Region:Middle East

Author(s):Dev

Product Code:KRAD0505

Pages:94

Published On:August 2025

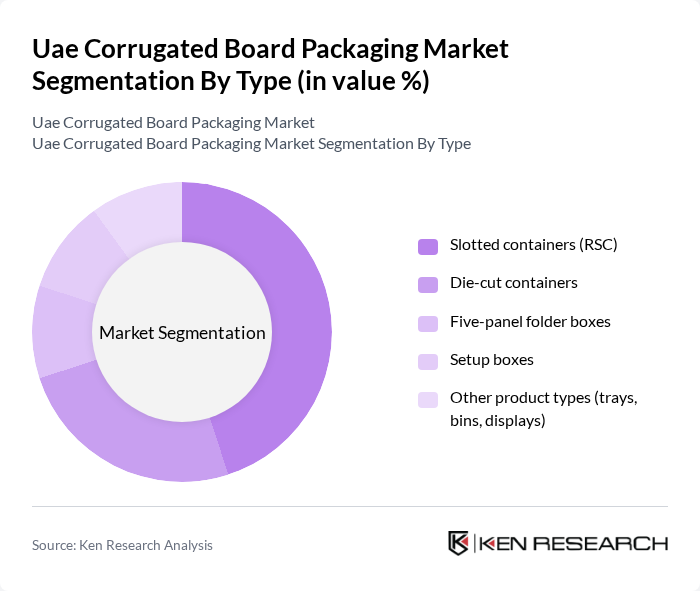

By Type:The corrugated board packaging market is segmented into various types, including slotted containers, die-cut containers, five-panel folder boxes, setup boxes, and other product types such as trays, bins, and displays. Among these, slotted containers (RSC) are the most widely used due to their versatility and cost-effectiveness, making them a preferred choice for various industries. Die-cut containers are also gaining traction, especially in retail, for their aesthetic appeal and customization options.

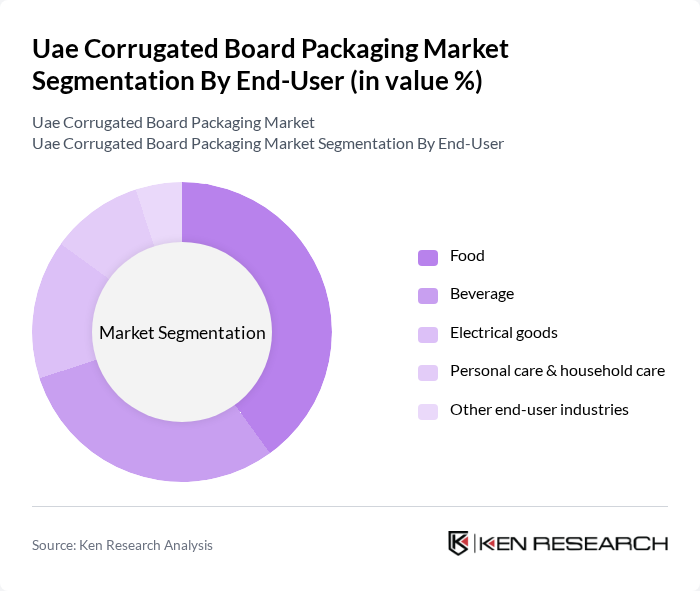

By End-User:The end-user segmentation includes food, beverage, electrical goods, personal care & household care, and other industries. The food and beverage sectors are the largest consumers of corrugated board packaging, driven by the need for safe and efficient packaging solutions that ensure product integrity during transportation and storage. The rise in online food delivery services has further accelerated the demand for packaging in these sectors.

The UAE Corrugated Board Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabian Packaging Co. LLC, Queenex Corrugated Carton Factory LLC, Gulf Carton Factory Co. LLC, Union Paper Mills (UPM), Al Rumanah Packaging, Al Salam Carton Manufacturing LLC, Universal Carton Industries LLC, Phoenix Carton Industries LLC, Emirates Printing Press LLC (Corrugated & Packaging), Hotpack Packaging Industries LLC, International Paper (Middle East & Africa) — UAE presence, DS Smith (Regional operations/import supply to UAE), Smurfit Kappa (Regional trading/import supply to UAE), NPP Packaging (National Printing Press Packaging), Falcon Pack contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE corrugated board packaging market appears promising, driven by a strong focus on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in sustainable materials and production methods. Additionally, the integration of smart technologies will enhance operational efficiency and customization capabilities. With the e-commerce sector continuing to expand, the demand for reliable packaging solutions will remain robust, positioning the market for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Slotted containers (RSC) Die-cut containers Five-panel folder boxes Setup boxes Other product types (trays, bins, displays) |

| By End-User | Food Beverage Electrical goods Personal care & household care Other end-user industries |

| By Application | E-commerce and parcel delivery Retail-ready packaging (RRP/SRP) Industrial shipping Protective/secondary packaging Displays and point-of-sale |

| By Distribution Channel | Direct sales (contracts with brands/retailers) Distributors Online/B2B portals Retail/wholesale outlets Others |

| By Material Type | Recycled liner/fluting Virgin kraft liner/fluting Coated/printed grades Specialty grades (moisture-resistant, heavy-duty) |

| By Board Grade | Single-wall (B/C/E flute) Double-wall (BC/EB) Triple-wall/heavy-duty Microflute & lightweight |

| By Printing/Finishing | Flexographic Digital Litho-laminate Value-added (coatings, die-cuts, laminations) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Packaging Managers, Quality Assurance Managers |

| Consumer Goods Packaging | 90 | Product Managers, Supply Chain Managers |

| Industrial Packaging Solutions | 80 | Operations Managers, Procurement Specialists |

| Export Packaging Requirements | 70 | Logistics Managers, Export Compliance Managers |

| Sustainability Initiatives in Packaging | 100 | Sustainability Managers, R&D Managers |

The UAE Corrugated Board Packaging Market is valued at approximately USD 1.35 billion, reflecting a significant growth trend driven by the demand for sustainable packaging solutions and the expansion of the e-commerce sector.