Region:Middle East

Author(s):Rebecca

Product Code:KRAB3561

Pages:88

Published On:October 2025

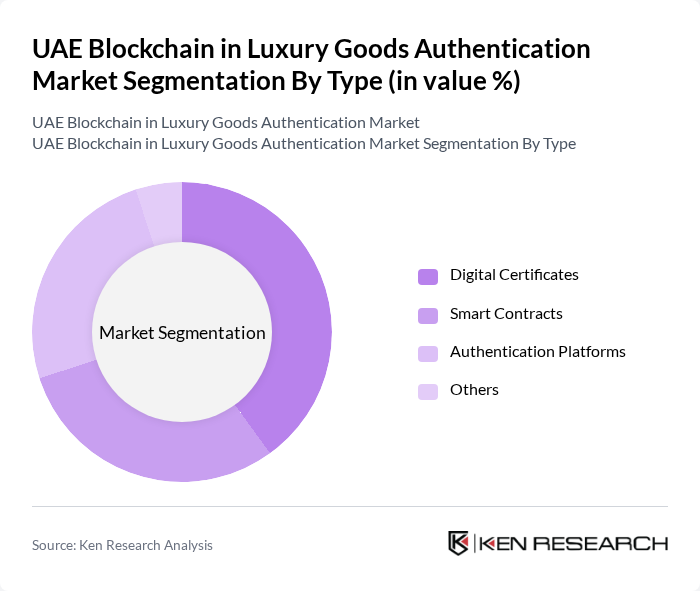

By Type:The market is segmented into Digital Certificates, Smart Contracts, Authentication Platforms, and Others. Digital Certificates are gaining traction due to their ability to provide verifiable proof of authenticity for luxury items. Smart Contracts streamline transactions and ensure compliance with agreements, while Authentication Platforms offer comprehensive solutions for brands to manage their product verification processes. The Others category includes emerging technologies and solutions that support blockchain applications in luxury goods.

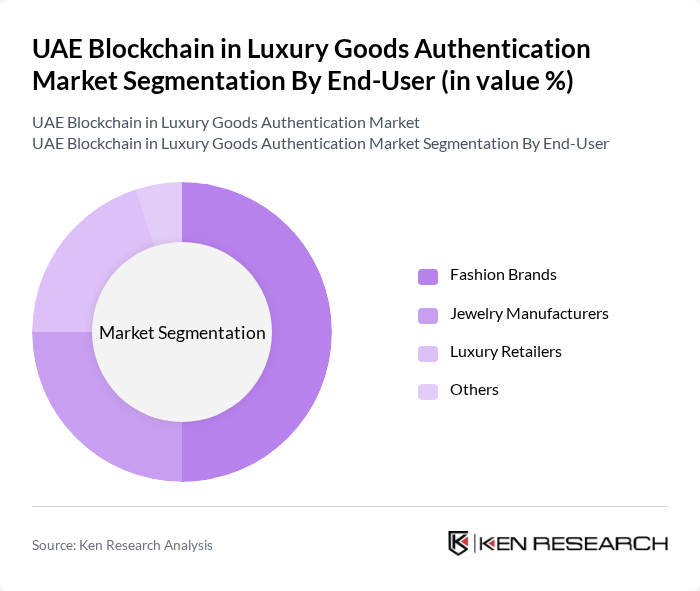

By End-User:The end-user segmentation includes Fashion Brands, Jewelry Manufacturers, Luxury Retailers, and Others. Fashion Brands dominate the market as they increasingly adopt blockchain for product authentication to combat counterfeiting. Jewelry Manufacturers also leverage blockchain to ensure the provenance of precious materials. Luxury Retailers benefit from enhanced customer trust through verified product authenticity, while the Others category encompasses various luxury sectors utilizing blockchain solutions.

The UAE Blockchain in Luxury Goods Authentication Market is characterized by a dynamic mix of regional and international players. Leading participants such as VeChain, Everledger, Luxochain, Chronicled, IBM, Provenance, Arianee, DLT Labs, Blockverify, Authentag, Circl, SkuChain, OriginTrail, Myco, CertiK contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE blockchain in luxury goods authentication market appears promising, driven by technological advancements and increasing consumer demand for transparency. As luxury brands continue to prioritize authenticity, the integration of blockchain technology is expected to become more prevalent. Additionally, the UAE's strategic initiatives to promote digital solutions will likely enhance the market landscape, fostering innovation and collaboration among stakeholders, ultimately leading to a more secure and trustworthy luxury goods market.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Certificates Smart Contracts Authentication Platforms Others |

| By End-User | Fashion Brands Jewelry Manufacturers Luxury Retailers Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores B2B Partnerships Others |

| By Region | Dubai Abu Dhabi Sharjah Others |

| By Product Category | Apparel Accessories Footwear Others |

| By Consumer Demographics | Age Group Income Level Gender Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Retailers | 100 | Store Managers, Brand Executives |

| Blockchain Technology Providers | 75 | Product Managers, Technical Leads |

| Consumer Insights | 150 | Luxury Goods Consumers, Brand Loyalists |

| Supply Chain Experts | 60 | Logistics Managers, Supply Chain Analysts |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

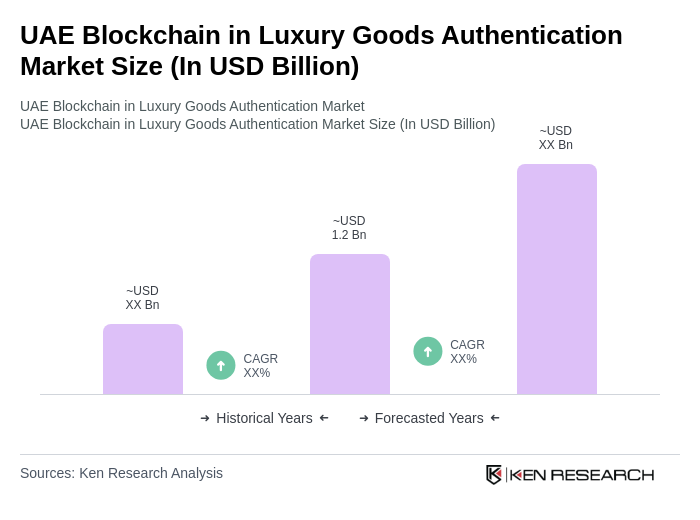

The UAE Blockchain in Luxury Goods Authentication Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for transparency and traceability in luxury goods, particularly in combating counterfeit products.