Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3215

Pages:93

Published On:September 2025

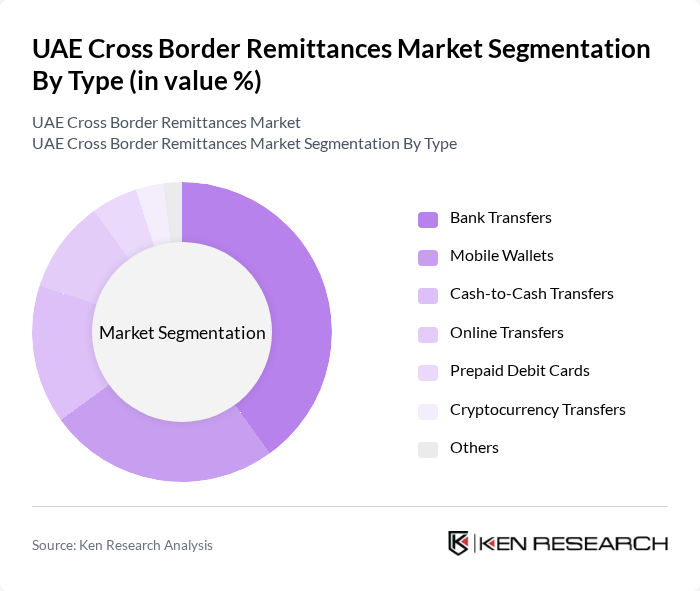

By Type:The segmentation by type includes various methods through which remittances are sent. The subsegments are Bank Transfers, Mobile Wallets, Cash-to-Cash Transfers, Online Transfers, Prepaid Debit Cards, Cryptocurrency Transfers, and Others.Bank Transfersremain the dominant channel, supported by established infrastructure and trust in the banking system.Mobile Walletsare rapidly gaining market share due to increasing smartphone penetration, digital payment adoption, and consumer preference for convenience and speed. The UAE’s digital pivot is further evidenced by a significant shift from physical exchange houses to mobile apps and online platforms, with nearly two-thirds of residents now preferring digital channels for remittance transfers.

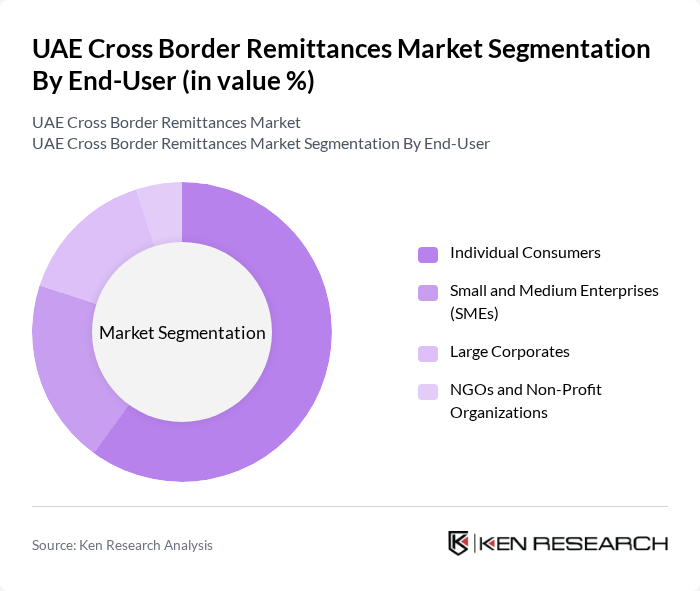

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporates, and NGOs and Non-Profit Organizations.Individual Consumersrepresent the largest segment, driven by the high volume of remittances sent by expatriates to their families and for humanitarian needs.SMEsalso contribute significantly, leveraging cross-border payment solutions for international business transactions and supply chain payments. The growing role of digital platforms and fintech solutions is making remittance services more accessible to both individuals and businesses.

The UAE Cross Border Remittances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), Remitly, Xoom (a PayPal Service), PayPal, Ria Money Transfer, WorldRemit, Al Ansari Exchange, UAE Exchange (now part of Finablr), Lulu Exchange, Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Mashreq Bank, First Abu Dhabi Bank (FAB), Al Fardan Exchange, Al Rostamani International Exchange, Sharaf Exchange, Mamo, Hubpay, Zand Bank, Ripple (for blockchain-based remittances) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cross-border remittances market appears promising, driven by technological advancements and an increasing expatriate population. As digital platforms gain traction, the market is likely to see a significant shift towards mobile and online remittance solutions. Additionally, partnerships between fintech companies and traditional banks are expected to enhance service offerings, making remittances more accessible and cost-effective for users. The focus on customer experience will further shape the competitive landscape, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash-to-Cash Transfers Online Transfers Prepaid Debit Cards Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporates NGOs and Non-Profit Organizations |

| By Payment Method | Bank Account Transfers Cash Payments Credit/Debit Card Payments Mobile Payments Blockchain-Based Payments |

| By Destination Region | South Asia (India, Pakistan, Bangladesh, etc.) Middle East (Egypt, Jordan, Lebanon, etc.) Africa (Nigeria, Kenya, Ethiopia, etc.) Southeast Asia (Philippines, Indonesia, etc.) Other Regions |

| By Frequency of Transactions | Daily Weekly Monthly Quarterly |

| By Transaction Size | Small Transactions (up to $500) Medium Transactions ($500 - $2,000) Large Transactions (above $2,000) |

| By Service Provider Type | Banks Exchange Houses Fintech Companies Money Transfer Operators (MTOs) Telecom/Payment Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Expatriates from South Asia, Africa, and the Philippines |

| Remittance Service Provider Insights | 60 | Managers and Executives from remittance companies |

| Banking Sector Perspectives | 50 | Banking Executives, Compliance Officers |

| Regulatory Impact Assessment | 40 | Policy Makers, Financial Regulators |

| Digital Remittance Trends | 70 | Tech Startups, Fintech Innovators |

The UAE Cross Border Remittances Market is valued at approximately USD 39 billion, reflecting its status as the second-largest hub for outbound remittances globally, driven by a significant expatriate population and increasing digitalization of financial services.