Region:Middle East

Author(s):Shubham

Product Code:KRAB6242

Pages:91

Published On:October 2025

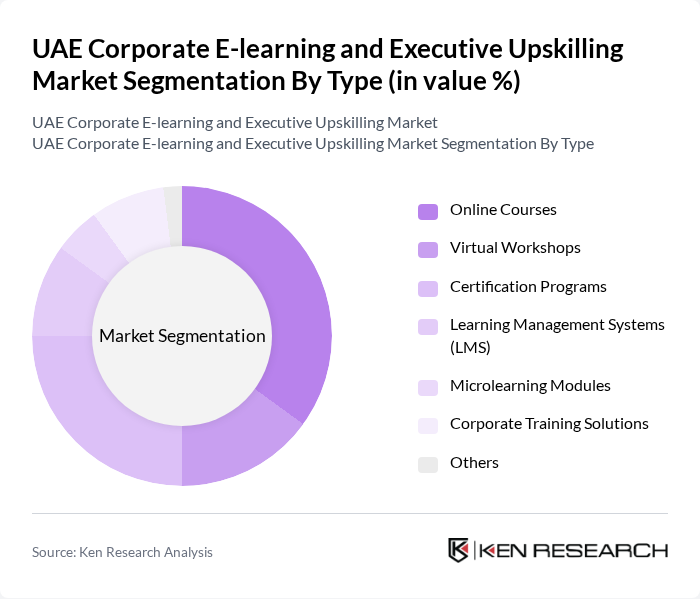

By Type:The market is segmented into various types of e-learning solutions, including online courses, virtual workshops, certification programs, learning management systems (LMS), microlearning modules, corporate training solutions, and others. Among these, online courses and certification programs are particularly popular due to their flexibility and the growing demand for recognized qualifications.

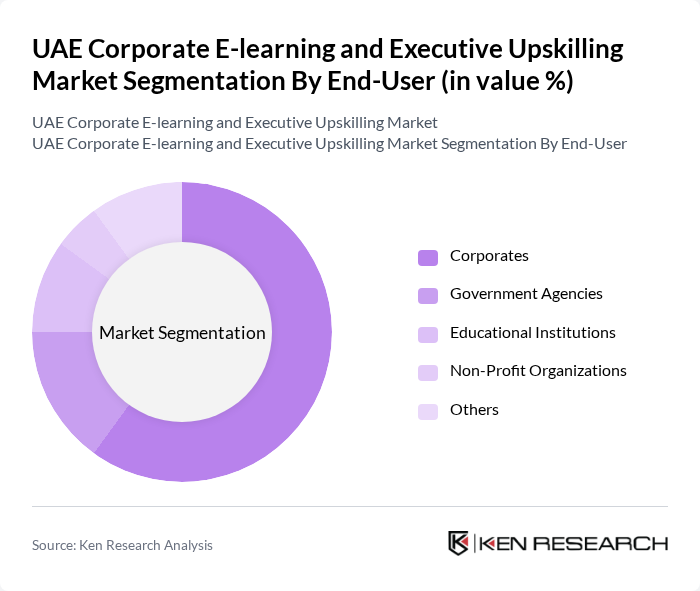

By End-User:The end-user segmentation includes corporates, government agencies, educational institutions, non-profit organizations, and others. Corporates are the leading end-users, driven by the need for employee training and development to keep pace with industry changes and technological advancements.

The UAE Corporate E-learning and Executive Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udacity, LinkedIn Learning, Skillsoft, Pluralsight, EdX, TalentLMS, Docebo, Moodle, SAP Litmos, Blackboard, Khan Academy, Simplilearn, FutureLearn, LearnWorlds contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE corporate e-learning market appears promising, driven by technological advancements and a growing emphasis on employee development. As organizations increasingly adopt blended learning models, the integration of AI and personalized learning experiences will likely enhance training effectiveness. Furthermore, the government's continued support for digital education initiatives will create a conducive environment for innovation, ensuring that e-learning solutions remain relevant and impactful in meeting the evolving needs of the workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Workshops Certification Programs Learning Management Systems (LMS) Microlearning Modules Corporate Training Solutions Others |

| By End-User | Corporates Government Agencies Educational Institutions Non-Profit Organizations Others |

| By Industry | Information Technology Healthcare Finance Retail Manufacturing Hospitality Others |

| By Learning Format | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Others |

| By Duration | Short Courses (Less than 1 month) Medium Courses (1-3 months) Long Courses (More than 3 months) Others |

| By Delivery Method | Instructor-Led Training Self-Paced Learning Hybrid Delivery Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate E-learning Adoption | 150 | HR Managers, Learning & Development Specialists |

| Executive Upskilling Programs | 100 | Training Coordinators, Senior Executives |

| Industry-Specific Training Needs | 80 | Department Heads, Skill Development Officers |

| Employee Engagement in E-learning | 120 | Employees from various sectors, Training Participants |

| Impact of E-learning on Performance | 90 | Performance Analysts, Business Unit Leaders |

The UAE Corporate E-learning and Executive Upskilling Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for digital learning solutions and the need for continuous professional development across various sectors.