Region:Middle East

Author(s):Shubham

Product Code:KRAA8705

Pages:97

Published On:November 2025

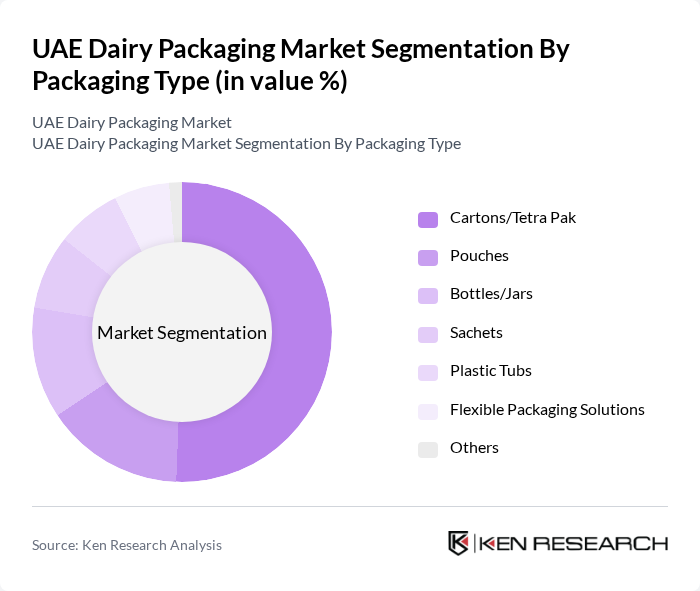

By Packaging Type:The packaging type segment includes various formats such as Cartons/Tetra Pak, Pouches, Bottles/Jars, Sachets, Plastic Tubs, Flexible Packaging Solutions, and Others. Cartons/Tetra Pak dominate the market due to their convenience, superior shelf stability, and ability to preserve product freshness. Pouches are gaining traction as a fast-growing format, appealing to on-the-go consumers and offering portion control with reduced packaging waste. Bottles and jars cater to premium dairy products, while sachets and tubs are popular for single-serve and dessert applications. Flexible packaging solutions are increasingly favored for their versatility, lightweight nature, and sustainability.

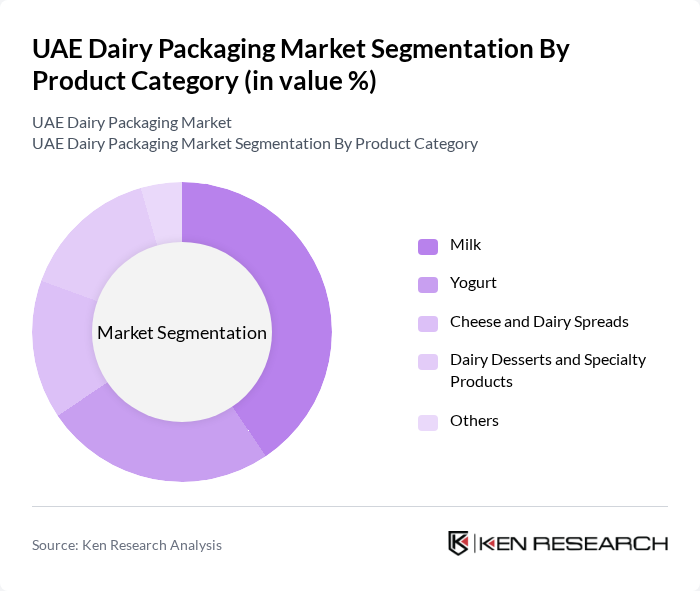

By Product Category:The product category segment encompasses Milk, Yogurt, Cheese and Dairy Spreads, Dairy Desserts and Specialty Products, and Others. Milk remains the leading product category, driven by high consumption rates, widespread household and food-service demand, and diverse packaging options. Yogurt, including spoonable and drinkable variants, is also popular due to its health benefits and convenience. Cheese and dairy spreads cater to a growing demand for convenience, while dairy desserts are increasingly favored for indulgence and variety. Specialty products are gaining traction as consumers seek unique flavors and experiences, including organic and fortified dairy items.

The UAE Dairy Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Dairy, Emirates Dairy, Almarai Company, Al Rawabi Dairy Company, Al Safi Danone, Nestlé Middle East and North Africa, Lactalis Group, FrieslandCampina, Danone Middle East, Tetra Pak, SIG Combibloc, Huhtamaki, Mondi Group, Sealed Air Corporation, Berry Global Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE dairy packaging market is poised for significant growth, driven by increasing consumer demand for health-oriented products and sustainable packaging solutions. As e-commerce continues to expand, dairy brands are likely to invest in innovative packaging that enhances product visibility and convenience. Additionally, collaborations with local dairy farms will foster a more resilient supply chain, ensuring quality and freshness. These trends indicate a dynamic market landscape, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Cartons/Tetra Pak (50.61% market share in 2024) Pouches (fastest-growing format at 6.18% CAGR through 2030) Bottles/Jars (premium segments for specialty products) Sachets (single-serve applications) Plastic Tubs (dairy desserts) Flexible Packaging Solutions Others |

| By Product Category | Milk (40.55% market share in 2024, 6.04% CAGR through 2030) Yogurt (spoonable and drinkable variants) Cheese and Dairy Spreads Dairy Desserts and Specialty Products Others |

| By Material Composition | Plastic (PET, HDPE, multilayer films) Paperboard and Carton Board Glass (premium and artisanal segments) Metal (cans for specialty products) Composite Materials |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Stores Direct-to-Consumer Models Food Service and Horeca |

| By Geographic Region | Dubai Abu Dhabi Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Sustainability Profile | Recyclable Packaging Solutions Biodegradable and Compostable Materials Reusable Container Systems Eco-Friendly Barrier Coatings Conventional Packaging |

| By Packaging Technology | Aseptic/UHT Packaging (extended shelf-life) Modified Atmosphere Packaging (MAP) Vacuum Packaging Active and Intelligent Packaging Digital Printing and Track-and-Trace Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Manufacturers | 80 | Production Managers, Quality Assurance Heads |

| Retail Outlets and Supermarkets | 50 | Store Managers, Category Buyers |

| Packaging Suppliers | 50 | Sales Directors, Product Development Managers |

| Consumer Focus Groups | 70 | Health-Conscious Consumers, Eco-Friendly Shoppers |

| Logistics and Distribution Firms | 30 | Logistics Managers, Supply Chain Analysts |

The UAE Dairy Packaging Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by increasing consumer demand for dairy products and a focus on sustainable packaging solutions.