Region:Middle East

Author(s):Dev

Product Code:KRAB8798

Pages:88

Published On:October 2025

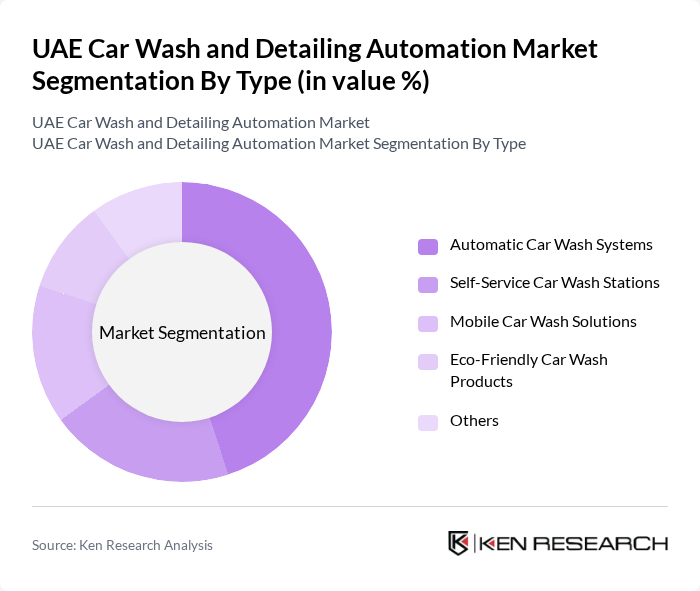

By Type:The market is segmented into various types, including Automatic Car Wash Systems, Self-Service Car Wash Stations, Mobile Car Wash Solutions, Eco-Friendly Car Wash Products, and Others. Among these, Automatic Car Wash Systems are leading the market due to their efficiency and convenience, appealing to consumers who prefer quick and high-quality services. The trend towards automation is driven by technological advancements and consumer demand for faster service.

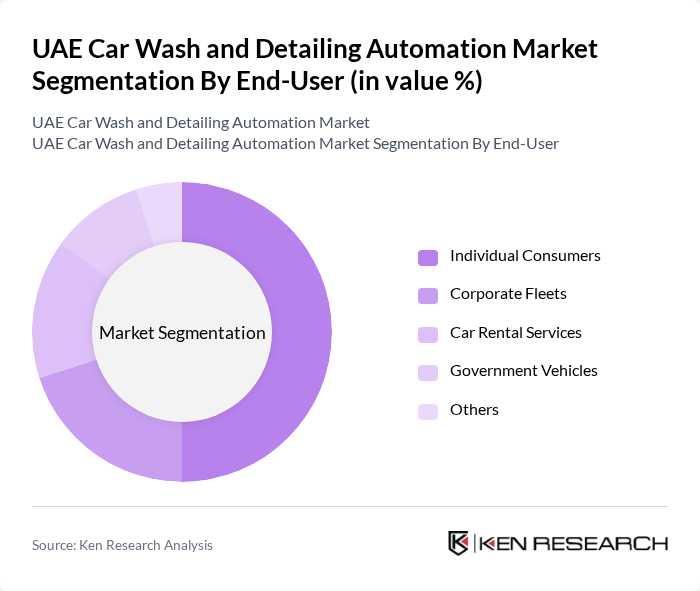

By End-User:The end-user segmentation includes Individual Consumers, Corporate Fleets, Car Rental Services, Government Vehicles, and Others. Individual Consumers dominate the market, driven by the increasing number of personal vehicles and a growing preference for convenience and quality in car care. The rise in disposable income and urbanization further supports this trend, as consumers seek efficient solutions for vehicle maintenance.

The UAE Car Wash and Detailing Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as WashTec AG, Istobal S.A., Tommy's Express Car Wash, Zips Car Wash, Eco Wash, DetailXPerts, Mr. Clean Car Wash, Autobell Car Wash, Quick Quack Car Wash, Splash Car Wash, Clean Car Wash, Waterless Car Wash, Shine On Car Wash, Detail King, The Car Wash Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE car wash and detailing automation market appears promising, driven by technological innovations and changing consumer preferences. As the market evolves, businesses are likely to focus on enhancing customer experiences through personalized services and mobile applications. Additionally, the integration of eco-friendly practices will become increasingly important, aligning with the UAE's sustainability initiatives. This shift will create a dynamic landscape for automated car wash services, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Car Wash Systems Self-Service Car Wash Stations Mobile Car Wash Solutions Eco-Friendly Car Wash Products Others |

| By End-User | Individual Consumers Corporate Fleets Car Rental Services Government Vehicles Others |

| By Service Type | Exterior Washing Interior Detailing Engine Cleaning Waxing and Polishing Others |

| By Payment Method | Cash Payments Credit/Debit Card Payments Mobile Payment Solutions Subscription Payments Others |

| By Location | Urban Areas Suburban Areas Rural Areas Highway Service Areas Others |

| By Customer Segment | Luxury Vehicle Owners Economy Vehicle Owners Commercial Vehicle Operators Fleet Management Companies Others |

| By Brand Preference | Local Brands International Brands Franchise Operations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Wash Service Providers | 100 | Business Owners, Operations Managers |

| Detailing Service Providers | 80 | Service Managers, Marketing Directors |

| Automotive Consumers | 150 | Car Owners, Fleet Managers |

| Technology Suppliers for Automation | 60 | Product Managers, Sales Executives |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Officers |

The UAE Car Wash and Detailing Automation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing vehicle ownership, rising disposable incomes, and a preference for automated services that enhance convenience for consumers.