Region:Middle East

Author(s):Geetanshi

Product Code:KRAB3301

Pages:90

Published On:October 2025

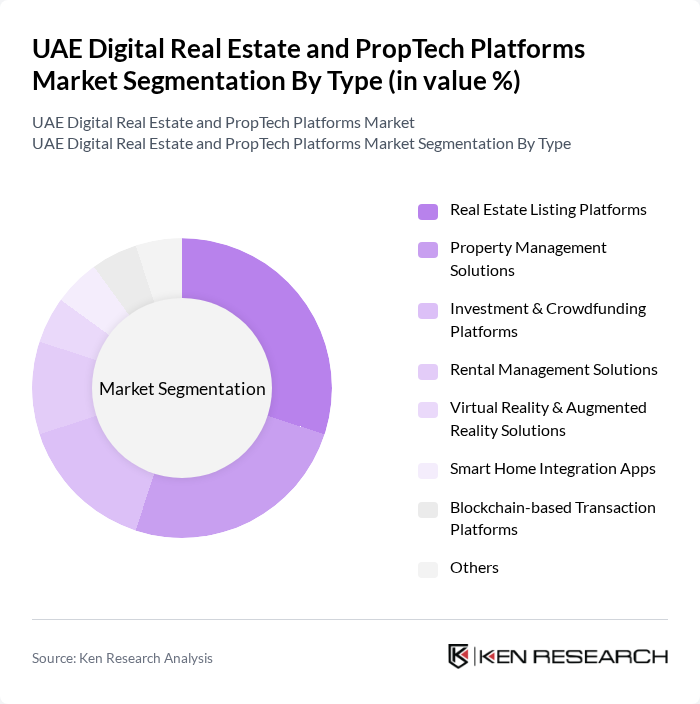

By Type:The market is segmented into various types, including Real Estate Listing Platforms, Property Management Solutions, Investment & Crowdfunding Platforms, Rental Management Solutions, Virtual Reality & Augmented Reality Solutions, Smart Home Integration Apps, Blockchain-based Transaction Platforms, and Others. Each segment plays a crucial role in enhancing the efficiency and effectiveness of real estate transactions, with immersive visualization tools and AI-driven analytics seeing accelerated adoption among developers and agents.

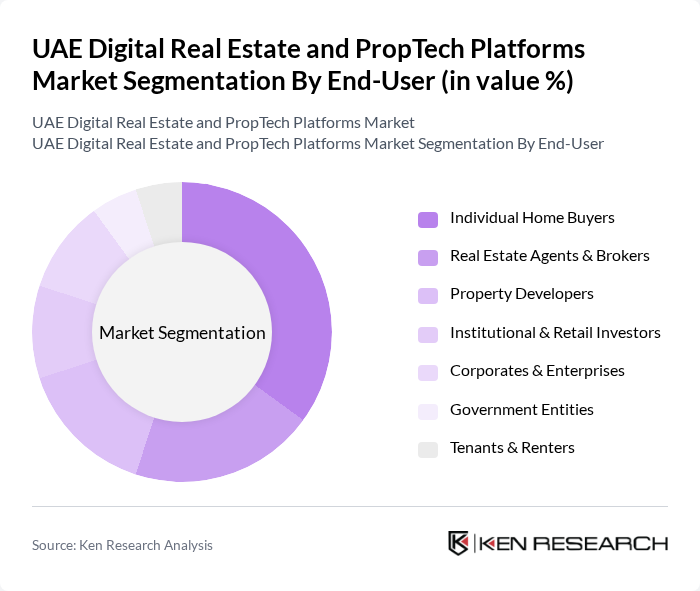

By End-User:The end-users of digital real estate and PropTech platforms include Individual Home Buyers, Real Estate Agents & Brokers, Property Developers, Institutional & Retail Investors, Corporates & Enterprises, Government Entities, and Tenants & Renters. Each user group has distinct needs and preferences that drive the demand for specific digital solutions, with individual buyers and agents increasingly relying on data-driven platforms for property search and transaction management.

The UAE Digital Real Estate and PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Dubizzle, Bayut, JustProperty, Aqarmap, Lifesize Plans Dubai, SmartCrowd, Provis, RAK Properties, Emaar Properties, Aldar Properties, DAMAC Properties, Nakheel, Azizi Developments, Dubai Investments, Sobha Realty, MENA Proptech Initiative contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Digital Real Estate and PropTech market appears promising, driven by ongoing technological advancements and increasing urbanization. As the population continues to grow, the demand for innovative real estate solutions will likely rise. Additionally, the integration of AI and big data analytics will enhance decision-making processes for buyers and sellers. The focus on sustainability and smart living will further shape the market, encouraging investments in eco-friendly properties and digital platforms that prioritize user experience and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Listing Platforms Property Management Solutions Investment & Crowdfunding Platforms Rental Management Solutions Virtual Reality & Augmented Reality Solutions Smart Home Integration Apps Blockchain-based Transaction Platforms Others |

| By End-User | Individual Home Buyers Real Estate Agents & Brokers Property Developers Institutional & Retail Investors Corporates & Enterprises Government Entities Tenants & Renters |

| By Sales Channel | Online Sales Platforms Offline Agency Sales Direct Developer Sales |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Application | Residential Sales & Leasing Commercial Sales & Leasing Property & Facility Management Real Estate Investment |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Policy Support | Subsidies for Smart Technologies Tax Incentives for Developers Regulatory Support for Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 80 | Real Estate Agents, Property Managers |

| Commercial Real Estate Solutions | 60 | Commercial Brokers, Investment Analysts |

| Property Management Software Users | 40 | Property Managers, IT Managers |

| Real Estate Investment Platforms | 50 | Investors, Financial Advisors |

| Digital Marketing for Real Estate | 45 | Marketing Managers, Digital Strategists |

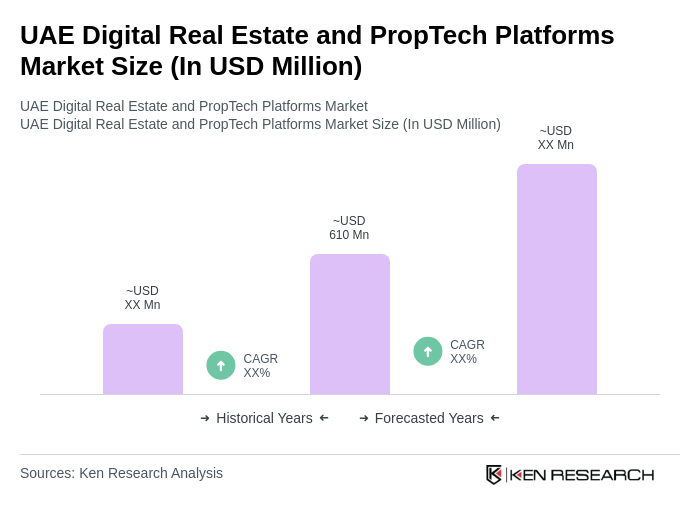

The UAE Digital Real Estate and PropTech Platforms Market is valued at approximately USD 610 million, reflecting significant growth driven by technological advancements and increased demand for digital solutions in real estate transactions.