Region:Middle East

Author(s):Rebecca

Product Code:KRAB7743

Pages:100

Published On:October 2025

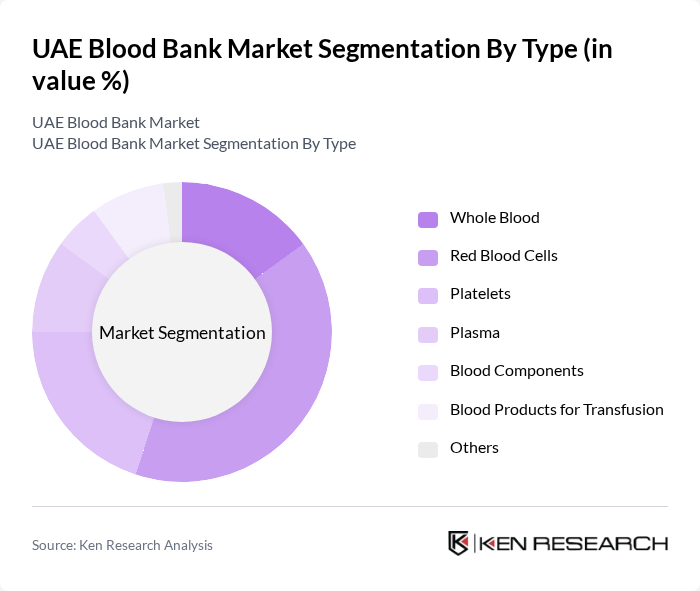

By Type:The market is segmented into various types of blood products, including Whole Blood, Red Blood Cells, Platelets, Plasma, Blood Components, Blood Products for Transfusion, and Others. Among these, Red Blood Cells are the most commonly used due to their critical role in transfusions for patients with anemia and surgical needs. The demand for Platelets has also seen a significant rise, particularly in cancer treatments and surgeries, reflecting changing healthcare needs.

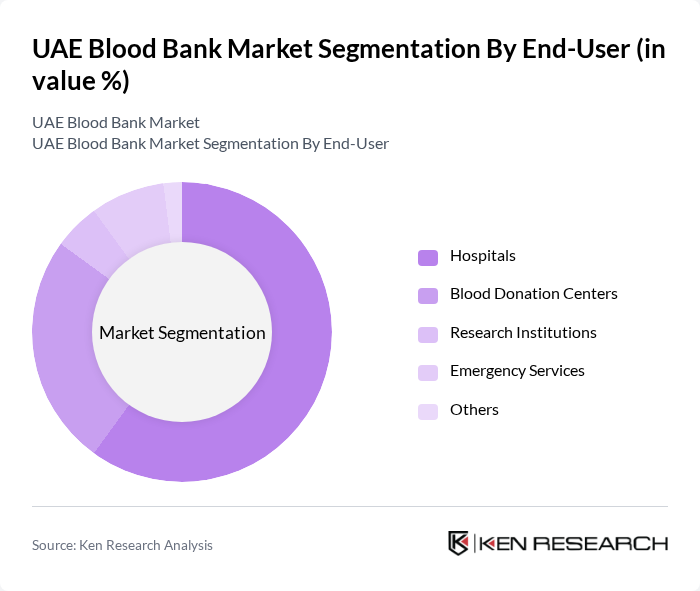

By End-User:The end-user segmentation includes Hospitals, Blood Donation Centers, Research Institutions, Emergency Services, and Others. Hospitals are the leading end-users, driven by the high demand for blood transfusions in surgical procedures and emergency care. Blood Donation Centers play a crucial role in maintaining the supply chain, while Research Institutions contribute to advancements in blood-related studies and therapies.

The UAE Blood Bank Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Blood Bank, Dubai Blood Donation Centre, Sharjah Blood Transfusion and Research Centre, Al Ain Blood Bank, Emirates Blood and Tissue Bank, Gulf Blood Bank, Life Blood Bank, Blood Bank of the UAE, National Blood Transfusion Service, Blood Bank of Dubai Health Authority, Abu Dhabi Health Services Company (SEHA), Mediclinic City Hospital Blood Bank, NMC Healthcare Blood Bank, Cleveland Clinic Abu Dhabi Blood Bank, American Hospital Dubai Blood Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE blood bank market appears promising, driven by technological advancements and increased public engagement. As automated systems and mobile blood donation units become more prevalent, efficiency in blood collection and donor participation is expected to rise. Additionally, partnerships with healthcare institutions will likely enhance the distribution and availability of blood products, ensuring that the growing demand is met effectively. Continuous government support will further bolster these initiatives, creating a robust blood banking ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Blood Red Blood Cells Platelets Plasma Blood Components Blood Products for Transfusion Others |

| By End-User | Hospitals Blood Donation Centers Research Institutions Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Blood Drives and Campaigns Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Geographic Coverage | Urban Areas Rural Areas Regional Blood Banks National Blood Services |

| By Blood Type | A+ O+ B+ AB+ Others |

| By Collection Method | Manual Collection Automated Collection Mobile Collection Units Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Bank Operations | 100 | Blood Bank Managers, Medical Directors |

| Community Blood Donation Drives | 80 | Event Coordinators, Volunteer Leaders |

| Healthcare Professional Insights | 75 | Nurses, Physicians, Blood Transfusion Specialists |

| Public Awareness Campaigns | 60 | Marketing Managers, Public Health Officials |

| Donor Experience Feedback | 90 | Regular Donors, First-time Donors |

The UAE Blood Bank Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing healthcare needs, chronic diseases, and heightened awareness of blood donation's importance.