Region:Middle East

Author(s):Rebecca

Product Code:KRAD8482

Pages:81

Published On:December 2025

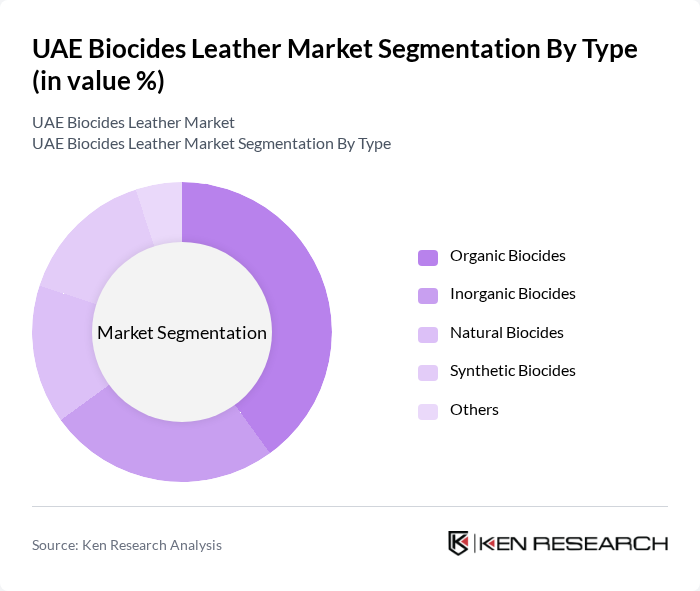

By Type:The market is segmented into various types of biocides, including Organic Biocides, Inorganic Biocides, Natural Biocides, Synthetic Biocides, and Others. Among these, Organic Biocides are gaining traction due to their effectiveness and lower environmental impact. The increasing preference for eco-friendly products is driving the demand for Organic Biocides, making them a leading sub-segment in the market.

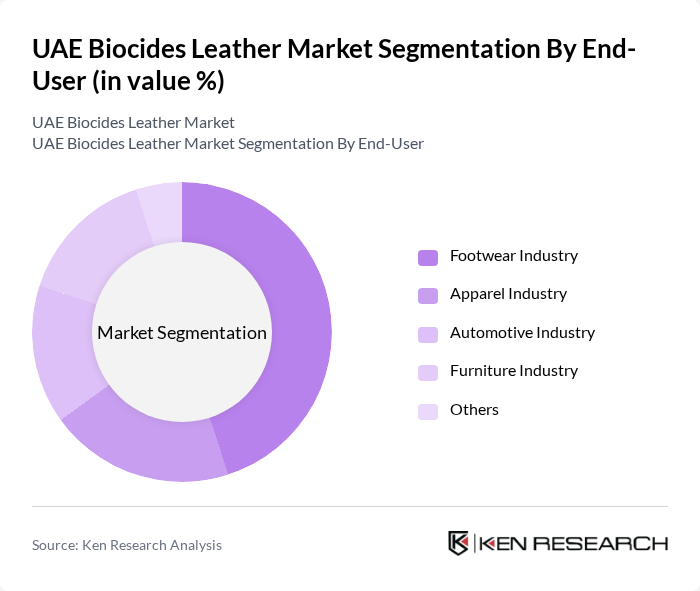

By End-User:The end-user segmentation includes the Footwear Industry, Apparel Industry, Automotive Industry, Furniture Industry, and Others. The Footwear Industry is the dominant segment, driven by the high demand for leather shoes and accessories. The growing fashion trends and consumer preferences for quality leather products are propelling the growth of this segment, making it a key player in the market.

The UAE Biocides Leather Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Lonza Group, Clariant AG, Dow Chemical Company, AkzoNobel N.V., Huntsman Corporation, Solvay S.A., Lanxess AG, Eastman Chemical Company, Croda International Plc, Biocides International, Ecolab Inc., Perstorp Holding AB, Archroma, Syngenta AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE biocides leather market appears promising, driven by a growing emphasis on sustainability and product safety. As consumer preferences shift towards eco-friendly options, manufacturers are likely to invest in innovative biocide solutions that align with these trends. Additionally, the expansion of the leather industry, supported by government initiatives, will create new opportunities for biocide applications. The market is expected to adapt to evolving regulations, ensuring compliance while enhancing product quality and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Biocides Inorganic Biocides Natural Biocides Synthetic Biocides Others |

| By End-User | Footwear Industry Apparel Industry Automotive Industry Furniture Industry Others |

| By Application | Leather Tanning Leather Finishing Leather Preservation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Product Formulation | Liquid Biocides Powder Biocides Gel Biocides Others |

| By Regulatory Compliance | ISO Certified Products Non-ISO Certified Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leather Manufacturing Companies | 100 | Production Managers, Quality Control Supervisors |

| Biocide Suppliers | 80 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 50 | Compliance Officers, Environmental Analysts |

| Leather Product Retailers | 70 | Procurement Managers, Store Operations Heads |

| Industry Experts and Consultants | 60 | Market Analysts, Industry Advisors |

The UAE Biocides Leather Market is valued at approximately USD 165 million, reflecting a significant growth trend driven by increasing demand for leather products across various industries, including footwear, automotive, and furniture.