Region:Middle East

Author(s):Shubham

Product Code:KRAB4411

Pages:96

Published On:October 2025

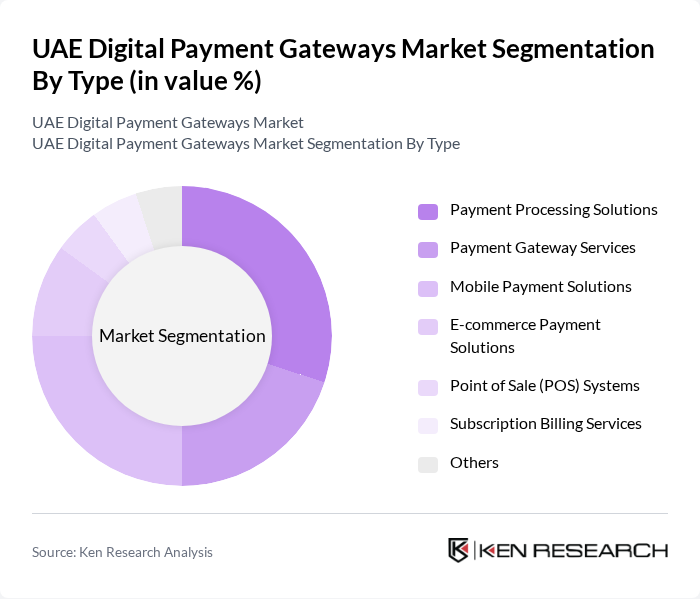

By Type:The market is segmented into various types, including Payment Processing Solutions, Payment Gateway Services, Mobile Payment Solutions, E-commerce Payment Solutions, Point of Sale (POS) Systems, Subscription Billing Services, and Others. Among these, Payment Processing Solutions and Mobile Payment Solutions are particularly prominent due to the increasing preference for seamless and efficient transaction methods.

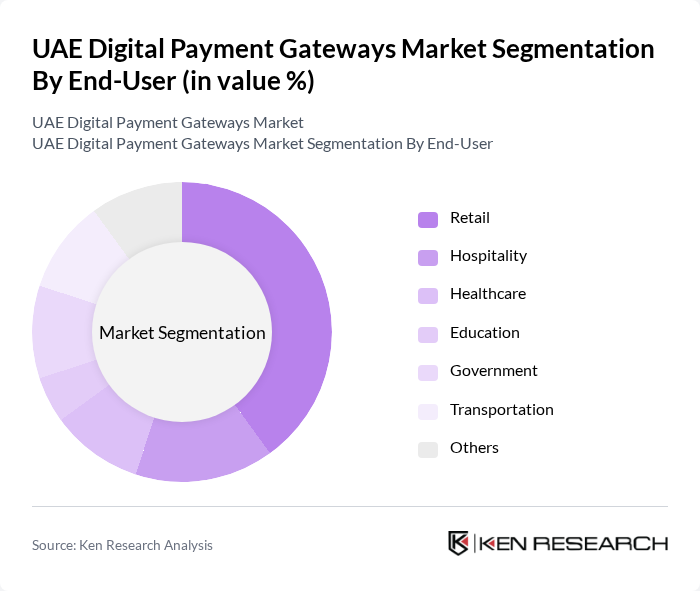

By End-User:The end-user segmentation includes Retail, Hospitality, Healthcare, Education, Government, Transportation, and Others. The Retail sector is the largest end-user, driven by the increasing trend of online shopping and the need for efficient payment solutions in physical stores.

The UAE Digital Payment Gateways Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayFort, Telr, Checkout.com, PayTabs, Adyen, Stripe, WorldPay, 2Checkout, CCAvenue, Fatoorah, HyperPay, Mollie, Razorpay, Square, Amazon Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital payment gateways market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance transaction security and streamline user experiences. Additionally, the growing trend of contactless payments and digital wallets will likely reshape the payment landscape, making transactions faster and more convenient. As the market matures, collaboration between fintech companies and traditional banks will further accelerate innovation and service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Payment Gateway Services Mobile Payment Solutions E-commerce Payment Solutions Point of Sale (POS) Systems Subscription Billing Services Others |

| By End-User | Retail Hospitality Healthcare Education Government Transportation Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery Cryptocurrency Others |

| By Industry Vertical | E-commerce Retail Travel and Tourism Telecommunications Financial Services Others |

| By Transaction Size | Micro Transactions Small Transactions Medium Transactions Large Transactions Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Payment Solutions | 150 | Retail Managers, Payment System Administrators |

| E-commerce Payment Gateways | 100 | E-commerce Directors, Digital Marketing Managers |

| Mobile Payment Adoption | 80 | Mobile App Developers, UX/UI Designers |

| Cross-border Payment Solutions | 70 | International Trade Managers, Compliance Officers |

| Fintech Innovations in Payments | 90 | Fintech Entrepreneurs, Product Managers |

The UAE Digital Payment Gateways Market is valued at approximately USD 5 billion, driven by the rapid adoption of digital payment solutions, increased smartphone penetration, and a growing preference for cashless transactions among consumers and businesses.