Region:Middle East

Author(s):Shubham

Product Code:KRAD0915

Pages:93

Published On:November 2025

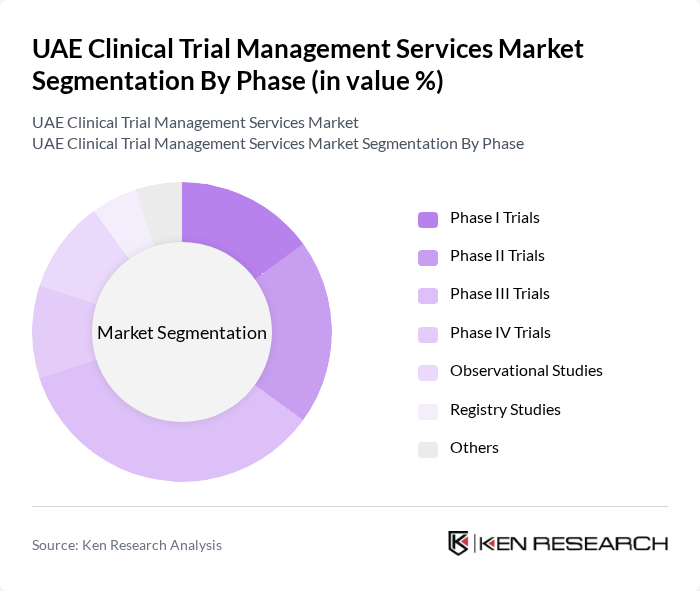

By Phase:The market is segmented into various phases of clinical trials, including Phase I, II, III, IV, observational studies, registry studies, and others. Among these, Phase III trials dominate the market due to their critical role in determining the efficacy and safety of new treatments before they receive regulatory approval. The increasing complexity of clinical trials, rising demand for robust patient data, and the need for multi-center studies contribute to the prominence of this segment.

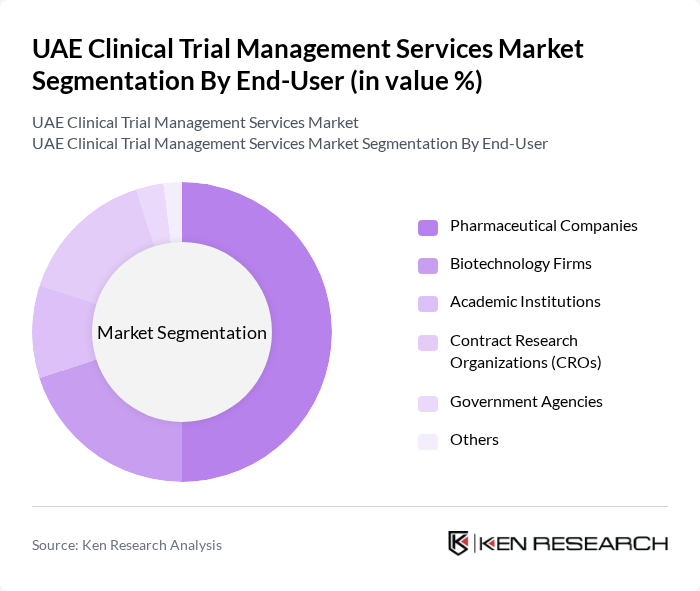

By End-User:The end-user segmentation includes pharmaceutical companies, biotechnology firms, academic institutions, contract research organizations (CROs), government agencies, and others. Pharmaceutical companies are the leading end-users, driven by their need for extensive clinical data to support drug development and regulatory submissions. The increasing investment in R&D, focus on personalized medicine, and expansion of clinical trial activity by these companies further solidify their dominant position in the market.

The UAE Clinical Trial Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Clinical Research Center (ADCRC), Dubai Health Authority Clinical Trials Center, Gulf Drug Clinical Research, Clinigen Group, Parexel International, Labcorp Drug Development (formerly Covance), ICON plc, Syneos Health, Medpace, Charles River Laboratories, IQVIA (formerly QuintilesIMS), PRA Health Sciences, WuXi AppTec, BioClinica, KCR contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE clinical trial management services market appears promising, driven by technological advancements and a growing focus on patient-centric approaches. The integration of digital technologies, such as telemedicine and electronic data capture, is expected to streamline trial processes and enhance patient engagement. Additionally, collaborations with international research entities will likely expand the scope of clinical trials, fostering innovation and improving treatment options for various diseases, including rare conditions, thereby enhancing the overall healthcare landscape in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Phase | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Observational Studies Registry Studies Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic Institutions Contract Research Organizations (CROs) Government Agencies Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Endocrinology Others |

| By Geography | Abu Dhabi Dubai Sharjah Ajman Others |

| By Study Design | Interventional Studies Observational Studies Expanded Access Studies Registry Studies Others |

| By Patient Population | Adult Population Pediatric Population Geriatric Population Others |

| By Funding Source | Government Funded Trials Industry Funded Trials Non-Profit Funded Trials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Clinical Trials | 80 | Clinical Research Coordinators, Project Managers |

| Medical Device Trials | 60 | Regulatory Affairs Specialists, Clinical Trial Managers |

| Oncology Trials | 50 | Oncologists, Research Nurses |

| Cardiovascular Trials | 40 | Cardiologists, Clinical Research Associates |

| Rare Disease Trials | 40 | Patient Advocacy Representatives, Clinical Investigators |

The UAE Clinical Trial Management Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by an increase in clinical trials, digital health technology adoption, and a focus on research and development in the pharmaceutical sector.