Region:Middle East

Author(s):Rebecca

Product Code:KRAB8759

Pages:97

Published On:October 2025

Market.png)

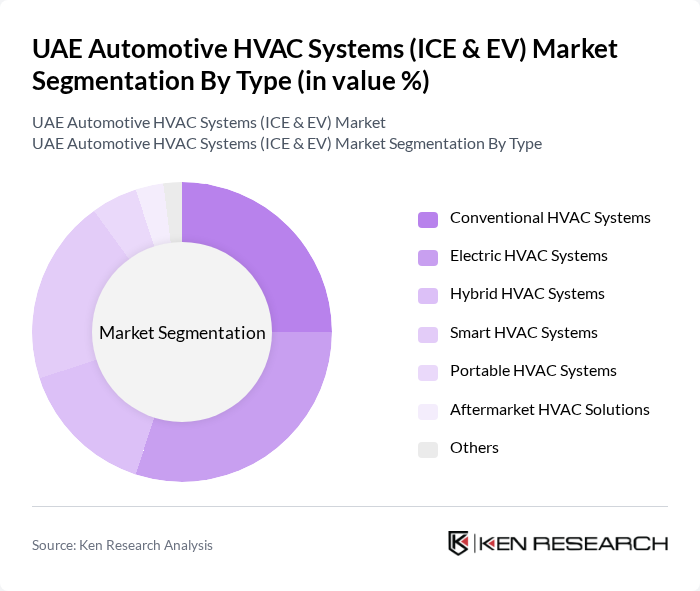

By Type:The market is segmented into various types of HVAC systems, including Conventional HVAC Systems, Electric HVAC Systems, Hybrid HVAC Systems, Smart HVAC Systems, Portable HVAC Systems, Aftermarket HVAC Solutions, and Others. Each type serves different consumer needs and preferences, with a notable trend towards electric and smart systems due to their energy efficiency and advanced features.

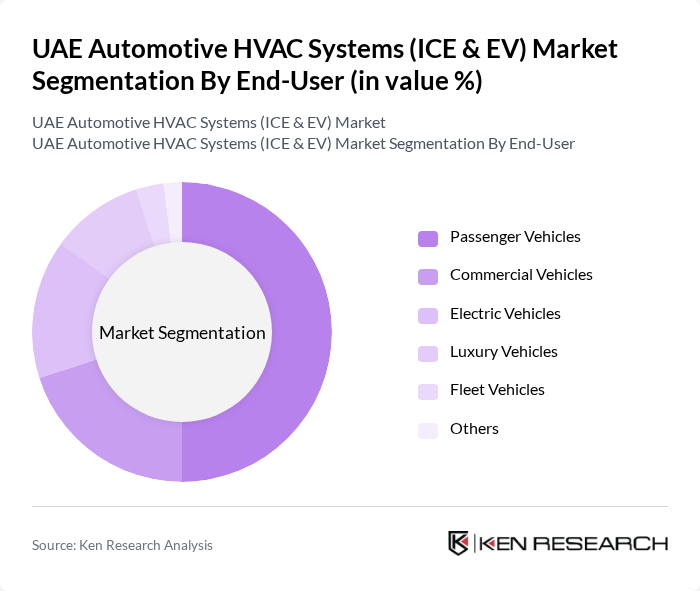

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Luxury Vehicles, Fleet Vehicles, and Others. The passenger vehicle segment is the largest due to the high demand for personal transportation and comfort features, while the electric vehicle segment is rapidly growing as consumers shift towards sustainable options.

The UAE Automotive HVAC Systems (ICE & EV) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Denso Corporation, Valeo SA, Mahle GmbH, Hanon Systems, Sanden Holdings Corporation, Delphi Technologies, Johnson Controls International plc, Webasto SE, Eberspächer Group, Aisin Seiki Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Continental AG, ZF Friedrichshafen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive HVAC systems market is poised for significant transformation, driven by technological advancements and regulatory changes. The integration of smart technologies and IoT capabilities is expected to enhance system efficiency and user experience. Additionally, as the government continues to promote electric vehicle adoption, the demand for specialized HVAC systems will likely increase. This evolving landscape presents opportunities for innovation and collaboration among manufacturers, paving the way for a more sustainable automotive future in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional HVAC Systems Electric HVAC Systems Hybrid HVAC Systems Smart HVAC Systems Portable HVAC Systems Aftermarket HVAC Solutions Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Fleet Vehicles Others |

| By Component | Compressors Condensers Evaporators Expansion Devices Control Systems Others |

| By Sales Channel | OEMs Aftermarket Online Retail Direct Sales Distributors Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Retail Outlets Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Application | Passenger Comfort Climate Control Air Quality Management Energy Efficiency Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| HVAC System Manufacturers | 100 | Product Managers, Technical Directors |

| Automotive OEMs (ICE) | 80 | Engineering Managers, Procurement Officers |

| Automotive OEMs (EV) | 70 | R&D Engineers, Sustainability Managers |

| Aftermarket HVAC Service Providers | 60 | Service Managers, Business Development Executives |

| Regulatory Bodies and Industry Associations | 50 | Policy Analysts, Industry Experts |

The UAE Automotive HVAC Systems market is valued at approximately USD 1.2 billion, driven by increasing demand for passenger comfort and energy-efficient solutions, particularly with the rise of electric vehicles (EVs) requiring advanced HVAC systems for optimal performance.