Region:Middle East

Author(s):Shubham

Product Code:KRAD5429

Pages:86

Published On:December 2025

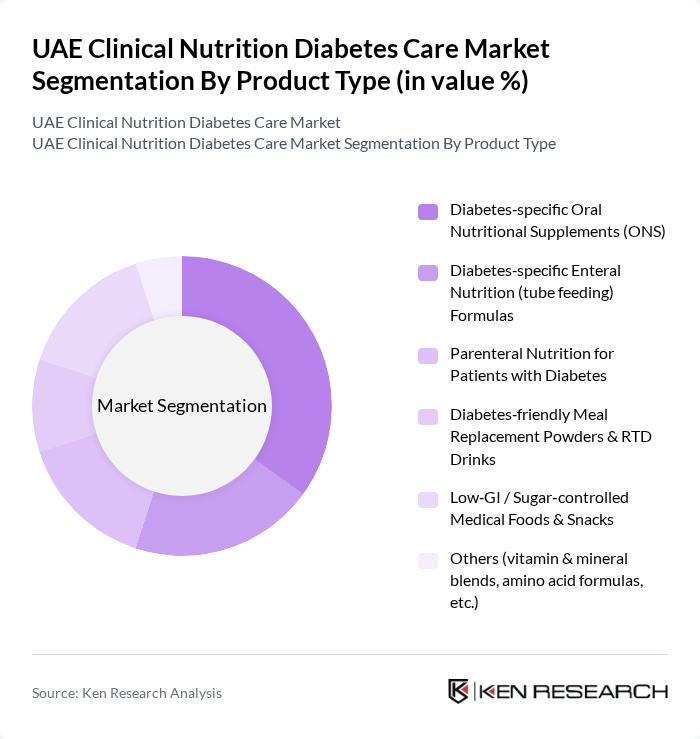

By Product Type:The product type segmentation includes various specialized nutritional products designed for diabetes management. The subsegments are Diabetes-specific Oral Nutritional Supplements (ONS), Diabetes-specific Enteral Nutrition (tube feeding) Formulas, Parenteral Nutrition for Patients with Diabetes, Diabetes-friendly Meal Replacement Powders & RTD Drinks, Low-GI / Sugar-controlled Medical Foods & Snacks, and Others (vitamin & mineral blends, amino acid formulas, etc.). Among these, Diabetes-specific Oral Nutritional Supplements (ONS) are leading the market due to their convenience and effectiveness in managing blood sugar levels.

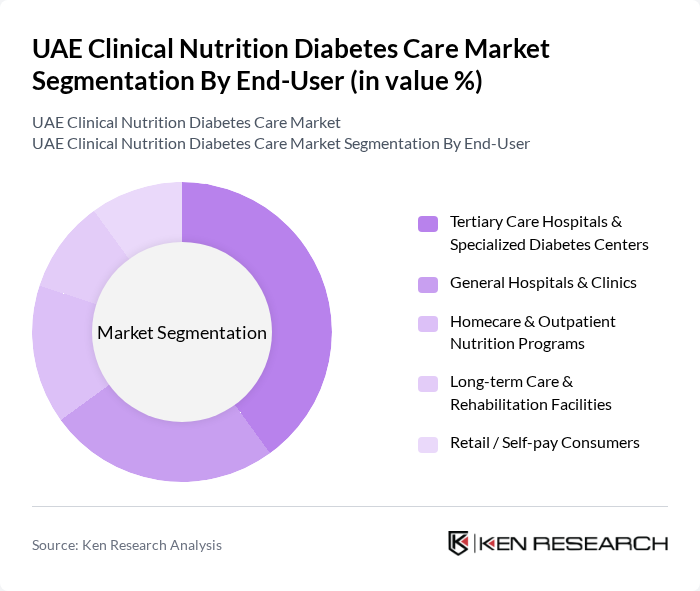

By End-User:The end-user segmentation encompasses various healthcare settings where clinical nutrition products are utilized. This includes Tertiary Care Hospitals & Specialized Diabetes Centers, General Hospitals & Clinics, Homecare & Outpatient Nutrition Programs, Long-term Care & Rehabilitation Facilities, and Retail / Self-pay Consumers. Tertiary Care Hospitals & Specialized Diabetes Centers dominate this segment due to their comprehensive diabetes management programs and access to specialized nutrition products.

