Region:Middle East

Author(s):Rebecca

Product Code:KRAD2911

Pages:98

Published On:November 2025

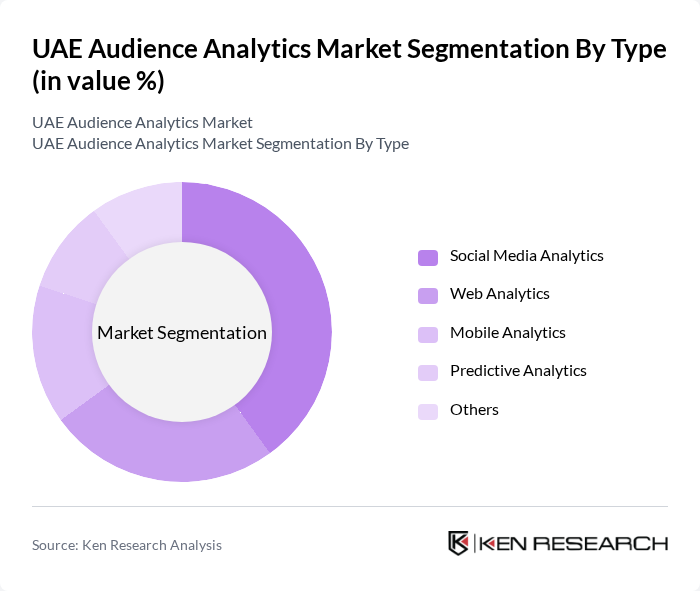

By Type:The audience analytics market can be segmented into various types, including Social Media Analytics, Web Analytics, Mobile Analytics, Predictive Analytics, and Others. Among these, Social Media Analytics is currently the leading sub-segment, driven by the increasing importance of social media platforms in marketing strategies. Businesses are leveraging social media data to gain insights into consumer preferences and behavior, which is crucial for targeted marketing efforts. Predictive Analytics is also gaining traction, with companies increasingly adopting AI-powered tools to forecast audience behavior and optimize marketing campaigns .

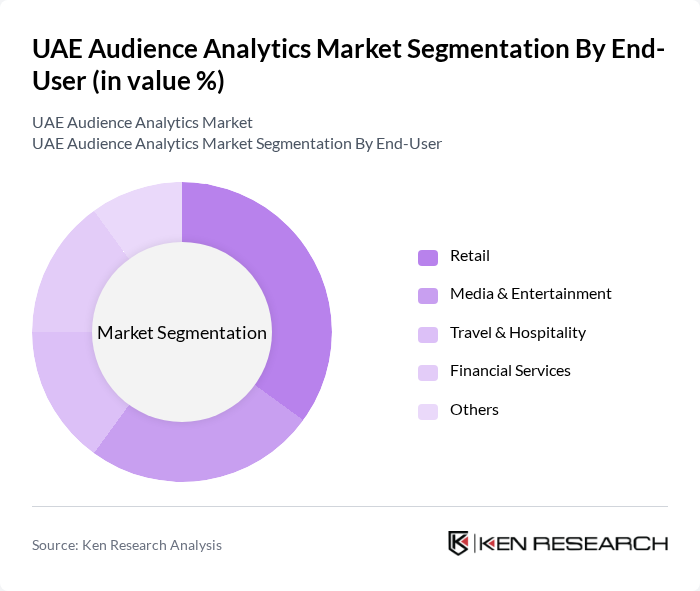

By End-User:The end-user segmentation of the audience analytics market includes Retail, Media & Entertainment, Travel & Hospitality, Financial Services, and Others. The Retail sector is the dominant end-user, as businesses increasingly rely on audience analytics to optimize their marketing strategies and enhance customer experiences. The growing trend of e-commerce and personalized marketing is driving the demand for analytics solutions in this sector. Media & Entertainment is also a major adopter, leveraging analytics for content personalization and audience engagement, while Financial Services use analytics for customer segmentation and risk assessment .

The UAE Audience Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nielsen, Adobe Analytics, Google Analytics, SAS Institute, IBM Watson Analytics, Oracle Analytics, SAP Analytics Cloud, HubSpot, Tableau Software, Mixpanel, Amplitude, Clicktale, Hotjar, Kissmetrics, Crazy Egg contribute to innovation, geographic expansion, and service delivery in this space.

The UAE audience analytics market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt real-time analytics and AI-driven insights, the focus will shift towards enhancing customer experiences. Moreover, the integration of cloud-based solutions will facilitate data accessibility and collaboration. Companies that prioritize data-driven decision-making will likely gain a competitive edge, positioning themselves to adapt to the rapidly changing digital landscape and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Analytics Web Analytics Mobile Analytics Predictive Analytics Others |

| By End-User | Retail Media & Entertainment Travel & Hospitality Financial Services Others |

| By Industry Vertical | E-commerce Telecommunications Healthcare Education Others |

| By Data Source | First-party Data Second-party Data Third-party Data Others |

| By Deployment Mode | On-premises Cloud-based Hybrid Others |

| By Analytics Type | Descriptive Analytics Diagnostic Analytics Prescriptive Analytics Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Audience Analytics | 100 | Marketing Managers, Data Analysts |

| Financial Services Analytics | 80 | Product Managers, Risk Analysts |

| Tourism and Hospitality Analytics | 70 | Operations Managers, Customer Experience Directors |

| Media and Entertainment Analytics | 60 | Content Strategists, Audience Development Managers |

| Telecommunications Audience Insights | 90 | Business Intelligence Analysts, Marketing Executives |

The UAE Audience Analytics Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by digital marketing strategies, social media adoption, and the need for businesses to understand consumer behavior through data analytics.