Region:Middle East

Author(s):Shubham

Product Code:KRAB7101

Pages:89

Published On:October 2025

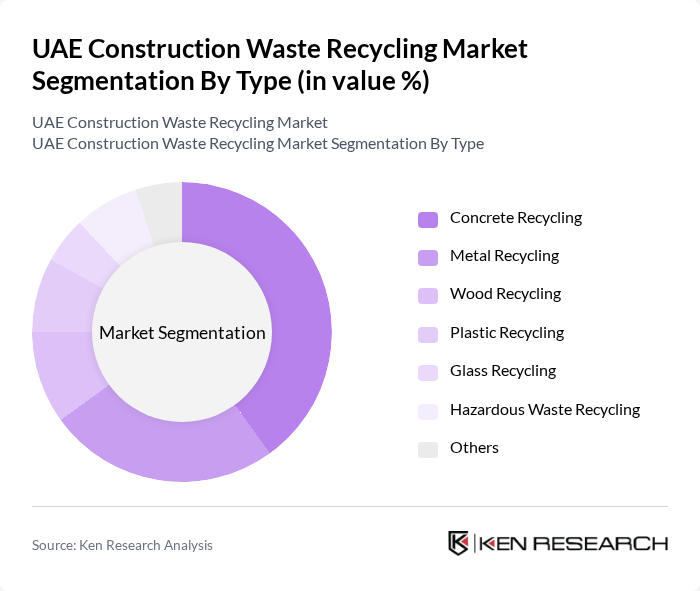

By Type:The market is segmented into various types of recycling processes, including concrete recycling, metal recycling, wood recycling, plastic recycling, glass recycling, hazardous waste recycling, and others. Among these, concrete recycling is the most dominant segment due to the high volume of concrete waste generated from construction activities. The increasing focus on sustainable construction practices and the reuse of materials have further propelled the demand for concrete recycling solutions. Metal recycling also holds a significant share, driven by the rising prices of metals and the need for resource conservation.

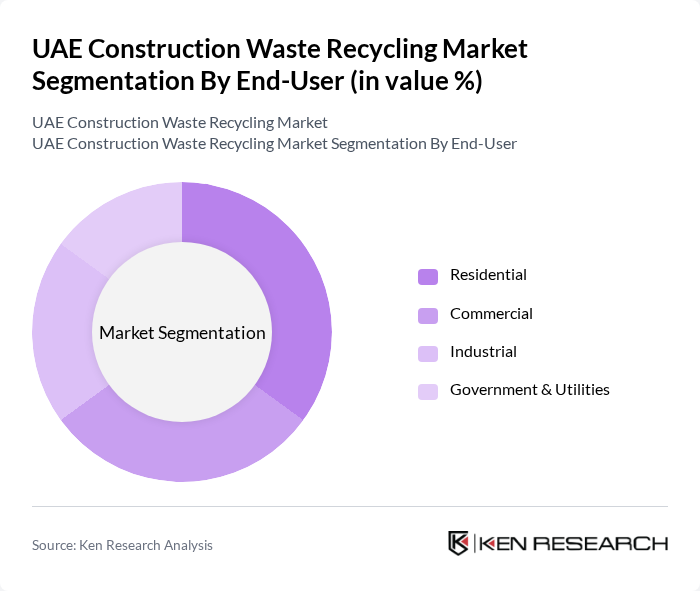

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential segment is witnessing significant growth due to the increasing number of housing projects and the emphasis on sustainable living. The commercial sector also contributes substantially, driven by the construction of office buildings, retail spaces, and hotels. Government initiatives to promote recycling in public infrastructure projects further enhance the demand from the government & utilities segment.

The UAE Construction Waste Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bee'ah, Averda, Dulsco, Emirates Recycling, Enviroserve, Green Planet, Abu Dhabi Waste Management Center, Dubai Municipality, Al Dhafra Recycling Industries, National Waste Management Company, EcoWaste, Waste Management Solutions, Recycle UAE, Clean City, Waste Management Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE construction waste recycling market appears promising, driven by increasing urbanization and stringent environmental regulations. As the government continues to enforce recycling targets, the industry is likely to see a shift towards sustainable practices. Additionally, technological advancements in recycling processes will enhance efficiency and reduce costs, making recycling more attractive. The growing emphasis on sustainability will further encourage construction firms to adopt eco-friendly practices, aligning with national goals for waste reduction and environmental protection.

| Segment | Sub-Segments |

|---|---|

| By Type | Concrete Recycling Metal Recycling Wood Recycling Plastic Recycling Glass Recycling Hazardous Waste Recycling Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Road Construction Building Construction Infrastructure Development Landscaping |

| By Collection Method | Curbside Collection Drop-off Centers Mobile Collection Units |

| By Processing Method | Mechanical Processing Manual Sorting Thermal Treatment |

| By Material Type | Inert Materials Non-Inert Materials |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Waste Management Practices | 100 | Project Managers, Sustainability Coordinators |

| Recycling Facility Operations | 80 | Facility Managers, Operations Directors |

| Government Policy Impact Assessment | 60 | Regulatory Officials, Environmental Consultants |

| Construction Sector Stakeholder Insights | 90 | Architects, Engineers, Contractors |

| Market Trends in Recycling Technologies | 70 | Technology Providers, Research Analysts |

The UAE Construction Waste Recycling Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, infrastructure development, and government initiatives focused on sustainability and waste reduction.