Region:Middle East

Author(s):Rebecca

Product Code:KRAD6220

Pages:86

Published On:December 2025

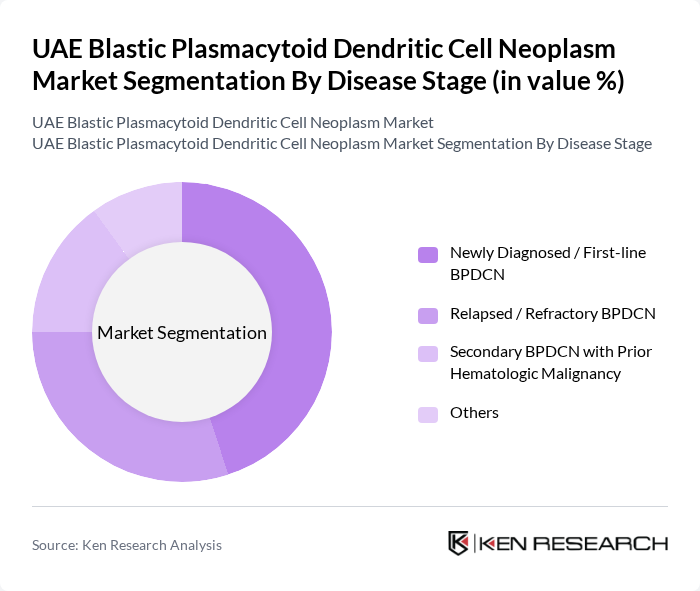

By Disease Stage:

The disease stage segmentation includes Newly Diagnosed / First-line BPDCN, Relapsed / Refractory BPDCN, Secondary BPDCN with Prior Hematologic Malignancy, and Others. The Newly Diagnosed / First-line BPDCN sub-segment is currently leading the market due to the increasing number of patients being diagnosed and the availability of effective first-line therapies. The focus on early detection and treatment has resulted in a higher patient influx into this category, driving its dominance in the market.

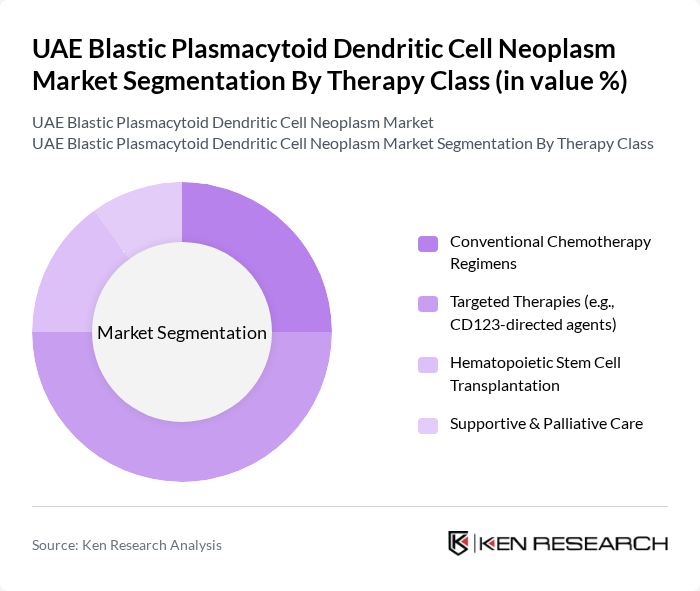

By Therapy Class:

This segmentation includes Conventional Chemotherapy Regimens, Targeted Therapies (e.g., CD123-directed agents), Hematopoietic Stem Cell Transplantation, and Supportive & Palliative Care. Targeted Therapies are currently the leading sub-segment, driven by the increasing adoption of precision medicine and the development of innovative therapies that specifically target BPDCN cells. The effectiveness of these therapies in improving patient outcomes has led to a growing preference among healthcare providers.

The UAE Blastic Plasmacytoid Dendritic Cell Neoplasm Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Health Services Company (SEHA), Dubai Health Authority (DHA), Ministry of Health and Prevention (MOHAP), Cleveland Clinic Abu Dhabi, Sheikh Shakhbout Medical City (SSMC), Tawam Hospital (SEHA Network), Mediclinic Middle East, Burjeel Holdings (Burjeel Hospital, Burjeel Medical City), NMC Healthcare, Aster DM Healthcare, Emirates Health Services, American Hospital Dubai, Al Zahra Hospital Dubai, Saudi German Hospital Dubai, and Dubai Healthcare City Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Blastic Plasmacytoid Dendritic Cell Neoplasm market appears promising, driven by ongoing advancements in personalized medicine and increased investment in biotechnology. As healthcare providers adopt more tailored treatment approaches, patient outcomes are expected to improve significantly. Additionally, the integration of artificial intelligence in diagnostics will enhance early detection capabilities, further supporting market growth. The focus on patient-centric care will also shape the development of innovative therapies and treatment protocols in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Disease Stage | Newly Diagnosed / First-line BPDCN Relapsed / Refractory BPDCN Secondary BPDCN with Prior Hematologic Malignancy Others |

| By Therapy Class | Conventional Chemotherapy Regimens Targeted Therapies (e.g., CD123-directed agents) Hematopoietic Stem Cell Transplantation Supportive & Palliative Care |

| By Line of Therapy | First-line Treatment Second-line Treatment Third-line and Above Maintenance / Consolidation |

| By Patient Demographics | Adult Patients (18–64 years) Geriatric Patients (65+ years) Pediatric / Adolescent Patients (<18 years) Others |

| By Emirate | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Care Setting | Tertiary Oncology Centers Secondary Care Hospitals Specialized Hematology & Bone Marrow Transplant Centers Others |

| By Clinical Trial & Research Activity | Interventional Drug Trials Observational / Registry Studies Academic & Industry-sponsored Collaborative Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologists and Hematologists | 45 | Medical Doctors, Cancer Specialists |

| Healthcare Administrators | 40 | Hospital Managers, Health Policy Makers |

| Patient Advocacy Groups | 40 | Patient Representatives, Support Group Leaders |

| Pharmaceutical Representatives | 45 | Sales Managers, Product Specialists |

| Clinical Researchers | 40 | Research Scientists, Clinical Trial Coordinators |

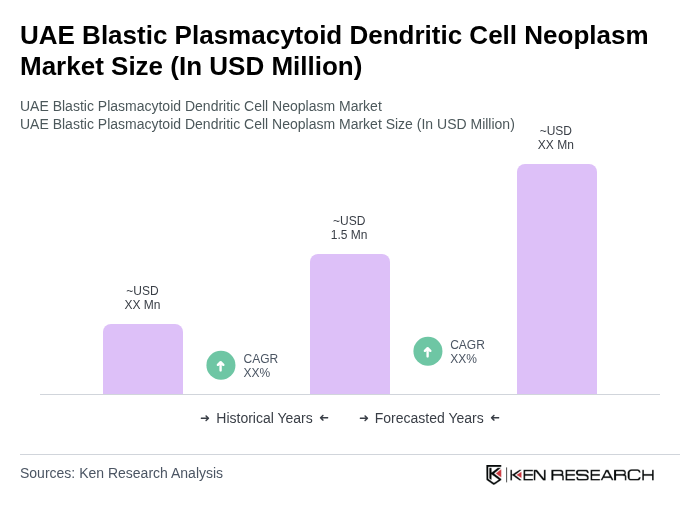

The UAE Blastic Plasmacytoid Dendritic Cell Neoplasm market is valued at approximately USD 1.5 million, reflecting a growing awareness of rare hematologic malignancies and advancements in diagnostic technologies and therapies.