Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6630

Pages:92

Published On:October 2025

By Type:

The market is segmented into three types: Cloud-Based CRM, On-Premise CRM, and Hybrid CRM. Among these, Cloud-Based CRM is the leading sub-segment, driven by its scalability, cost-effectiveness, and ease of access. Businesses are increasingly opting for cloud solutions to enhance collaboration and streamline operations. On-Premise CRM is preferred by organizations with stringent data security requirements, while Hybrid CRM offers a balanced approach, combining the benefits of both cloud and on-premise solutions.

By End-User:

The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, and Government Agencies. SMEs are the dominant segment, as they increasingly adopt AI-powered CRM solutions to enhance customer engagement and streamline operations. Large enterprises leverage these solutions for advanced analytics and customer insights, while government agencies focus on improving public service delivery through AI integration.

The UAE AI-Powered CRM Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, HubSpot, Zoho CRM, Microsoft Dynamics 365, Oracle CRM, SAP CRM, Freshworks, Pipedrive, SugarCRM, Nimble, Insightly, Close.io, Keap, Bitrix24, Agile CRM contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI-powered CRM software market appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to prioritize customer-centric strategies, the demand for sophisticated CRM solutions is expected to rise. Additionally, the integration of AI technologies will enhance data analytics capabilities, enabling companies to make informed decisions. The ongoing government initiatives to support digital transformation will further accelerate market growth, fostering innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based CRM On-Premise CRM Hybrid CRM |

| By End-User | Small and Medium Enterprises Large Enterprises Government Agencies |

| By Industry Vertical | Retail Healthcare Financial Services Telecommunications |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Sales Automation Marketing Automation Customer Service Automation |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Model |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Adoption of AI-Powered CRM | 100 | Business Owners, Marketing Managers |

| Enterprise-Level CRM Implementation | 80 | IT Directors, CRM Administrators |

| Sector-Specific CRM Usage (Retail) | 70 | Sales Managers, Customer Experience Leads |

| Government Sector CRM Solutions | 50 | Public Sector IT Managers, Policy Makers |

| Healthcare CRM Integration | 60 | Healthcare Administrators, IT Specialists |

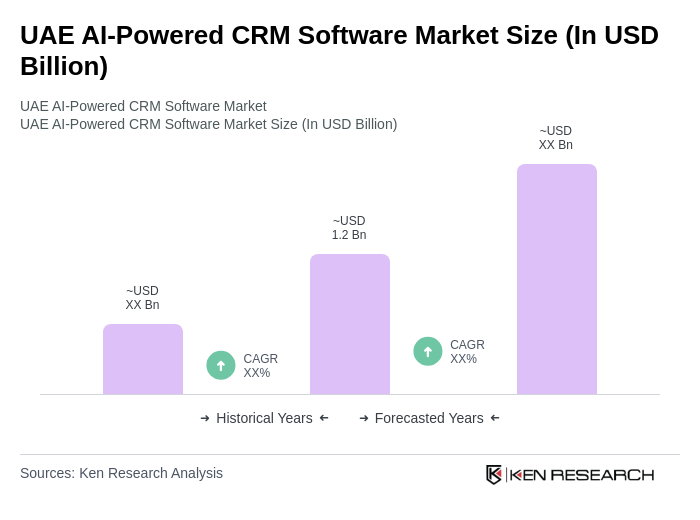

The UAE AI-Powered CRM Software Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of AI technologies in customer relationship management and digital transformation initiatives across various sectors.