Region:Middle East

Author(s):Dev

Product Code:KRAB6889

Pages:85

Published On:October 2025

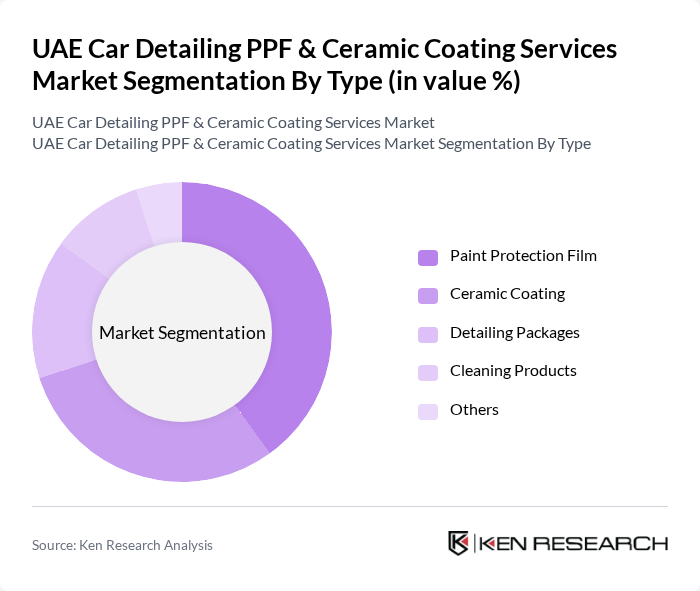

By Type:The market is segmented into various types, including Paint Protection Film, Ceramic Coating, Detailing Packages, Cleaning Products, and Others. Among these, Paint Protection Film is gaining significant traction due to its effectiveness in protecting vehicles from scratches and environmental damage. Ceramic Coating is also popular for its long-lasting protective qualities and ease of maintenance. The demand for detailing packages is rising as consumers seek comprehensive care for their vehicles, while cleaning products and other services complement these primary offerings.

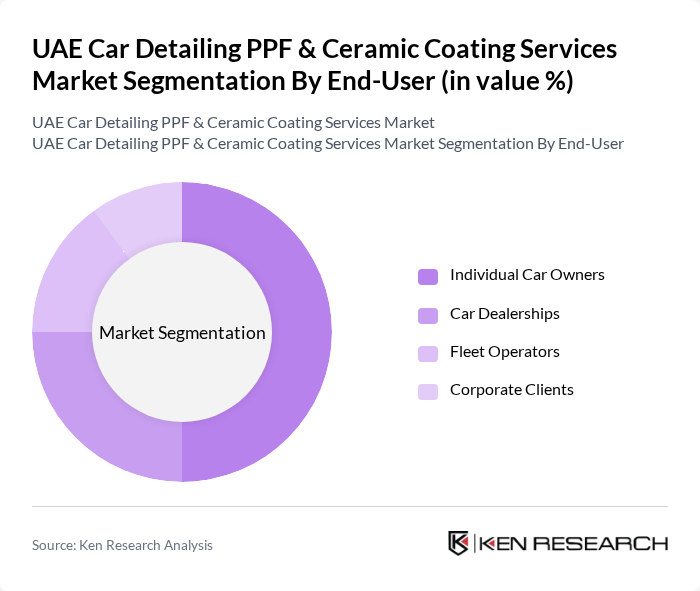

By End-User:The end-user segmentation includes Individual Car Owners, Car Dealerships, Fleet Operators, and Corporate Clients. Individual car owners represent the largest segment, driven by the growing trend of personal vehicle ownership and the desire for maintaining vehicle aesthetics. Car dealerships also play a crucial role, as they often provide detailing services to enhance the appeal of their inventory. Fleet operators and corporate clients are increasingly investing in detailing services to maintain their vehicles' appearance and value, contributing to market growth.

The UAE Car Detailing PPF & Ceramic Coating Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shine & Protect, Auto Detailing UAE, Ceramic Pro UAE, PPF Masters, Detail King, The Detailers, Gulf Detailing, Elite Car Care, Auto Spa, Diamond Shine, ProShield, Glossy Finish, Detail Garage, Prestige Detailing, Ultimate Shine contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE car detailing market appears promising, driven by evolving consumer preferences and technological advancements. As more consumers prioritize vehicle maintenance, the demand for high-quality detailing services is expected to rise. Additionally, the integration of advanced technologies, such as mobile detailing apps and AI-driven customer service solutions, will enhance operational efficiency. Service providers that adapt to these trends will likely capture a larger market share, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Paint Protection Film Ceramic Coating Detailing Packages Cleaning Products Others |

| By End-User | Individual Car Owners Car Dealerships Fleet Operators Corporate Clients |

| By Service Type | Interior Detailing Exterior Detailing Engine Bay Cleaning Headlight Restoration |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets Mobile Services |

| By Price Range | Budget Mid-Range Premium |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Luxury Vehicle Owners Economy Vehicle Owners Commercial Vehicle Owners Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Detailing Service Providers | 100 | Business Owners, Service Managers |

| Automotive Enthusiasts | 80 | Car Owners, Hobbyists |

| Industry Experts and Consultants | 50 | Automotive Analysts, Market Researchers |

| Consumers of PPF and Ceramic Coating | 120 | Recent Customers, Vehicle Owners |

| Automotive Retailers and Distributors | 70 | Sales Managers, Product Distributors |

The UAE Car Detailing PPF & Ceramic Coating Services Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness and demand for vehicle maintenance and protection services.