Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6648

Pages:83

Published On:October 2025

Market.png)

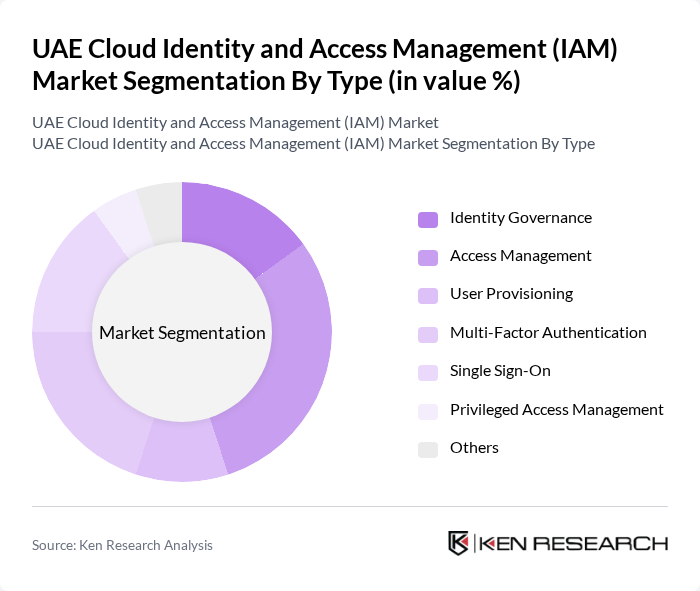

By Type:The IAM market can be segmented into various types, including Identity Governance, Access Management, User Provisioning, Multi-Factor Authentication, Single Sign-On, Privileged Access Management, and Others. Among these, Access Management is currently the leading sub-segment, driven by the increasing need for secure access to applications and data. Organizations are prioritizing solutions that provide seamless user experiences while ensuring robust security measures. The growing adoption of cloud services and the need for compliance with data protection regulations further enhance the demand for Access Management solutions.

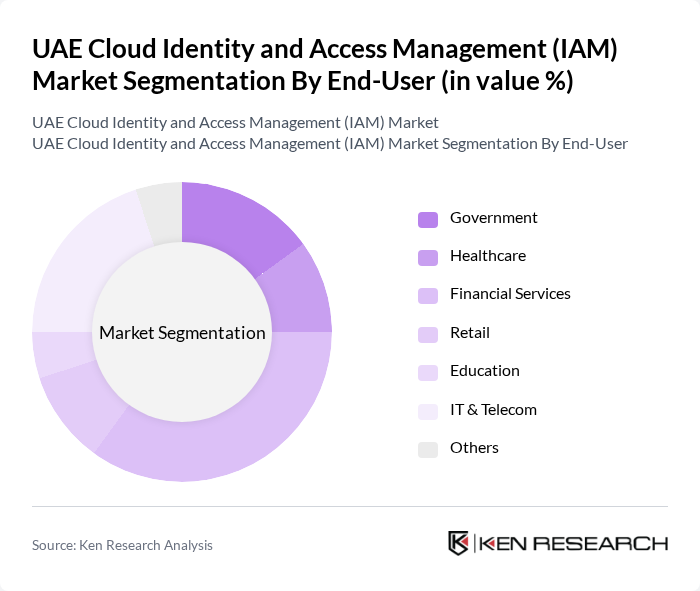

By End-User:The IAM market is segmented by end-users, including Government, Healthcare, Financial Services, Retail, Education, IT & Telecom, and Others. The Financial Services sector is the dominant segment, as it requires stringent security measures to protect sensitive customer data and comply with regulatory standards. The increasing frequency of cyberattacks in this sector has led organizations to invest heavily in IAM solutions to safeguard their operations and maintain customer trust.

The UAE Cloud Identity and Access Management (IAM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Okta, Inc., Microsoft Corporation, IBM Corporation, Ping Identity Corporation, ForgeRock, Inc., RSA Security LLC, CyberArk Software Ltd., OneLogin, Inc., SailPoint Technologies Holdings, Inc., CA Technologies, Auth0, Inc., Centrify Corporation, Identity Automation, Inc., SecureAuth Corporation, JumpCloud, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE IAM market is poised for significant evolution, driven by technological advancements and increasing regulatory pressures. As organizations prioritize cybersecurity, the adoption of AI-driven IAM solutions is expected to rise, enhancing threat detection and response capabilities. Additionally, the shift towards zero trust security models will redefine access management strategies, ensuring that security measures are robust and adaptive. The focus on user experience will also shape future developments, making IAM solutions more intuitive and efficient for end-users.

| Segment | Sub-Segments |

|---|---|

| By Type | Identity Governance Access Management User Provisioning Multi-Factor Authentication Single Sign-On Privileged Access Management Others |

| By End-User | Government Healthcare Financial Services Retail Education IT & Telecom Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Compliance Standards | GDPR ISO 27001 NIST PCI DSS Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services IAM Solutions | 100 | IT Security Managers, Compliance Officers |

| Healthcare Sector IAM Implementation | 80 | Healthcare IT Directors, Data Protection Officers |

| Government IAM Initiatives | 70 | Government IT Administrators, Cybersecurity Analysts |

| Retail Sector Cloud IAM Adoption | 60 | Retail IT Managers, E-commerce Directors |

| Manufacturing Industry IAM Solutions | 50 | Operations Managers, IT Infrastructure Leads |

The UAE Cloud Identity and Access Management (IAM) Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing need for secure access to cloud applications and the rising number of cyber threats.