Region:Middle East

Author(s):Dev

Product Code:KRAB3620

Pages:99

Published On:October 2025

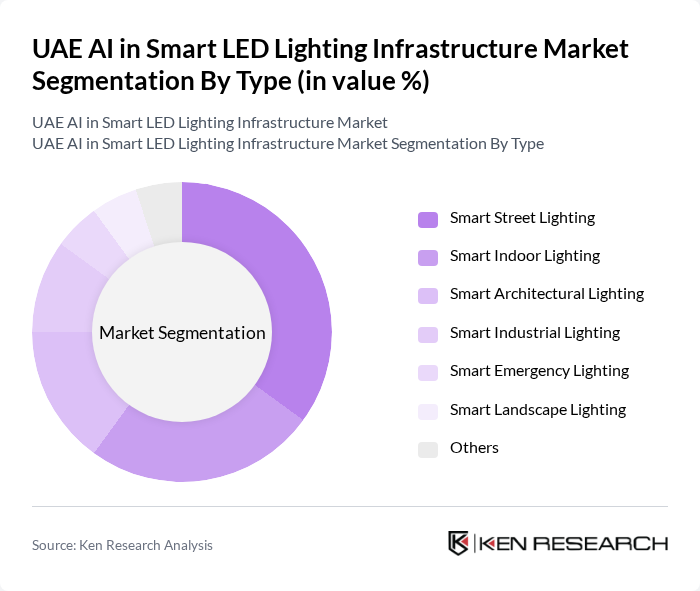

By Type:The market is segmented into various types of smart LED lighting solutions, including Smart Street Lighting, Smart Indoor Lighting, Smart Architectural Lighting, Smart Industrial Lighting, Smart Emergency Lighting, Smart Landscape Lighting, and Others. Each of these segments caters to different applications and consumer needs, contributing to the overall market growth.

The Smart Street Lighting segment is currently dominating the market due to its widespread adoption in urban areas, driven by the need for enhanced public safety and energy efficiency. Cities are increasingly investing in smart street lighting systems that utilize AI and IoT technologies to optimize energy consumption and improve maintenance efficiency. This segment is favored by municipalities looking to reduce operational costs while enhancing the quality of urban life.

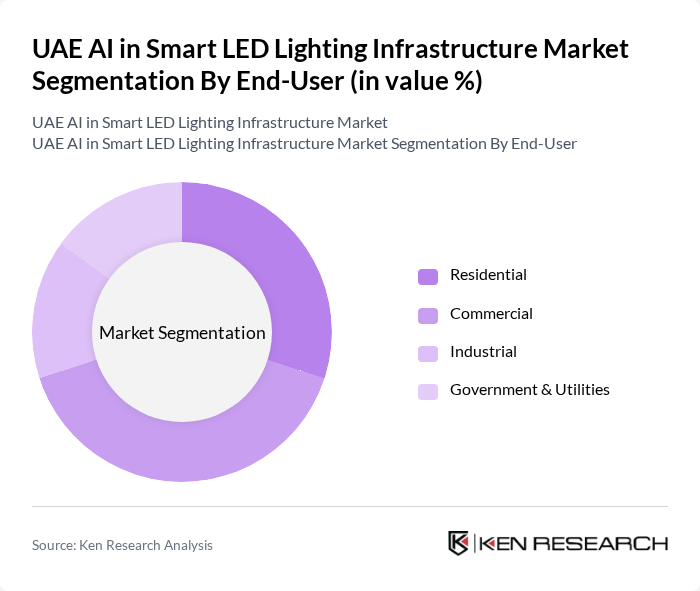

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and applications for smart LED lighting solutions, influencing the overall market dynamics.

The Commercial segment is leading the market, driven by the increasing adoption of smart lighting solutions in retail spaces, offices, and hospitality sectors. Businesses are investing in smart LED lighting to enhance customer experience, reduce energy costs, and comply with sustainability regulations. The growing trend of smart buildings and energy-efficient workplaces further propels the demand in this segment.

The UAE AI in Smart LED Lighting Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting, Signify N.V., Osram Licht AG, Cree, Inc., General Electric Company, Acuity Brands, Inc., Eaton Corporation, Zumtobel Group AG, Hubbell Lighting, Inc., Legrand S.A., Lutron Electronics Co., Inc., Panasonic Corporation, Schneider Electric SE, Tridonic GmbH & Co KG, Toshiba Lighting & Technology Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI in smart LED lighting infrastructure market appears promising, driven by ongoing government support and technological advancements. By future, the integration of AI and IoT in lighting systems is expected to enhance operational efficiency and sustainability. As urbanization continues, cities will increasingly adopt smart lighting solutions to address energy consumption and safety concerns. The focus on renewable energy sources will further propel the market, creating a conducive environment for innovation and investment in smart lighting technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Street Lighting Smart Indoor Lighting Smart Architectural Lighting Smart Industrial Lighting Smart Emergency Lighting Smart Landscape Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Urban Infrastructure Smart Homes Public Spaces Transportation Systems |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Smart Lighting Projects | 100 | City Planners, Urban Development Officials |

| Commercial Building Implementations | 80 | Facility Managers, Building Owners |

| Public Space Lighting Solutions | 70 | Public Works Directors, Infrastructure Managers |

| AI Technology Providers | 60 | Product Development Managers, Technology Executives |

| Energy Efficiency Consultants | 50 | Energy Auditors, Sustainability Advisors |

The UAE AI in Smart LED Lighting Infrastructure Market is valued at approximately USD 1.2 billion, driven by the demand for energy-efficient lighting solutions and government initiatives aimed at enhancing sustainability in urban areas.