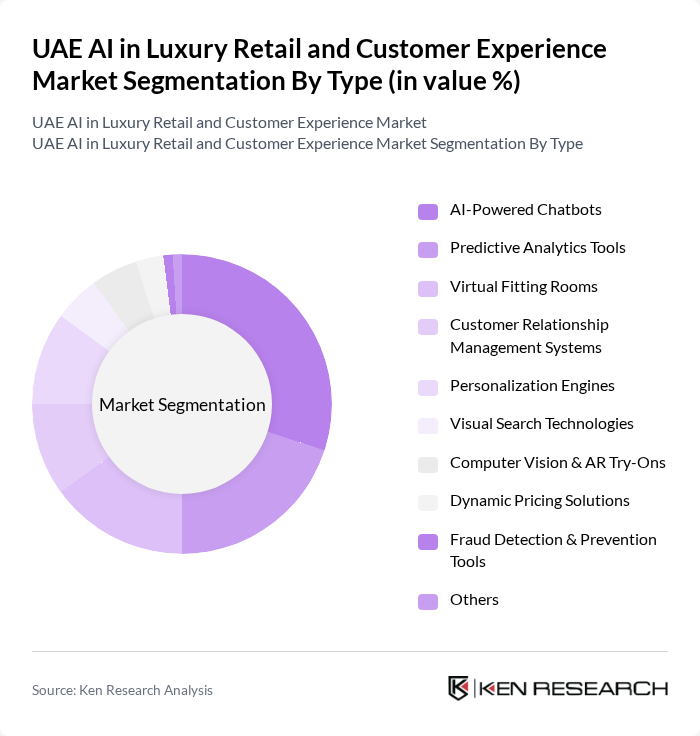

By Type:The market is segmented into various types of AI technologies that enhance customer experience and operational efficiency. Key subsegments include AI-Powered Chatbots, Predictive Analytics Tools, Virtual Fitting Rooms, Customer Relationship Management Systems, Personalization Engines, Visual Search Technologies, Computer Vision & AR Try-Ons, Dynamic Pricing Solutions, Fraud Detection & Prevention Tools, and Others. Among these, AI-Powered Chatbots are leading the market due to their ability to provide instant customer support and enhance user engagement. The increasing demand for personalized shopping experiences drives the adoption of these technologies, making them essential for luxury retailers.

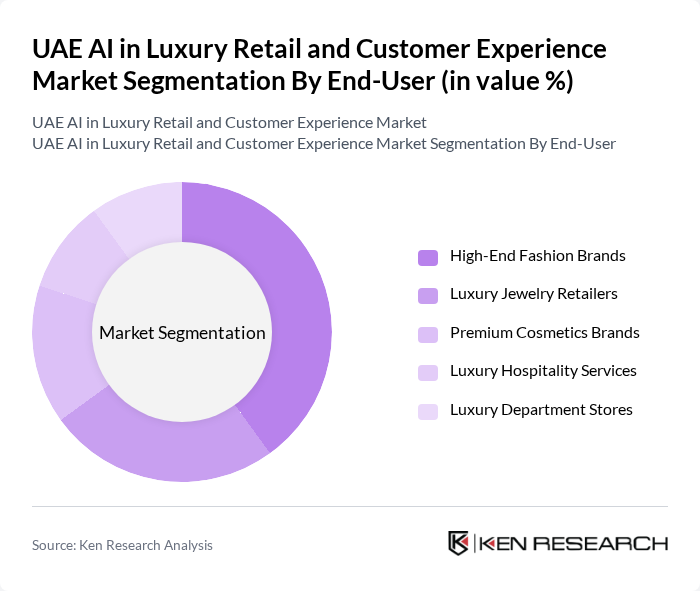

By End-User:The end-user segmentation includes High-End Fashion Brands, Luxury Jewelry Retailers, Premium Cosmetics Brands, Luxury Hospitality Services, and Luxury Department Stores. High-End Fashion Brands dominate this segment, driven by their need for innovative customer engagement strategies and personalized shopping experiences. The luxury fashion sector is increasingly adopting AI technologies to enhance customer interactions, streamline inventory management, and provide tailored recommendations, making it a key player in the market.

The UAE AI in Luxury Retail and Customer Experience Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chalhoub Group, Al Haramain Perfumes, Al Tayer Group, Majid Al Futtaim, Emaar Malls, Dubai Duty Free, Al-Futtaim Group, Landmark Group, Jashanmal National Company, Paris Gallery, Rivoli Group, Al Jaber Group, BinHendi Enterprises, Apparel Group, Ahmed Seddiqi & Sons contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI in luxury retail market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI solutions, the focus will shift towards enhancing customer engagement through personalized experiences and seamless omnichannel strategies. Additionally, the integration of sustainability practices will become paramount, aligning with global trends. This evolution will not only redefine luxury retail but also foster a more innovative and customer-centric market landscape in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Powered Chatbots Predictive Analytics Tools Virtual Fitting Rooms Customer Relationship Management Systems Personalization Engines Visual Search Technologies Computer Vision & AR Try-Ons Dynamic Pricing Solutions Fraud Detection & Prevention Tools Others |

| By End-User | High-End Fashion Brands Luxury Jewelry Retailers Premium Cosmetics Brands Luxury Hospitality Services Luxury Department Stores |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Department Stores Direct-to-Consumer Sales Omnichannel Retail |

| By Customer Segment | Millennials Gen Z Affluent Consumers Corporate Clients Tourists |

| By Geographic Presence | Dubai Abu Dhabi Sharjah Other Emirates Tourist Destinations |

| By Product Category | Apparel Accessories Footwear Home Decor Fragrances & Cosmetics |

| By Price Range | Premium Luxury Ultra-Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Retail Executives | 50 | CEOs, CMOs, and Digital Transformation Officers |

| AI Technology Providers | 40 | Product Managers, Business Development Leads |

| Luxury Consumers | 120 | Affluent Shoppers, Frequent Luxury Buyers |

| Retail Staff | 60 | Sales Associates, Customer Experience Managers |

| Industry Experts | 40 | Consultants, Academics, and Market Analysts |

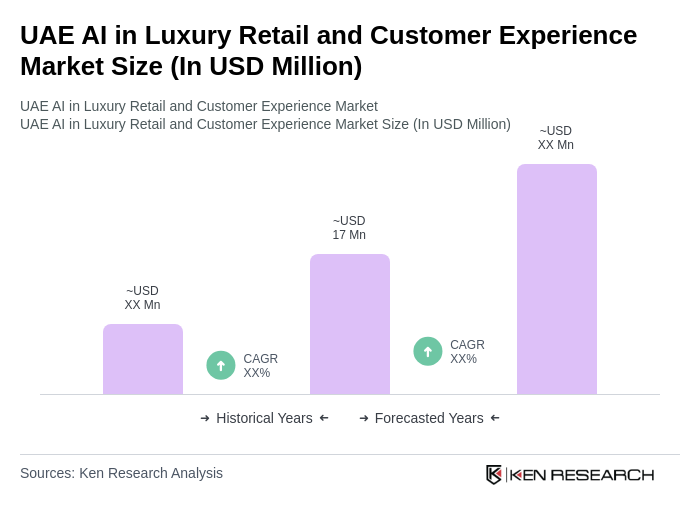

The UAE AI in Luxury Retail and Customer Experience Market is valued at approximately USD 17 million, reflecting significant growth driven by the adoption of AI technologies that enhance customer engagement and personalization in the luxury retail sector.