Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8521

Pages:96

Published On:October 2025

Tools Market.png)

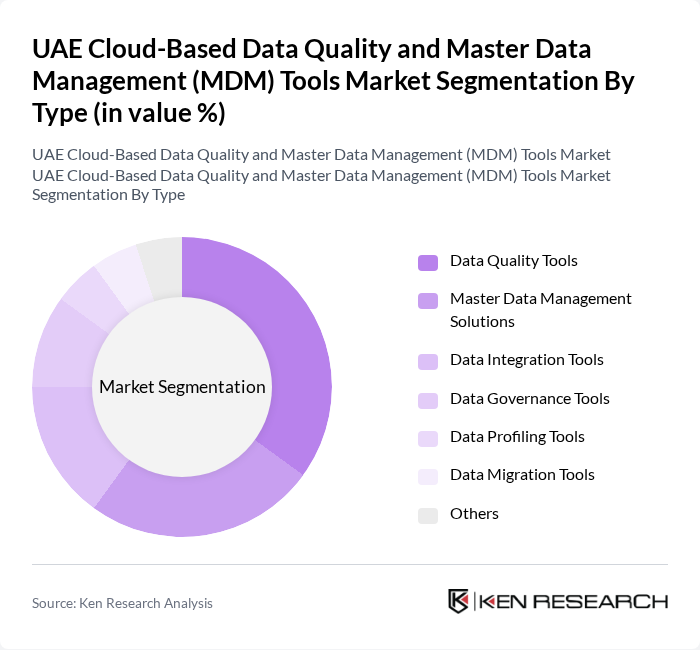

By Type:

The subsegments under this category include Data Quality Tools, Master Data Management Solutions, Data Integration Tools, Data Governance Tools, Data Profiling Tools, Data Migration Tools, and Others. Among these, Data Quality Tools are currently dominating the market due to the increasing emphasis on data accuracy and reliability. Organizations are investing heavily in these tools to ensure that their data is clean, consistent, and usable, which is critical for effective decision-making and compliance with regulations. The growing awareness of the importance of data quality in driving business success is propelling this segment forward.

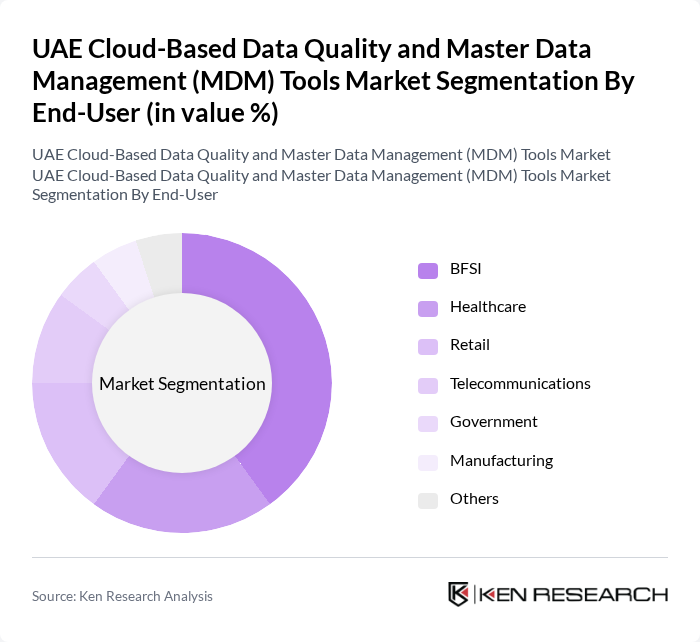

By End-User:

The subsegments in this category include BFSI, Healthcare, Retail, Telecommunications, Government, Manufacturing, and Others. The BFSI sector is leading the market, driven by stringent regulatory requirements and the need for accurate customer data management. Financial institutions are increasingly adopting MDM tools to enhance customer insights, improve compliance, and streamline operations. The growing digitalization in banking and finance is further propelling the demand for data management solutions in this sector.

The UAE Cloud-Based Data Quality and Master Data Management (MDM) Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Informatica, SAP SE, IBM Corporation, Talend, Oracle Corporation, SAS Institute Inc., Microsoft Corporation, TIBCO Software Inc., Ataccama, Profisee, Stibo Systems, Data Ladder, Syncsort, D&B Hoovers, Experian Data Quality contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cloud-based data quality and MDM tools market appears promising, driven by technological advancements and increasing digitalization. As organizations prioritize data governance and compliance, the demand for automated data management solutions is expected to rise. Furthermore, the integration of AI and machine learning technologies will enhance data analytics capabilities, enabling businesses to derive actionable insights from their data. This trend will likely foster innovation and growth in the sector, positioning it for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Quality Tools Master Data Management Solutions Data Integration Tools Data Governance Tools Data Profiling Tools Data Migration Tools Others |

| By End-User | BFSI Healthcare Retail Telecommunications Government Manufacturing Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Pricing Model | Subscription-based Pay-as-you-go One-time License Fee |

| By Industry Vertical | Financial Services Healthcare Services Retail and E-commerce Telecommunications Government Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Management | 100 | Data Analysts, Compliance Officers |

| Healthcare Data Quality Initiatives | 80 | IT Managers, Health Information Officers |

| Retail Sector MDM Implementation | 70 | Supply Chain Managers, Marketing Analysts |

| Telecommunications Data Governance | 90 | Data Scientists, Network Operations Managers |

| Government Data Quality Standards | 60 | Policy Makers, IT Governance Leads |

The UAE Cloud-Based Data Quality and Master Data Management (MDM) Tools Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing need for data accuracy and regulatory compliance across various sectors.