Region:Middle East

Author(s):Shubham

Product Code:KRAD3577

Pages:86

Published On:November 2025

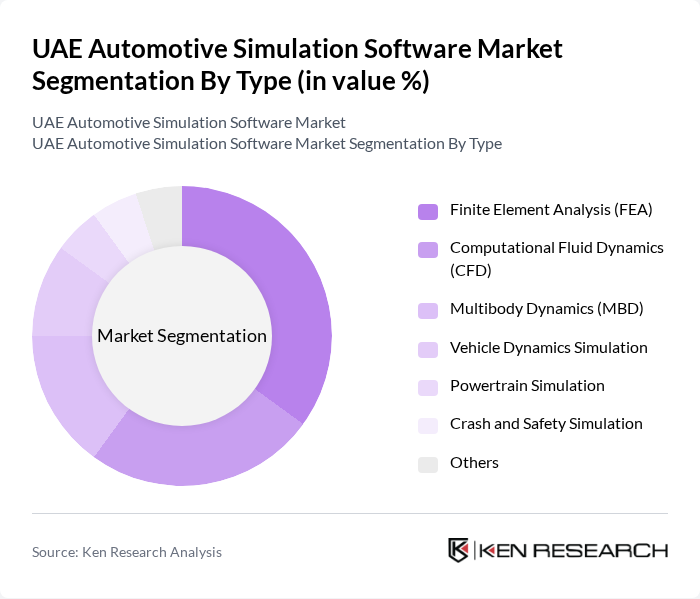

By Type:The market is segmented into various types of simulation software, including Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), Multibody Dynamics (MBD), Vehicle Dynamics Simulation, Powertrain Simulation, Crash and Safety Simulation, and Others. Among these, Finite Element Analysis (FEA) is the leading sub-segment due to its critical role in structural analysis and design validation, which is essential for automotive manufacturers aiming to enhance vehicle safety and performance. The adoption of FEA is further driven by the need to validate lightweight materials and crashworthiness in electric and autonomous vehicles .

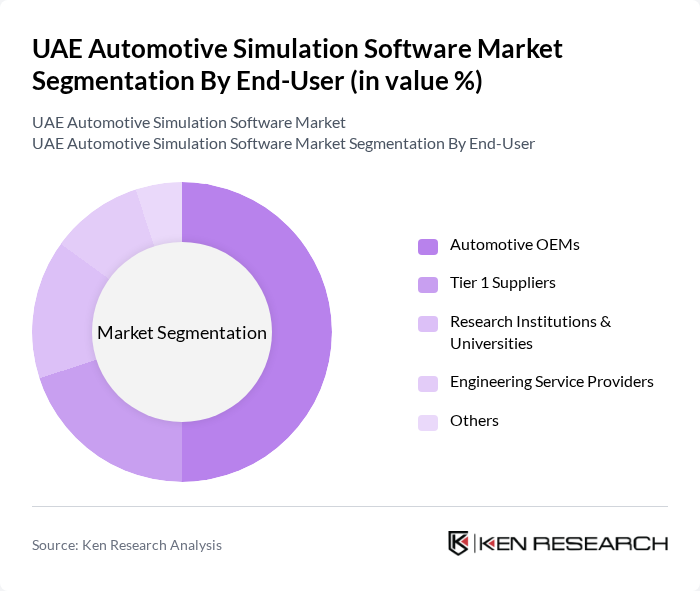

By End-User:The end-user segmentation includes Automotive OEMs, Tier 1 Suppliers, Research Institutions & Universities, Engineering Service Providers, and Others. Automotive OEMs are the dominant segment, driven by their need for advanced simulation tools to streamline design processes, enhance product quality, and comply with stringent safety regulations. The increasing complexity of vehicle platforms, especially with the integration of electric and autonomous systems, is further boosting simulation adoption among OEMs .

The UAE Automotive Simulation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ANSYS, Inc., Siemens Digital Industries Software, Dassault Systèmes, Altair Engineering, Inc., MathWorks, PTC Inc., AVL List GmbH, COMSOL, Inc., Hexagon AB, ESI Group, MSC Software Corporation (Hexagon), Applied Intuition, Inc., dSPACE GmbH, National Instruments Corporation (NI), IPG Automotive GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive simulation software market is poised for significant transformation, driven by technological advancements and regulatory changes. As the demand for electric and autonomous vehicles continues to rise, manufacturers will increasingly rely on simulation tools to enhance design efficiency and safety. Additionally, the integration of AI and machine learning into simulation processes will streamline development cycles, enabling faster innovation. The government's commitment to smart transportation initiatives will further bolster investment in simulation technologies, fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Finite Element Analysis (FEA) Computational Fluid Dynamics (CFD) Multibody Dynamics (MBD) Vehicle Dynamics Simulation Powertrain Simulation Crash and Safety Simulation Others |

| By End-User | Automotive OEMs Tier 1 Suppliers Research Institutions & Universities Engineering Service Providers Others |

| By Application | Design and Development Testing and Validation Autonomous Vehicle Simulation Manufacturing Process Simulation Training and Simulation Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Software Licensing Model | Subscription-Based Perpetual Licensing Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Product Development Managers, R&D Engineers |

| Simulation Software Providers | 40 | Sales Directors, Technical Support Managers |

| Fleet Management Companies | 40 | Operations Managers, Fleet Analysts |

| Academic Institutions | 40 | Research Professors, Automotive Engineering Students |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

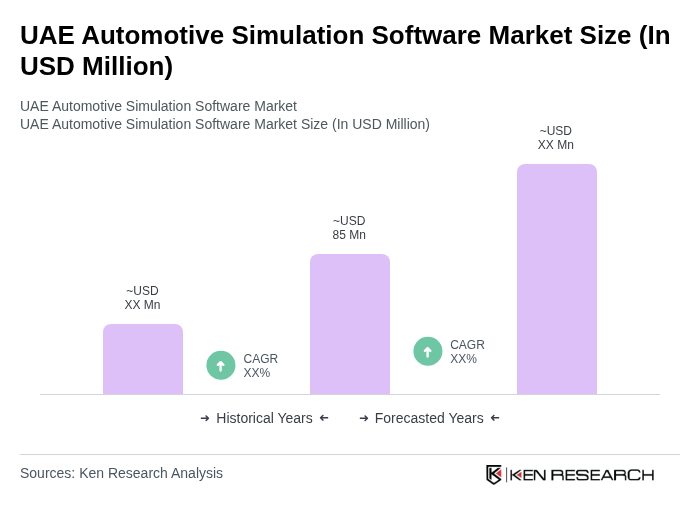

The UAE Automotive Simulation Software Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for advanced simulation tools in automotive design and development.