Region:Middle East

Author(s):Rebecca

Product Code:KRAC8579

Pages:90

Published On:November 2025

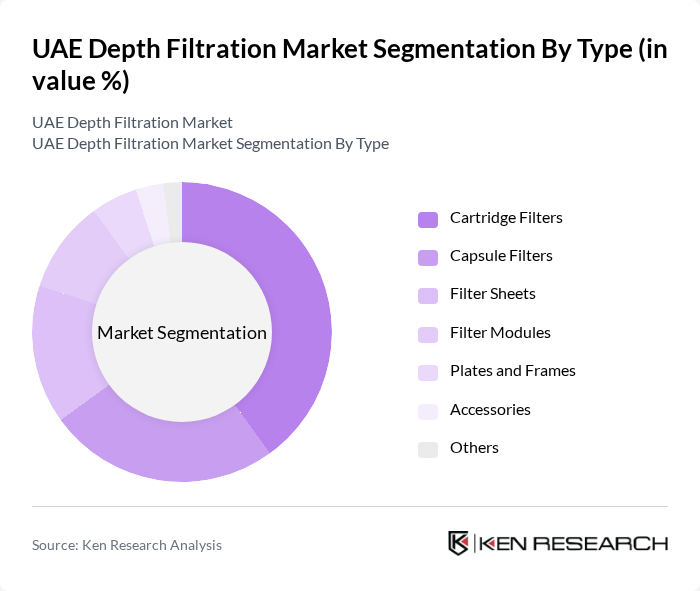

By Type:The depth filtration market can be segmented into various types, including Cartridge Filters, Capsule Filters, Filter Sheets, Filter Modules, Plates and Frames, Accessories, and Others. Among these, Cartridge Filters are gaining significant traction due to their versatility and efficiency in various applications, with global market data indicating cartridge filters commanding approximately 49.5% market share. Capsule Filters are also popular for their compact design and ease of use, particularly in the pharmaceutical and biotechnology sectors. The demand for Filter Sheets and Filter Modules is growing as industries seek to enhance their filtration processes.

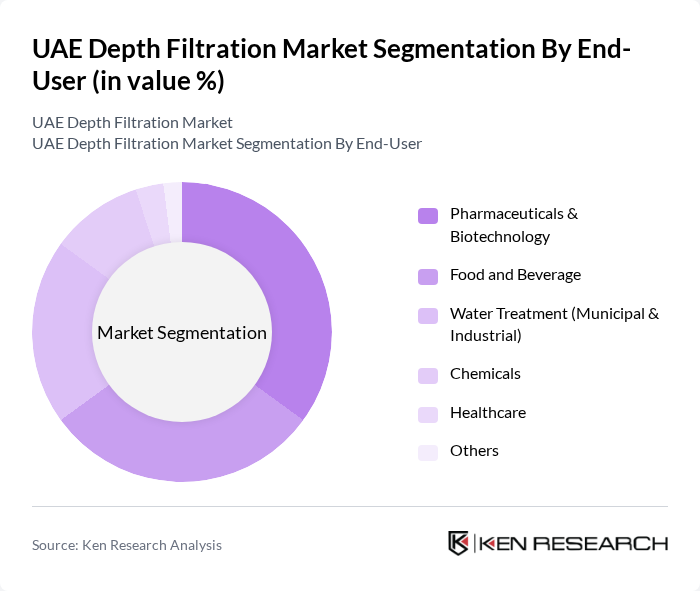

By End-User:The depth filtration market is segmented by end-user industries, including Pharmaceuticals & Biotechnology, Food and Beverage, Water Treatment (Municipal & Industrial), Chemicals, Healthcare, and Others. The Pharmaceuticals & Biotechnology sector is the leading end-user, driven by stringent regulatory requirements for product purity and safety, with global projections indicating this segment will secure approximately 42.5% market share by 2035. The Food and Beverage industry follows closely, as companies seek to ensure the quality and safety of their products through effective filtration solutions.

The UAE Depth Filtration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pall Corporation, 3M Company, Merck KGaA, Sartorius AG, SUEZ Water Technologies & Solutions, Eaton Corporation, Danaher Corporation (including Pall and Cytiva), Filtration Group, Ahlstrom-Munksjö, Graver Technologies, Donaldson Company, Veolia Water Technologies, Xylem Inc., Alfa Laval, Clarcor Inc. (a Parker Hannifin company), Porvair Filtration Group, Amazon Filters Ltd., Pentair plc, Mann+Hummel Group, Parker Hannifin Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE depth filtration market is poised for significant growth, driven by increasing investments in water treatment infrastructure and a shift towards sustainable practices. As the government implements stricter water quality standards, industries will need to adopt advanced filtration technologies to comply. Additionally, the integration of IoT in filtration systems is expected to enhance operational efficiency, providing real-time monitoring and data analytics, which will further propel market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cartridge Filters Capsule Filters Filter Sheets Filter Modules Plates and Frames Accessories Others |

| By End-User | Pharmaceuticals & Biotechnology Food and Beverage Water Treatment (Municipal & Industrial) Chemicals Healthcare Others |

| By Application | Final Product Processing Cell Clarification Raw Material Filtration Blood Separation Liquid Filtration Air Filtration Process Filtration Others |

| By Material / Media Type | Diatomaceous Earth Cellulose Activated Carbon Polypropylene Glass Fiber Perlite Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Technology | Conventional Filtration Advanced Filtration Technologies Hybrid Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Filtration | 50 | Quality Control Managers, Production Supervisors |

| Food & Beverage Processing | 40 | Operations Managers, Compliance Officers |

| Water Treatment Facilities | 45 | Plant Managers, Environmental Engineers |

| Industrial Applications | 40 | Procurement Managers, Technical Directors |

| Research & Development Labs | 40 | Lab Managers, Research Scientists |

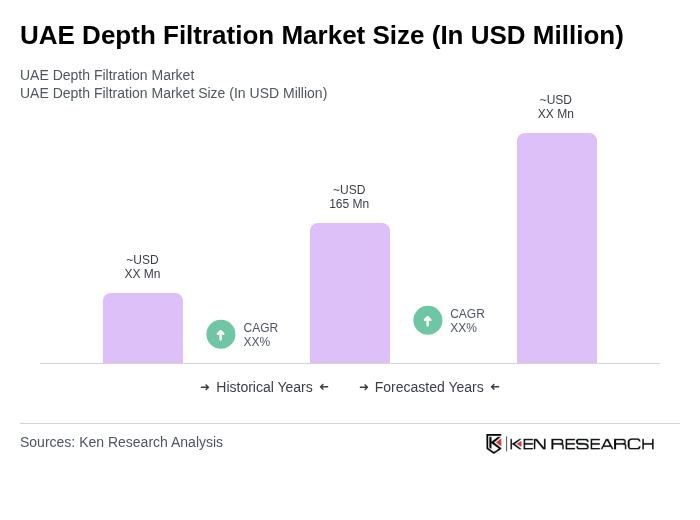

The UAE Depth Filtration Market is valued at approximately USD 165 million, driven by the increasing demand for high-quality filtration solutions across various industries, including pharmaceuticals, food and beverage, and water treatment.