Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9080

Pages:98

Published On:November 2025

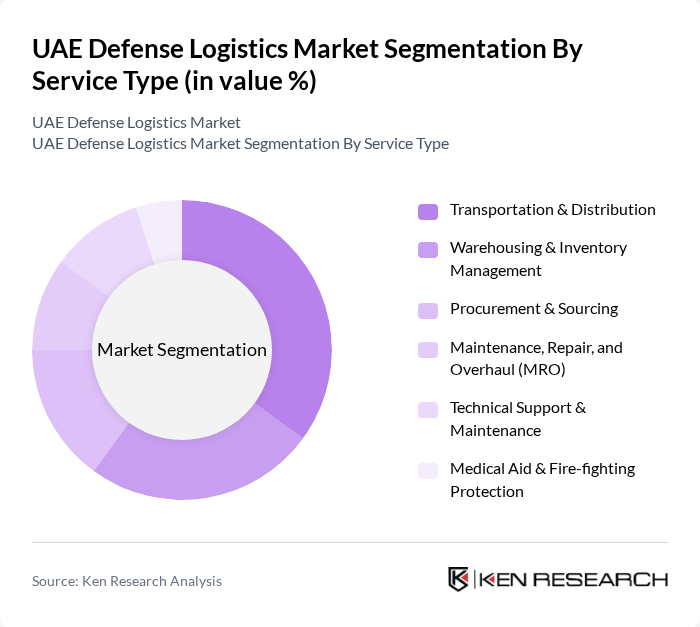

By Service Type:The service type segmentation includes various essential services that support defense logistics operations. The subsegments are Transportation & Distribution, Warehousing & Inventory Management, Procurement & Sourcing, Maintenance, Repair, and Overhaul (MRO), Technical Support & Maintenance, and Medical Aid & Fire-fighting Protection. Among these, Transportation & Distribution is the leading subsegment, driven by the increasing need for efficient movement of military supplies and personnel. The demand for rapid deployment capabilities and logistical support for military operations has significantly influenced this trend .

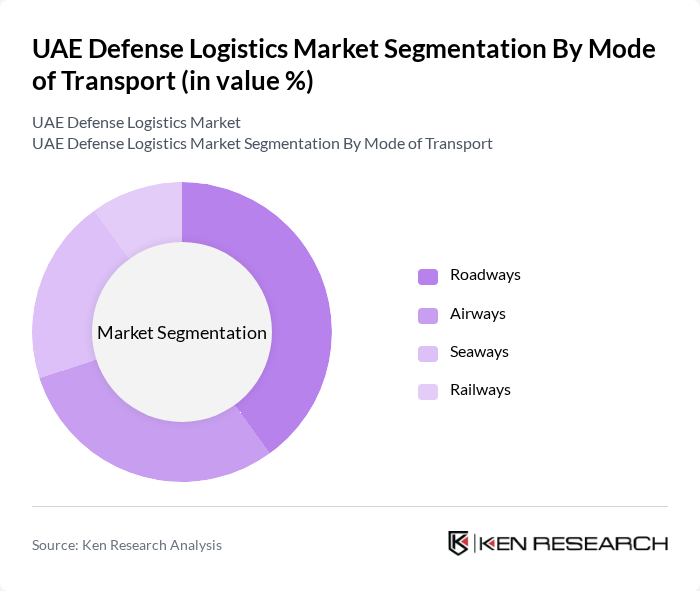

By Mode of Transport:The mode of transport segmentation encompasses various transportation methods utilized in defense logistics. The subsegments include Roadways, Airways, Seaways, and Railways. Among these, Roadways dominate the market due to their flexibility and ability to provide direct access to military bases and operational areas. The increasing focus on rapid deployment and the need for efficient ground transportation solutions have further solidified the importance of this mode in defense logistics .

The UAE Defense Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as EDGE Group, Emirates Defense Industries Company (EDIC), Abu Dhabi Ship Building (ADSB), Tawazun Economic Council, Al Jaber Group, International Golden Group (IGG), Lockheed Martin, BAE Systems, Northrop Grumman, General Dynamics, Rheinmetall AG, Leonardo S.p.A., L3Harris Technologies, Raytheon Technologies, Thales Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE defense logistics market is poised for significant transformation, driven by technological advancements and increased defense spending. As the government prioritizes military modernization, logistics providers will need to adapt to evolving demands. The integration of AI, automation, and data analytics will enhance operational efficiency, while strategic partnerships with global defense firms will foster innovation. Additionally, the focus on sustainable logistics practices will shape future operations, ensuring that the sector remains resilient and responsive to emerging challenges and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation & Distribution Warehousing & Inventory Management Procurement & Sourcing Maintenance, Repair, and Overhaul (MRO) Technical Support & Maintenance Medical Aid & Fire-fighting Protection |

| By Mode of Transport | Roadways Airways Seaways Railways |

| By End-User | Army Navy Air Force Government Agencies Private Defense Contractors |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Technology | Automated Logistics Systems RFID and Tracking Technologies Cloud-Based Logistics Solutions Others |

| By Application | Military Operations Humanitarian Aid Disaster Relief Others |

| By Investment Source | Government Funding Private Investments International Aid Others |

| By Commodity Type | Armament Military Troop Equipment Fuel & Provisions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Logistics Operations | 60 | Logistics Officers, Supply Chain Managers |

| Defense Procurement Processes | 50 | Procurement Specialists, Contract Managers |

| Supplier Relationship Management | 40 | Vendor Managers, Operations Directors |

| Technology Integration in Logistics | 40 | IT Managers, Systems Analysts |

| Logistics Training and Development | 40 | Training Coordinators, HR Managers |

The UAE Defense Logistics Market is valued at approximately USD 3.5 billion, driven by increased defense spending, strategic partnerships, and the demand for advanced logistics solutions to support military operations.