The UAE Clinical Nutrition Diabetes Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (Abbott Nutrition), Nestlé Health Science, Danone Nutricia, Fresenius Kabi, B. Braun Melsungen AG, Mead Johnson Nutrition (Reckitt), Ajinomoto Group, Otsuka Pharmaceutical Co., Ltd., Baxter International Inc., AYMES International Ltd., Nutricia Middle East DMCC, Abbott Laboratories S.A. (Middle East & UAE operations), Nestlé Middle East FZE, Fresenius Kabi Gulf FZ LLC, Local & Regional Players (e.g., Gulf Pharmaceutical Industries – Julphar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Clinical Nutrition Diabetes Care Market appears promising, driven by technological advancements and a growing emphasis on personalized healthcare. As telehealth services expand, patients will gain easier access to nutrition consultations, enhancing their management of diabetes. Additionally, the integration of artificial intelligence in developing personalized nutrition plans is expected to revolutionize patient care, ensuring tailored dietary recommendations that align with individual health needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diabetes?specific Oral Nutritional Supplements (ONS) Diabetes?specific Enteral Nutrition (tube feeding) Formulas Parenteral Nutrition for Patients with Diabetes Diabetes?friendly Meal Replacement Powders & RTD Drinks Low?GI / Sugar?controlled Medical Foods & Snacks Others (vitamin & mineral blends, amino acid formulas, etc.) |

| By End-User | Tertiary Care Hospitals & Specialized Diabetes Centers General Hospitals & Clinics Homecare & Outpatient Nutrition Programs Long-term Care & Rehabilitation Facilities Retail / Self-pay Consumers |

| By Distribution Channel | Institutional Sales (hospitals, clinics, long-term care) Hospital & Chain Pharmacies Community Pharmacies & Drug Stores Modern Grocery Retail (Supermarkets/Hypermarkets) E-commerce & Online Pharmacies Others |

| By Patient Demographics | Pediatric Patients with Diabetes Adult Patients with Diabetes Geriatric Patients with Diabetes High?BMI / Obese Diabetic Patients Others |

| By Diabetes Type / Clinical Condition | Type 1 Diabetes Type 2 Diabetes Gestational Diabetes Pre-diabetes & Impaired Glucose Tolerance Diabetes with Co-morbidities (CKD, CVD, etc.) Others |

| By Product Formulation & Nutritional Profile | Low Glycemic Index (Low?GI) Formulations High?Protein / High?Fiber Formulations Sugar?Free / No Added Sugar Formulations Gluten-Free & Lactose-Free Formulations Specialized Formulas for Renal / Cardio?metabolic Complications Organic / Clean?label Formulations Others |

| By Packaging Type | Bottles & Ready?to?Drink (RTD) Packs Sachets & Stick Packs Tetra Packs / Cartons Cans Bulk Institutional Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Nutrition Services | 120 | Clinical Nutritionists, Dietitians |

| Diabetes Care Programs | 100 | Healthcare Providers, Diabetes Educators |

| Patient Dietary Management | 80 | Diabetes Patients, Caregivers |

| Health Policy Impact | 60 | Health Policy Makers, Public Health Officials |

| Market Trends in Nutrition | 90 | Nutrition Researchers, Academic Experts |

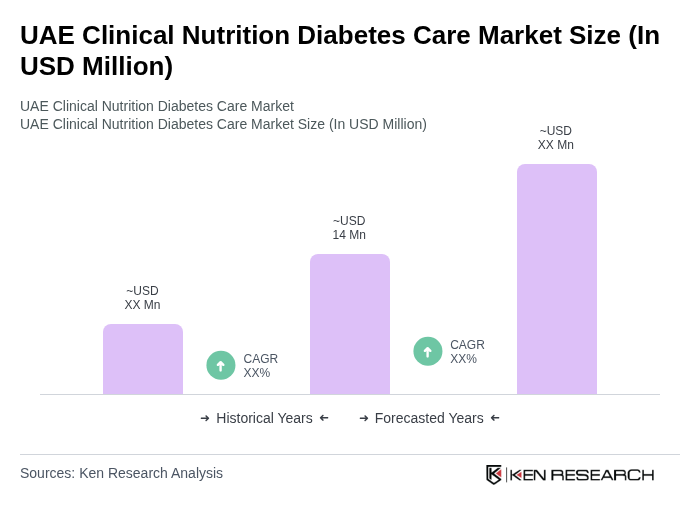

The UAE Clinical Nutrition Diabetes Care Market is valued at approximately USD 14 million, reflecting a significant growth driven by the increasing prevalence of diabetes and rising healthcare expenditures in the region.