Region:Middle East

Author(s):Rebecca

Product Code:KRAD8178

Pages:95

Published On:December 2025

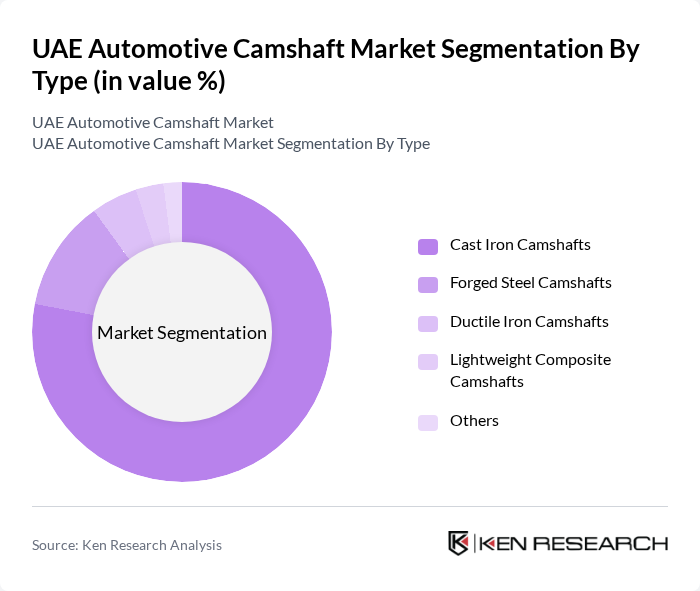

By Type:The market is segmented into various types of camshafts, including Cast Iron Camshafts, Forged Steel Camshafts, Ductile Iron Camshafts, Lightweight Composite Camshafts, and Others. Each type serves different applications based on performance requirements and cost considerations.

The Cast Iron Camshafts segment is currently dominating the market due to their durability and cost-effectiveness, making them a preferred choice for many automotive manufacturers. The increasing production of passenger vehicles and commercial vehicles has further bolstered the demand for cast iron camshafts. Additionally, the trend towards lightweight materials is gradually increasing the market share of Lightweight Composite Camshafts, which are gaining traction in high-performance applications.

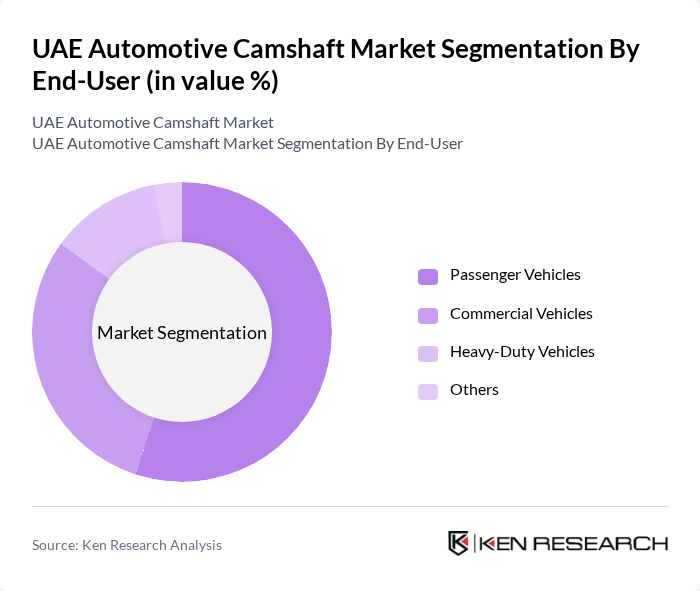

By End-User:The market is segmented based on end-users, including Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, and Others. Each segment reflects the specific needs and applications of camshafts in different vehicle types.

The Passenger Vehicles segment holds the largest market share, driven by the increasing consumer preference for personal vehicles and the growing automotive industry in the UAE. The rise in disposable income and urbanization has led to a surge in vehicle ownership, further enhancing the demand for camshafts in this segment. Meanwhile, the Commercial Vehicles segment is also witnessing significant growth due to the expansion of logistics and transportation services in the region.

The UAE Automotive Camshaft Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mahle GmbH, Aisin Seiki Co., Ltd., Schaeffler AG, BorgWarner Inc., Valeo SA, ZF Friedrichshafen AG, Eaton Corporation, Hitachi Automotive Systems Ltd., NSK Ltd., NTN Corporation, Tenneco Inc., Delphi Technologies PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive camshaft market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt lightweight materials and smart technologies, the demand for innovative camshaft designs will rise. Additionally, the expansion of electric vehicle production will create new opportunities for camshaft manufacturers to develop specialized components, aligning with the UAE's vision for a diversified and sustainable automotive industry by 2030.

| Segment | Sub-Segments |

|---|---|

| By Type | Cast Iron Camshafts Forged Steel Camshafts Ductile Iron Camshafts Lightweight Composite Camshafts Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Others |

| By Engine Type | Gasoline Engines Diesel Engines Hybrid Engines CNG/Alternative Fuel Engines |

| By Manufacturing Process | Casting Forging Machining Others |

| By Distribution Channel | Direct Sales to OEMs Authorized Distributors Aftermarket Retailers Online Sales |

| By Application | OEM (Original Equipment Manufacturing) Aftermarket Replacement Others |

| By Region | Abu Dhabi Dubai Sharjah Others (Ajman, Umm Al Quwain, Ras Al Khaimah, Fujairah) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Camshaft Manufacturers | 45 | Production Managers, Quality Control Engineers |

| Commercial Vehicle Engine Suppliers | 38 | Procurement Directors, Technical Sales Representatives |

| Aftermarket Camshaft Retailers | 32 | Store Managers, Product Line Managers |

| Automotive Repair Shops | 42 | Service Managers, Lead Technicians |

| Automotive Engineering Consultants | 28 | Consultants, Industry Analysts |

The UAE Automotive Camshaft Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for high-performance vehicles and advancements in automotive technology.