Region:Middle East

Author(s):Rebecca

Product Code:KRAC3219

Pages:96

Published On:October 2025

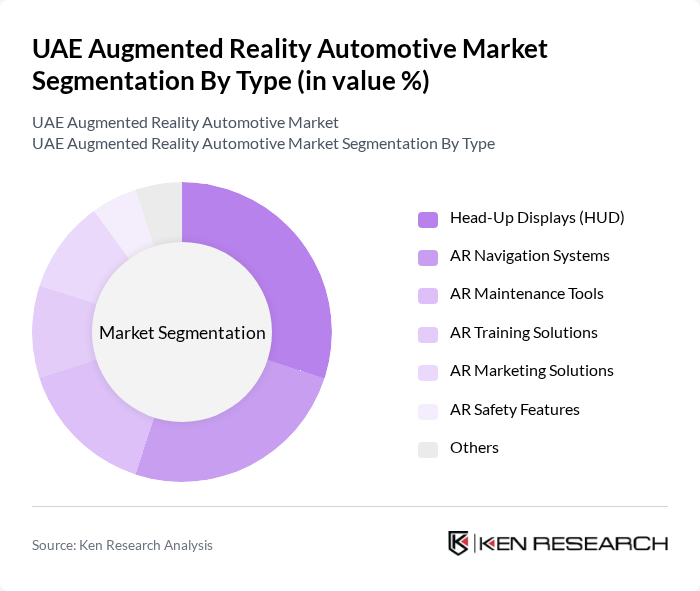

By Type:The market is segmented into various types of augmented reality solutions, including Head-Up Displays (HUD), AR Navigation Systems, AR Maintenance Tools, AR Training Solutions, AR Marketing Solutions, AR Safety Features, and Others. Each of these sub-segments plays a crucial role in enhancing the overall driving experience and operational efficiency in the automotive sector. Head-Up Displays (HUD) remain the most prominent segment, driven by OEM integration and consumer demand for real-time, in-field-of-view information. AR Navigation Systems are increasingly adopted for advanced guidance and hazard detection, while AR Maintenance Tools and Training Solutions are gaining traction in fleet and service operations .

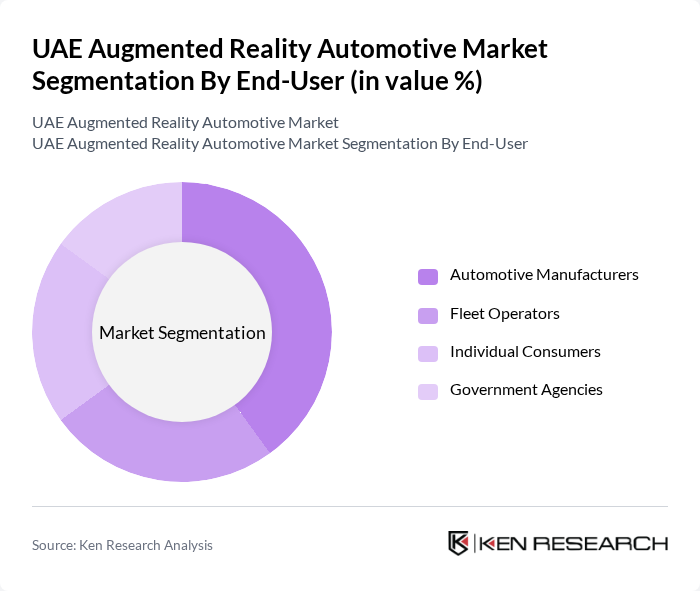

By End-User:The end-user segmentation includes Automotive Manufacturers, Fleet Operators, Individual Consumers, and Government Agencies. Each of these segments utilizes augmented reality solutions to improve operational efficiency, enhance customer engagement, and ensure compliance with safety regulations. Automotive Manufacturers lead adoption, leveraging AR for both in-vehicle features and aftersales support, while Fleet Operators increasingly deploy AR for maintenance and driver training. Individual Consumers are adopting AR through premium vehicle models, and Government Agencies are integrating AR in public transport and safety initiatives .

The UAE Augmented Reality Automotive Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Robert Bosch GmbH, Panasonic Automotive Systems, Visteon Corporation, WayRay AG, Harman International (Samsung Electronics), Valeo SA, Hyundai Mobis, Denso Corporation, Garmin Ltd., Pioneer Corporation, Nippon Seiki Co., Ltd., Luxoft (DXC Technology), Aptiv PLC, Faurecia Clarion Electronics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE augmented reality automotive market appears promising, driven by technological advancements and increasing consumer interest. As the integration of AR with artificial intelligence becomes more prevalent, functionalities such as real-time navigation and enhanced safety features are expected to improve significantly. Furthermore, the shift towards electric and autonomous vehicles will likely create new avenues for AR applications, enhancing the overall driving experience and safety standards in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Head-Up Displays (HUD) AR Navigation Systems AR Maintenance Tools AR Training Solutions AR Marketing Solutions AR Safety Features Others |

| By End-User | Automotive Manufacturers Fleet Operators Individual Consumers Government Agencies |

| By Application | Driver Assistance Vehicle Maintenance Marketing and Sales Training and Education |

| By Distribution Channel | Direct Sales Online Retail Automotive Dealerships Distributors |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Technology Integration | Standalone AR Systems Integrated AR Systems Cloud-Based AR Solutions Sensor Technology (Radar, LiDAR, Image Sensors, Sensor Fusion) Display Technology (TFT-LCD, OLED, MicroLED) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Product Development Managers, Technology Officers |

| AR Technology Providers | 50 | Business Development Managers, Technical Leads |

| Automotive Retailers | 40 | Sales Managers, Customer Experience Directors |

| Consumer Focus Groups | 50 | Car Owners, Tech Enthusiasts |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

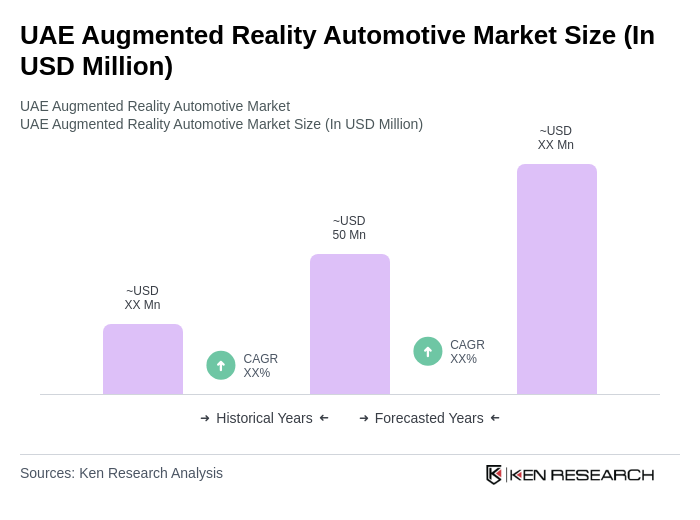

The UAE Augmented Reality Automotive Market is valued at approximately USD 50 million, reflecting a significant growth driven by the increasing adoption of advanced technologies and augmented reality applications in the automotive sector.