Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8129

Pages:95

Published On:October 2025

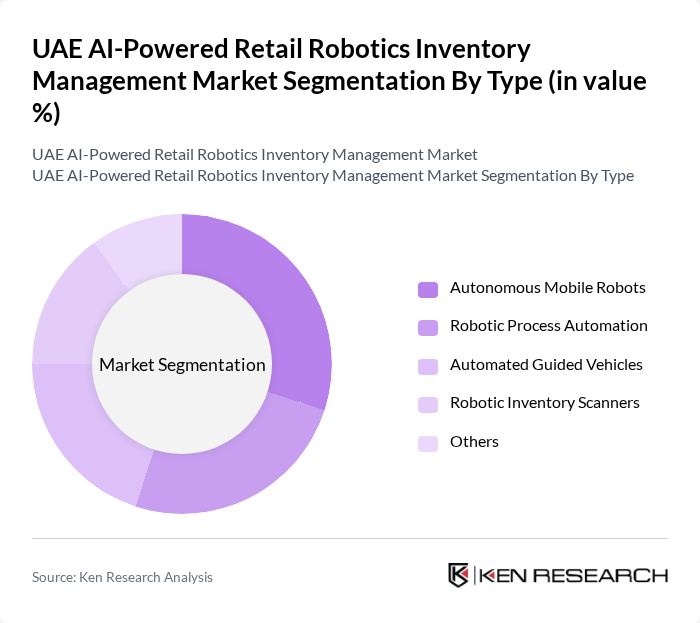

By Type:The market is segmented into various types of robotics solutions that cater to different operational needs in retail environments. The key subsegments include Autonomous Mobile Robots, Robotic Process Automation, Automated Guided Vehicles, Robotic Inventory Scanners, and Others. Each of these subsegments plays a crucial role in enhancing inventory management efficiency and accuracy.

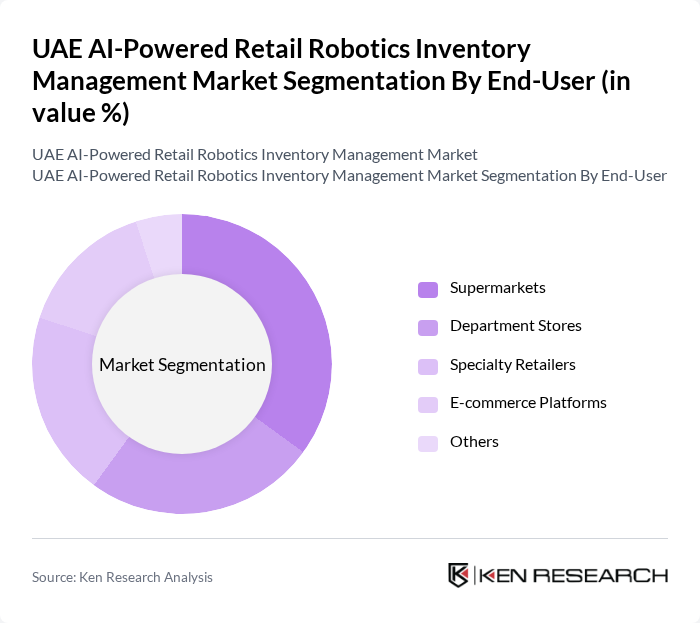

By End-User:The end-user segmentation includes various retail formats that utilize AI-powered robotics for inventory management. Key subsegments are Supermarkets, Department Stores, Specialty Retailers, E-commerce Platforms, and Others. Each end-user category has unique requirements and benefits from tailored robotic solutions to optimize their inventory processes.

The UAE AI-Powered Retail Robotics Inventory Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fetch Robotics, Simbe Robotics, Bossa Nova Robotics, SoftBank Robotics, Locus Robotics, GreyOrange, Robotize, Knapp AG, Zebra Technologies, Aitomation, Invia Robotics, 6 River Systems, BlueBotics, Seegrid, Auro Robotics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI-powered retail robotics inventory management market appears promising, driven by technological advancements and increasing consumer expectations. As retailers continue to embrace digital transformation, the integration of AI and machine learning will enhance operational efficiency and customer engagement. Furthermore, the rise of omnichannel retailing will necessitate more sophisticated inventory management solutions, positioning AI-powered robotics as a critical component in meeting these demands and ensuring competitive advantage in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Mobile Robots Robotic Process Automation Automated Guided Vehicles Robotic Inventory Scanners Others |

| By End-User | Supermarkets Department Stores Specialty Retailers E-commerce Platforms Others |

| By Application | Stock Management Order Fulfillment Inventory Tracking Data Collection and Analysis Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | AI-Driven Robotics Machine Learning Integration IoT-Enabled Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Inventory Management | 100 | Inventory Managers, Store Operations Directors |

| Electronics Retail Robotics Integration | 80 | IT Managers, Supply Chain Analysts |

| Fashion Retail Stock Optimization | 70 | Merchandising Managers, Logistics Coordinators |

| Pharmaceutical Inventory Automation | 60 | Pharmacy Managers, Compliance Officers |

| General Retail AI Adoption Trends | 90 | Retail Strategy Executives, Technology Officers |

The UAE AI-Powered Retail Robotics Inventory Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of automation technologies in the retail sector.