Region:Middle East

Author(s):Geetanshi

Product Code:KRAB3338

Pages:97

Published On:October 2025

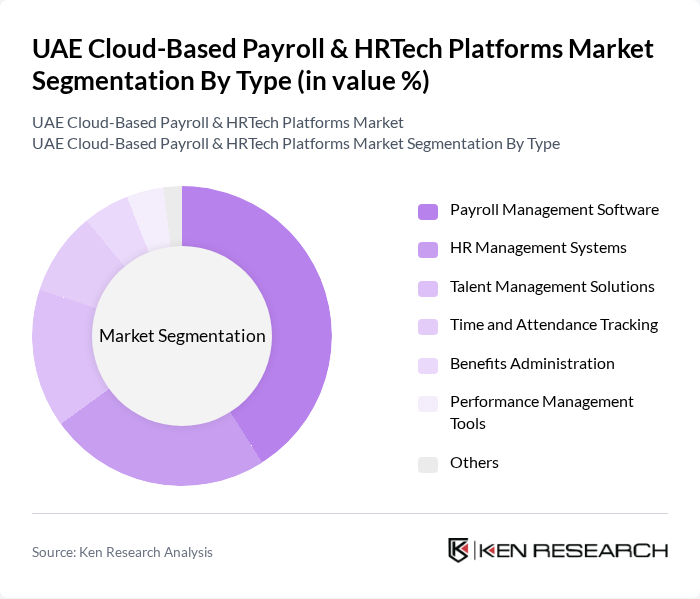

By Type:The market is segmented into various types of solutions that address different HR requirements. The primary subsegments include Payroll Management Software, HR Management Systems, Talent Management Solutions, Time and Attendance Tracking, Benefits Administration, Performance Management Tools, and Others. Among these, Payroll Management Software is the most widely adopted, as it is essential for ensuring regulatory compliance and efficient salary processing .

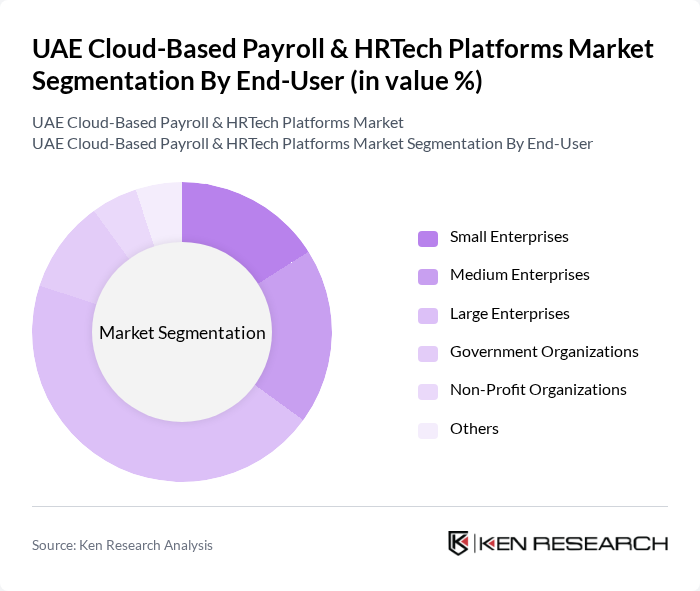

By End-User:The end-user segmentation includes Small Enterprises, Medium Enterprises, Large Enterprises, Government Organizations, Non-Profit Organizations, and Others. Large Enterprises represent the largest share due to their complex HR requirements and greater capacity to invest in integrated payroll and HR solutions that support compliance and operational excellence .

The UAE Cloud-Based Payroll & HRTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle HCM Cloud, SAP SuccessFactors, Workday, ADP, Paychex, Bayzat, ZenHR, PeopleStrong, Darwinbox, Bayt.com (for recruitment modules), GulfTalent (for recruitment modules), NGA Human Resources, Ramco Systems, Sage Middle East, Xero, BambooHR, Gusto, Paylocity, Rippling, Justworks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cloud-based payroll and HRTech platforms market appears promising, driven by technological advancements and a growing emphasis on employee-centric solutions. As organizations increasingly adopt AI and machine learning, the efficiency of payroll processing is expected to improve significantly. Additionally, the expansion of cloud infrastructure will facilitate greater accessibility and scalability, allowing businesses to tailor solutions to their specific needs while enhancing overall operational efficiency in the HR domain.

| Segment | Sub-Segments |

|---|---|

| By Type | Payroll Management Software HR Management Systems Talent Management Solutions Time and Attendance Tracking Benefits Administration Performance Management Tools Others |

| By End-User | Small Enterprises Medium Enterprises Large Enterprises Government Organizations Non-Profit Organizations Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Industry Vertical | IT and Telecom Healthcare Retail Manufacturing Financial Services Hospitality Others |

| By Geographic Presence | UAE GCC Region MENA Region Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| By Customer Size | Small Businesses Medium-Sized Businesses Large Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector HR Management | 50 | HR Directors, Payroll Managers |

| Retail Industry Payroll Solutions | 60 | Operations Managers, HR Coordinators |

| Financial Services HRTech Adoption | 55 | Compliance Officers, HR Business Partners |

| SME Cloud Payroll Utilization | 65 | Business Owners, Finance Managers |

| Technology Sector HR Innovations | 70 | CTOs, HR Technology Specialists |

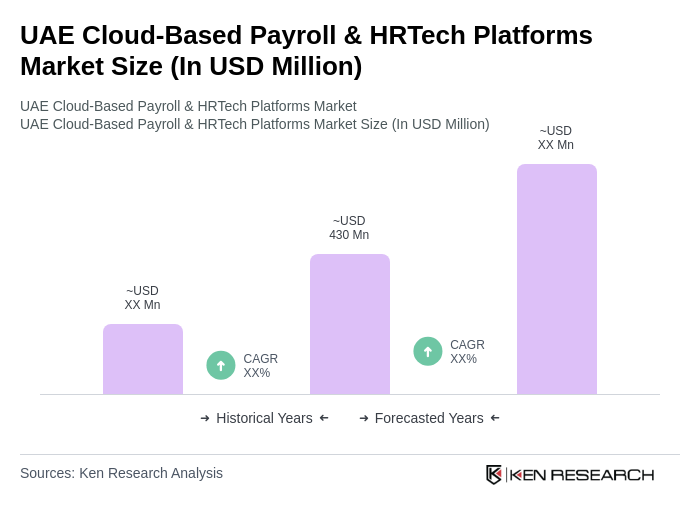

The UAE Cloud-Based Payroll & HRTech Platforms Market is valued at approximately USD 430 million, reflecting significant growth driven by the increasing adoption of digital HR and payroll solutions among businesses in the region.