Region:Middle East

Author(s):Rebecca

Product Code:KRAD6170

Pages:91

Published On:December 2025

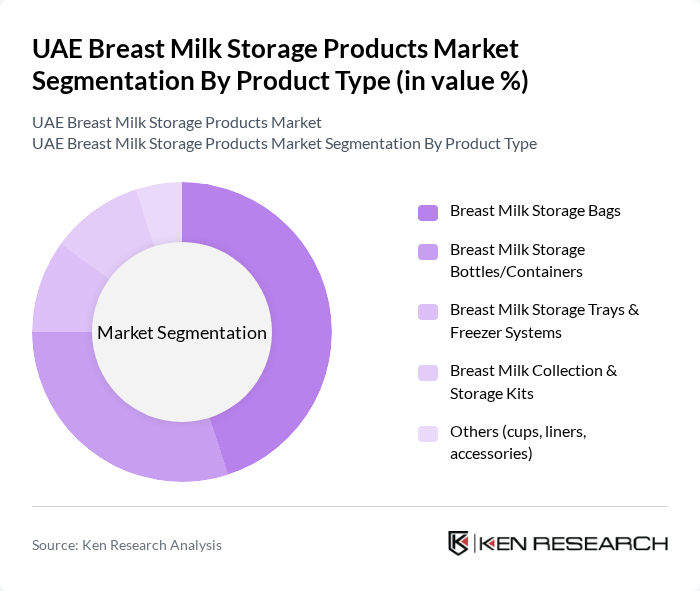

By Product Type:The product type segmentation includes various categories such as breast milk storage bags, bottles/containers, trays & freezer systems, collection & storage kits, and others like cups and liners. This structure is consistent with global breast milk storage products categorization, where bags and bottles are the primary formats and are complemented by organized freezer systems and accessory kits. Among these, breast milk storage bags are currently dominating the market due to their convenience, affordability, and ease of use, reflecting wider regional and global trends where bags account for the largest share of breast milk storage revenues. They are favored by mothers for their lightweight design, space?saving flat?freeze form factor, and ability to be easily frozen or thawed, making them a practical choice for busy parents.

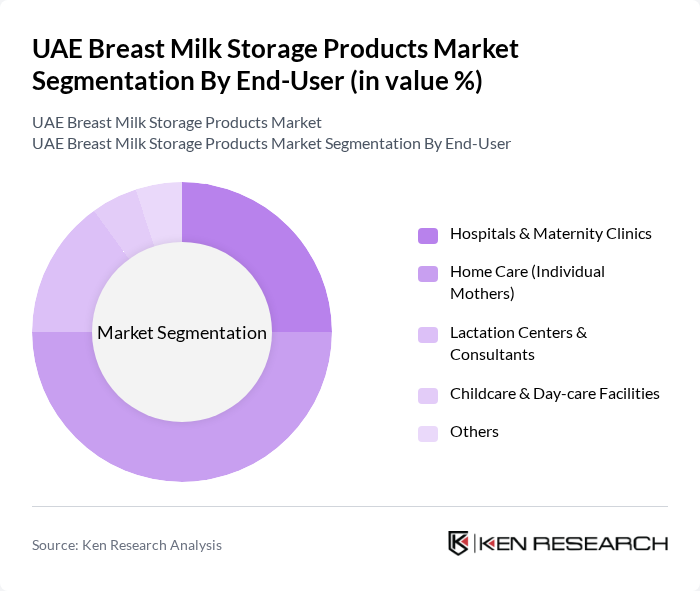

By End-User:The end-user segmentation encompasses hospitals & maternity clinics, home care (individual mothers), lactation centers & consultants, childcare & day-care facilities, and others. This segmentation reflects the main channels through which breast milk storage products are used and distributed in the UAE and broader Middle East and Africa region. The home care segment is leading the market, driven by the increasing number of mothers opting for breastfeeding, higher female labor force participation, and the need for convenient storage solutions at home supported by strong retail pharmacy and e?commerce availability. This trend is further supported by the growing awareness of the nutritional benefits of breast milk promoted through hospital?based lactation support programs and public health campaigns.

The UAE Breast Milk Storage Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medela AG, Lansinoh Laboratories, Inc., Philips Avent (Koninklijke Philips N.V.), Tommee Tippee (Mayborn Group Limited), Spectra Baby (Uzinmedicare Co., Ltd.), NUK (MAPA GmbH), Pigeon Corporation, Dr. Brown’s (Handi-Craft Company), Munchkin, Inc., Baby Brezza, Nanobébé, Chicco (Artsana S.p.A.), Comotomo, Aventis Baby (Regional Private Label / Pharmacy Brand), MumZworld / FirstCry (Key Online Retail & Private Label Presence) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE breast milk storage products market appears promising, driven by increasing consumer awareness and technological advancements. As more mothers recognize the importance of breastfeeding and the convenience of modern storage solutions, demand is expected to rise. Additionally, the market is likely to see a shift towards eco-friendly products, aligning with global sustainability trends. Collaborations with healthcare providers will further enhance product visibility and consumer trust, fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Breast Milk Storage Bags Breast Milk Storage Bottles/Containers Breast Milk Storage Trays & Freezer Systems Breast Milk Collection & Storage Kits Others (cups, liners, accessories) |

| By End-User | Hospitals & Maternity Clinics Home Care (Individual Mothers) Lactation Centers & Consultants Childcare & Day-care Facilities Others |

| By Distribution Channel | E-commerce (Marketplaces & Brand Webstores) Supermarkets/Hypermarkets Pharmacies & Drug Stores Baby Specialty Stores & Mothercare Chains Others (hospital tenders, clinics) |

| By Material | BPA-Free Plastic (PE/PP) Glass Silicone Multi-layer / High-barrier Films Others (stainless steel, compostable materials) |

| By Storage Capacity | Up to 120 ml ml – 240 ml Above 240 ml Assorted/Multipack Sizes |

| By Brand Origin | Global Brands Regional/MENA Brands Private Labels (Retailer & Pharmacy Brands) Others |

| By Price Range | Economy Mid-Range Premium Subscription / Bundle Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pediatricians, Lactation Consultants |

| New Mothers | 120 | First-time Mothers, Caregivers |

| Retailers of Baby Products | 80 | Store Managers, Product Buyers |

| Healthcare Policy Makers | 50 | Public Health Officials, Policy Advisors |

| Market Analysts | 60 | Industry Analysts, Market Researchers |

The UAE Breast Milk Storage Products Market is valued at approximately USD 5 million, reflecting a growing demand driven by increased awareness of breastfeeding benefits and the rising number of working mothers seeking convenient storage solutions.