Region:Middle East

Author(s):Rebecca

Product Code:KRAD4235

Pages:100

Published On:December 2025

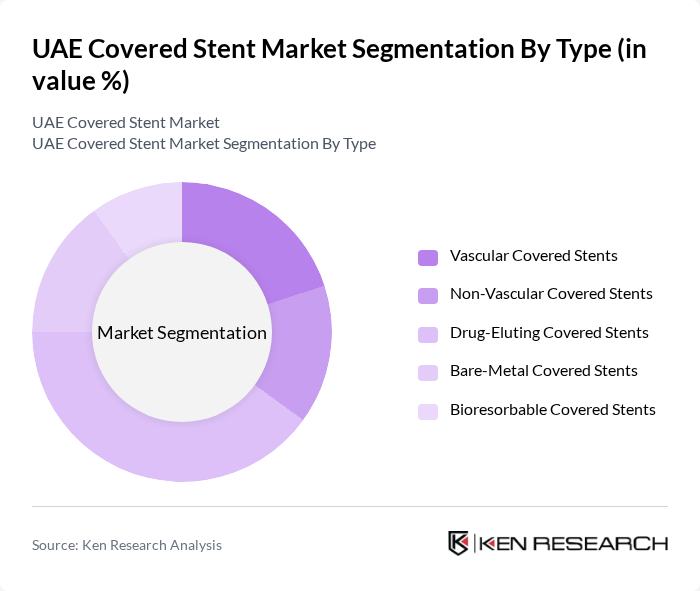

By Type:The market can be segmented into various types of covered stents, including Vascular Covered Stents, Non-Vascular Covered Stents, Drug-Eluting Covered Stents, Bare-Metal Covered Stents, and Bioresorbable Covered Stents. Vascular covered stents, particularly those used in peripheral and aortic endovascular procedures, account for a substantial share of overall covered stent use, reflecting the clinical focus on managing complex arterial diseases and aneurysms. Drug-Eluting Covered Stents are increasingly important due to their ability to release medication that helps prevent restenosis and maintain long-term vessel patency, making them a preferred choice for many healthcare providers in complex coronary and peripheral indications. The increasing awareness of the benefits of these stents among patients and physicians, supported by clinical guidelines favoring drug-eluting technologies over traditional bare-metal options, is driving their demand.

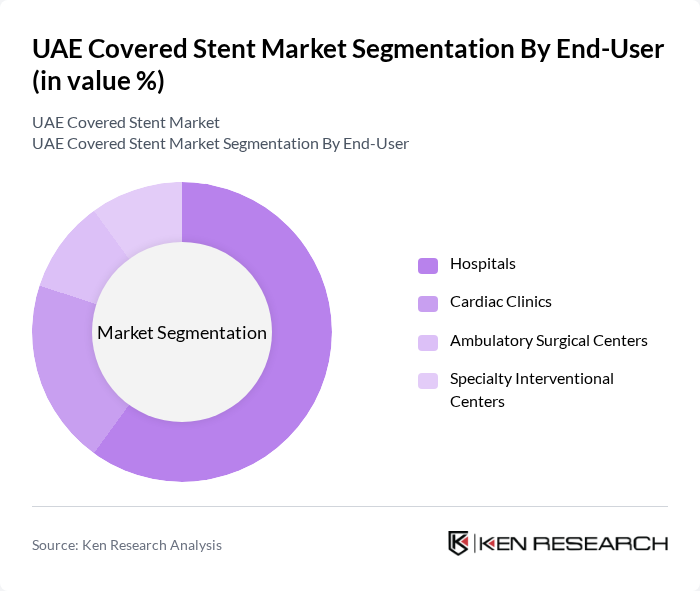

By End-User:The end-user segmentation includes Hospitals, Cardiac Clinics, Ambulatory Surgical Centers, and Specialty Interventional Centers. Hospitals dominate this segment due to their comprehensive catheterization laboratories, vascular surgery and interventional radiology units, and access to advanced imaging and hybrid operating rooms, which are essential for complex covered stent procedures. The increasing number of coronary and peripheral vascular interventions performed in multi-specialty hospitals, together with rising referrals from primary care and cardiac clinics, is driving the demand for covered stents in this setting. Ambulatory surgical centers and specialty interventional centers are gradually expanding their role as health systems shift suitable endovascular cases to lower-acuity, cost-efficient settings, further supporting segment growth.

The UAE Covered Stent Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Biotronik SE & Co. KG, Terumo Corporation, Cook Medical LLC, B. Braun Melsungen AG, Cordis Corporation (a Cardinal Health company), JOTEC GmbH (a Medtronic company), MedNova Medical Devices, Svelte Medical Systems, Inc., Endologix, Inc. (a Surmodics company), InspireMD, Inc., Avinger, Inc., W. L. Gore & Associates, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE covered stent market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centered care. As healthcare providers continue to adopt minimally invasive procedures, the demand for innovative stent solutions is expected to rise. Additionally, the integration of digital health technologies will enhance patient monitoring and outcomes, further solidifying the role of covered stents in cardiovascular treatment protocols. The market is poised for growth as stakeholders adapt to evolving healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Vascular Covered Stents Non-Vascular Covered Stents Drug-Eluting Covered Stents Bare-Metal Covered Stents Bioresorbable Covered Stents |

| By End-User | Hospitals Cardiac Clinics Ambulatory Surgical Centers Specialty Interventional Centers |

| By Material | Metallic Stents (Stainless Steel, Cobalt-Chromium, Nitinol) Polymer-Based Stents Composite Stents Others |

| By Procedure Type | Elective Procedures Emergency Procedures Others |

| By Distribution Channel | Direct Sales to Hospitals Medical Device Distributors Online Sales (B2B Platforms) Others |

| By Region | Abu Dhabi Dubai Sharjah Others (Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain) |

| By Patient Demographics | Age Group (Adults, Seniors) Gender (Male, Female) Comorbidities (Diabetes, Hypertension, Chronic Kidney Disease) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologist Insights | 45 | Interventional Cardiologists, Electrophysiologists |

| Hospital Procurement Strategies | 38 | Procurement Managers, Supply Chain Directors |

| Medical Device Distribution Channels | 32 | Distributors, Sales Representatives |

| Patient Experience and Outcomes | 28 | Cardiac Rehabilitation Specialists, Patient Advocates |

| Regulatory and Compliance Perspectives | 22 | Regulatory Affairs Managers, Quality Assurance Officers |

The UAE Covered Stent Market is valued at approximately USD 7 million, reflecting its growth driven by the rising prevalence of cardiovascular diseases, lifestyle-related risk factors, and advancements in stent technology.