Region:Middle East

Author(s):Shubham

Product Code:KRAD5525

Pages:89

Published On:December 2025

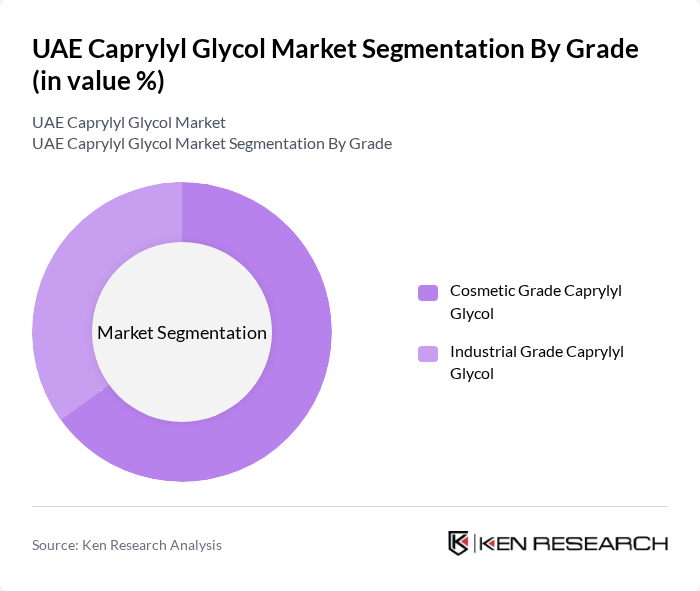

By Grade:

The market is segmented into two primary grades: Cosmetic Grade Caprylyl Glycol and Industrial Grade Caprylyl Glycol, in line with global industry practice where cosmetic grade represents the dominant share. The Cosmetic Grade segment is currently dominating the market due to the increasing use of caprylyl glycol in skincare, haircare, wipes, deodorants, and other personal care products as a multifunctional humectant and preservative booster. Consumers are increasingly seeking products that are safe, gentle, and effective, with reduced traditional preservative load, leading to a higher demand for cosmetic?grade ingredients that support “clean beauty” and sensitive?skin claims. The Industrial Grade segment, while significant, is primarily utilized in cleaning, disinfectant, lubricant, and specialty chemical applications where the antimicrobial and solvency properties of caprylyl glycol are valued, and these end uses are growing but at a slower pace compared to the booming cosmetic and personal care sector in the UAE and wider region.

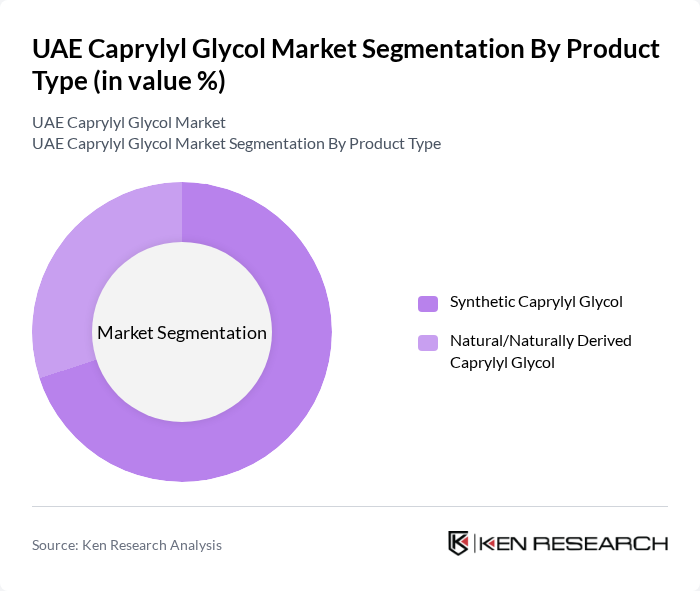

By Product Type:

The market is divided into Synthetic Caprylyl Glycol and Natural/Naturally Derived Caprylyl Glycol. The Synthetic Caprylyl Glycol segment holds a larger share due to its cost-effectiveness, reliable large-scale availability, and consistent purity and performance, which makes it a preferred choice for high?volume personal care, pharmaceutical, and industrial formulations globally and in the Middle East. However, the Natural/Naturally Derived segment is gaining traction as consumers increasingly favor eco-friendly, bio?based, and sustainably sourced ingredients, prompting brands in the UAE to launch products with nature-inspired preservation systems and to position caprylyl glycol in combination with other naturally derived actives. This shift in consumer preference toward clean-label and green beauty concepts is driving growth in the natural segment, albeit from a smaller base compared to synthetic options, particularly in premium and niche product lines.

The UAE Caprylyl Glycol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Evonik Industries AG, Croda International Plc, Symrise AG, Clariant AG, Solvay S.A., Seppic S.A. (Air Liquide Group), Lonza Group AG, Ashland Global Holdings Inc., Innospec Inc., The Dow Chemical Company, KAO Corporation, Vantage Specialty Chemicals, Galaxy Surfactants Ltd., Cornelius Group plc contribute to innovation, geographic expansion, and service delivery in this space.

The UAE caprylyl glycol market is poised for significant growth, driven by increasing consumer demand for personal care and cosmetic products that prioritize skin health. As manufacturers innovate and adapt to market trends, the incorporation of multifunctional ingredients will become more prevalent. Additionally, the shift towards eco-friendly formulations will likely shape product development strategies. Companies that effectively navigate regulatory challenges and leverage emerging market opportunities will be well-positioned to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Grade | Cosmetic Grade Caprylyl Glycol Industrial Grade Caprylyl Glycol |

| By Product Type | Synthetic Caprylyl Glycol Natural/Naturally Derived Caprylyl Glycol |

| By Application | Skin Care Products Hair Care Products Toiletries and Personal Hygiene (including wet wipes) Makeup and Color Cosmetics Pharmaceuticals and Topical Formulations Household & Industrial Cleaning Formulations |

| By End-Use Industry | Cosmetics and Personal Care Manufacturers Pharmaceutical Manufacturers Industrial & Institutional (I&I) Cleaning Product Manufacturers Contract Manufacturers (CMOs/CDMOs) |

| By Distribution Channel | Direct Sales to Manufacturers Specialty Chemical Distributors Online B2B Platforms |

| By Form | Liquid Form Solid/Flake Form |

| By Emirate | Abu Dhabi Dubai Sharjah & Northern Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry Insights | 110 | Product Development Managers, Brand Managers |

| Pharmaceutical Applications | 75 | Regulatory Affairs Specialists, Quality Control Managers |

| Personal Care Products | 95 | Marketing Directors, R&D Scientists |

| Specialty Chemical Distributors | 60 | Sales Managers, Supply Chain Coordinators |

| Market Trends and Consumer Preferences | 80 | Market Analysts, Consumer Insights Managers |

The UAE Caprylyl Glycol market is valued at approximately USD 18 million, contributing to the broader Middle East and Africa caprylyl glycol market, which ranges from USD 48 million to USD 66 million depending on the source and base year.