Region:Middle East

Author(s):Rebecca

Product Code:KRAD8483

Pages:87

Published On:December 2025

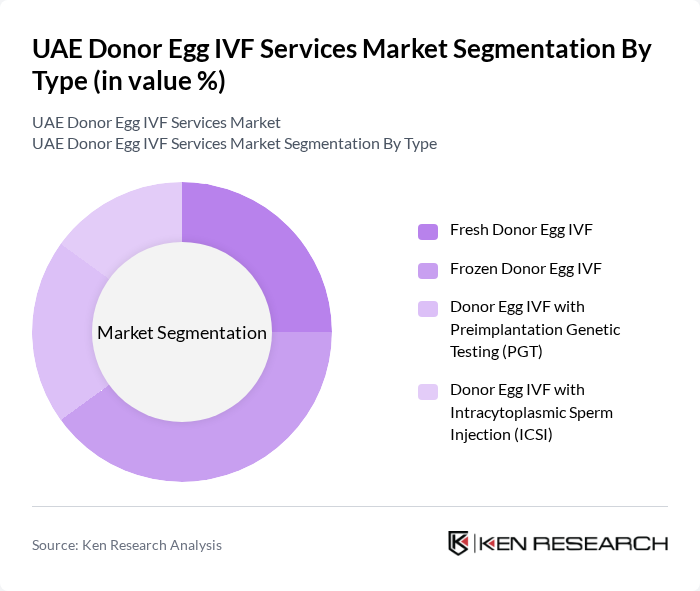

By Type:The market is segmented into various types of donor egg IVF services, including Fresh Donor Egg IVF, Frozen Donor Egg IVF, Donor Egg IVF with Preimplantation Genetic Testing (PGT), and Donor Egg IVF with Intracytoplasmic Sperm Injection (ICSI). Among these, Frozen Donor Egg IVF is gaining traction due to its convenience and flexibility for patients, allowing for better planning and timing of treatments as it eliminates the need for synchronized donor-recipient cycles and leverages established egg banks.

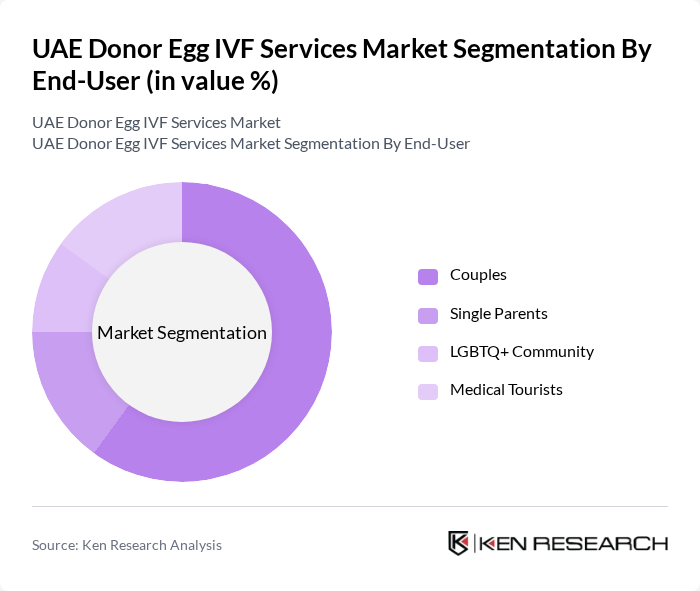

By End-User:The end-users of donor egg IVF services include Couples, Single Parents, the LGBTQ+ Community, and Medical Tourists. Couples represent the largest segment, driven by the increasing prevalence of infertility issues and the desire for family planning. The acceptance of donor egg IVF among single parents and the LGBTQ+ community is also on the rise, reflecting changing societal norms and greater inclusivity in reproductive health.

The UAE Donor Egg IVF Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fakih IVF Fertility Center, Bourn Hall Fertility Clinic, IVI Middle East Fertility Clinic, ART Fertility Clinics, Conceive Gynecology & Fertility Hospital, Orchid Fertility Clinic, New Hope IVF, HealthPlus Fertility Centre, The Dubai Center for Gynecology and Fertility, First IVF Fertility Center, Select IVF, Burjeel Hospital, HelpPlus Fertility Centre, Dubai Fertility Center, American Hospital Dubai (IVF Unit) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE donor egg IVF services market appears promising, driven by advancements in reproductive technologies and increasing societal acceptance of assisted reproductive methods. As the government continues to support fertility treatments, more couples are likely to explore donor egg IVF options. Additionally, the integration of telemedicine and personalized treatment plans is expected to enhance patient experiences, making fertility services more accessible and tailored to individual needs, ultimately fostering growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Donor Egg IVF Frozen Donor Egg IVF Donor Egg IVF with Preimplantation Genetic Testing (PGT) Donor Egg IVF with Intracytoplasmic Sperm Injection (ICSI) |

| By End-User | Couples Single Parents LGBTQ+ Community Medical Tourists |

| By Age Group | Under 30 35 40 Over 40 |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Northern Emirates |

| By Treatment Protocol | Standard IVF Protocol Natural Cycle IVF Preimplantation Genetic Diagnosis (PGD) Preimplantation Genetic Screening (PGS) |

| By Service Provider Type | Specialized Fertility Clinics Hospital-based IVF Units Multi-specialty Healthcare Centers Others |

| By Service Package | Basic Donor Egg IVF Package Comprehensive Donor Egg IVF Package Premium Donor Egg IVF Package with Genetic Testing Customized Treatment Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IVF Clinic Directors | 45 | Clinic Owners, Medical Directors |

| Patients Undergoing Donor Egg IVF | 120 | Infertility Patients, Couples Seeking Treatment |

| Reproductive Endocrinologists | 40 | Fertility Specialists, IVF Consultants |

| Healthcare Policy Makers | 25 | Health Ministry Officials, Regulatory Bodies |

| Fertility Support Groups | 30 | Patient Advocates, Support Group Leaders |

The UAE Donor Egg IVF Services Market is valued at approximately USD 320 million, reflecting a significant growth driven by increasing infertility rates and advancements in assisted reproductive technologies.