Region:Middle East

Author(s):Rebecca

Product Code:KRAD6254

Pages:88

Published On:December 2025

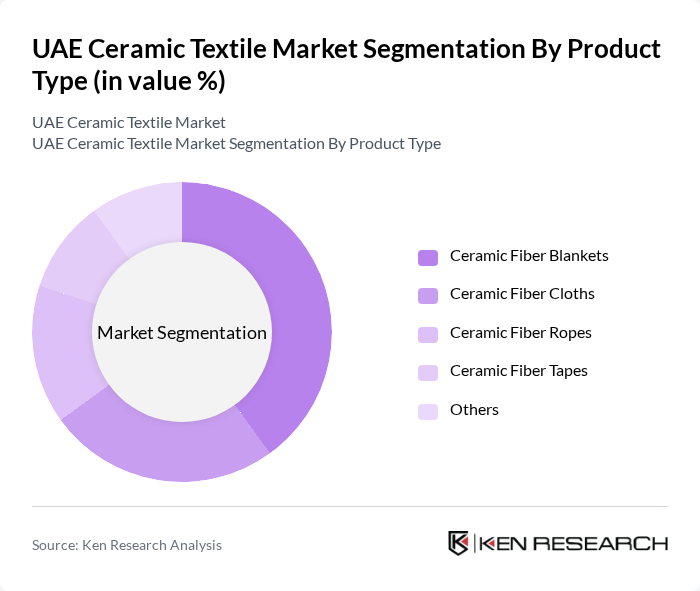

By Product Type:The product type segmentation includes various forms of ceramic textiles, each serving specific applications and industries. The dominant sub-segment is Ceramic Fiber Blankets, which are widely used for thermal insulation in high-temperature environments. Ceramic Fiber Cloths and Ropes also hold significant market shares due to their versatility and effectiveness in various industrial applications. The Others category includes niche products that cater to specialized needs.

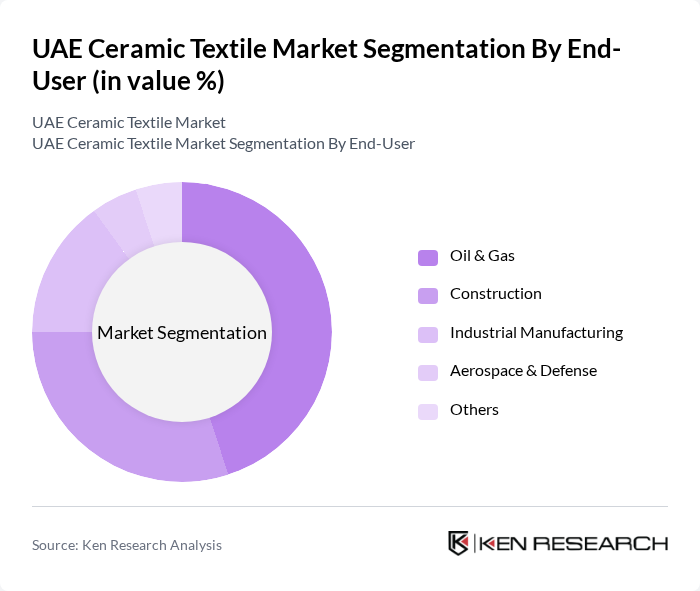

By End-User:The end-user segmentation highlights the various industries utilizing ceramic textiles. The Oil & Gas sector is the largest consumer, driven by the need for high-temperature insulation and fire protection. The Construction industry follows closely, as regulations increasingly mandate the use of fire-resistant materials. Aerospace & Defense also represents a significant market due to stringent safety standards and the demand for lightweight, high-performance materials.

The UAE Ceramic Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unifrax I LLC, Luyang Energy-Saving Materials Co., Ltd., Morgan Advanced Materials, Rath Group, Isolite Insulating Products Co., Ltd., Ibiden Co., Ltd., Nutec, HarbisonWalker International, Mitsubishi Chemical Holdings Corporation, 3M Company, DuPont de Nemours, Inc., Saudi Basic Industries Corporation (SABIC), Emirates Insulation Manufacturing Company (EIMCO), Al Ghurair Industries, Gulf Thermo Gulf contribute to innovation, geographic expansion, and service delivery in this space.

The UAE ceramic textile market is poised for significant growth, driven by advancements in technology and increasing demand across various sectors. As industries prioritize energy efficiency and safety, the adoption of ceramic textiles is expected to rise. Furthermore, the government's focus on diversifying the economy and promoting local manufacturing will likely create a favorable environment for market expansion. Innovations in sustainable production methods will also play a crucial role in shaping the future landscape of this industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Ceramic Fiber Blankets Ceramic Fiber Cloths Ceramic Fiber Ropes Ceramic Fiber Tapes Others |

| By End-User | Oil & Gas Construction Industrial Manufacturing Aerospace & Defense Others |

| By Application | Thermal Insulation Fire Protection High-Temperature Seals Protective Clothing Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms Industrial Suppliers Others |

| By Fiber Type | Alumina-Silica Polycrystalline Sol-Gel Others |

| By Temperature Resistance | Up to 1000°C 1400°C Above 1400°C Others |

| By Price Range | Standard Grade Mid-Range High-Performance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Ceramic Textiles | 100 | Production Managers, Quality Control Supervisors |

| Retailers of Home Decor Products | 80 | Store Managers, Merchandising Directors |

| Interior Designers and Architects | 70 | Design Consultants, Project Managers |

| Importers and Distributors of Textile Products | 60 | Supply Chain Managers, Procurement Specialists |

| Trade Associations and Regulatory Bodies | 50 | Policy Makers, Industry Analysts |

The UAE Ceramic Textile Market is valued at approximately USD 170 million, driven by the demand for high-performance insulation materials across various industries, including oil and gas, construction, and aerospace.