Region:Middle East

Author(s):Rebecca

Product Code:KRAC8519

Pages:82

Published On:November 2025

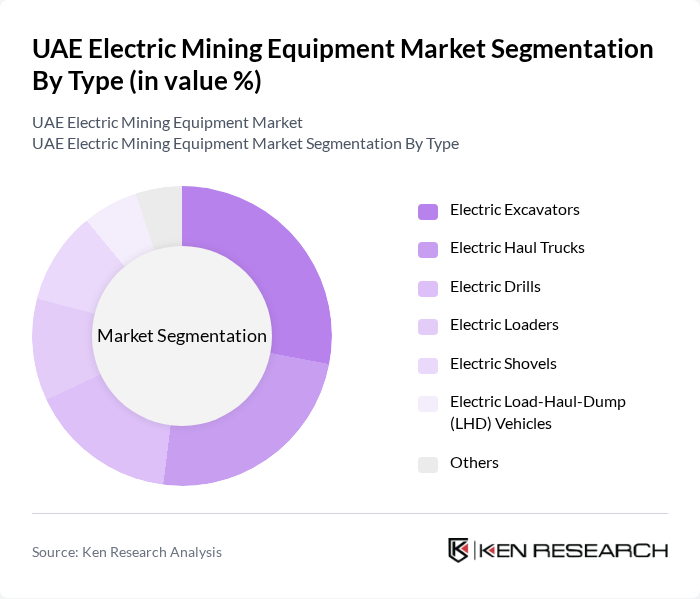

By Type:The market is segmented into various types of electric mining equipment, including Electric Excavators, Electric Haul Trucks, Electric Drills, Electric Loaders, Electric Shovels, Electric Load-Haul-Dump (LHD) Vehicles, and Others. Among these, Electric Load-Haul-Dump (LHD) Vehicles are currently leading the market in the underground segment due to their efficiency in material handling and adaptability to automated operations. The growing trend towards automation, electrification, and the need for reduced operational costs are driving the demand for LHDs and electric excavators, making them preferred choices for mining companies .

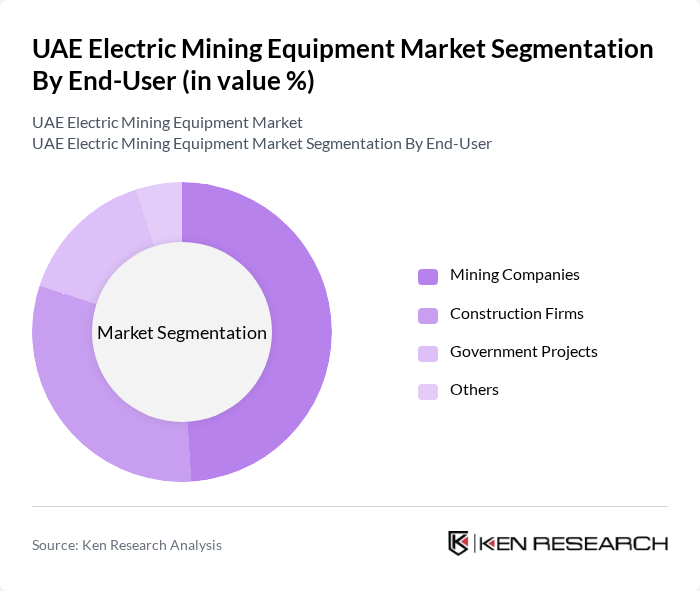

By End-User:The end-user segmentation includes Mining Companies, Construction Firms, Government Projects, and Others. Mining Companies are the leading end-users of electric mining equipment, driven by the need for efficient, safe, and sustainable operations. The increasing focus on reducing carbon footprints, enhancing productivity, and complying with environmental regulations is pushing these companies to adopt electric equipment, thereby dominating the market .

The UAE Electric Mining Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Sandvik AB, Epiroc AB, Liebherr Group, Doosan Infracore, JCB, Wirtgen Group, Atlas Copco AB, Terex Corporation, Bell Equipment, XCMG Group, and SANY Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE electric mining equipment market appears promising, driven by a combination of technological advancements and regulatory support. As the government continues to enforce stricter emission regulations, mining companies are likely to invest more in electric solutions. Additionally, the growing trend towards automation and IoT integration in mining operations will further enhance the efficiency and safety of electric equipment, positioning the UAE as a leader in sustainable mining practices in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Excavators Electric Haul Trucks Electric Drills Electric Loaders Electric Shovels Electric Load-Haul-Dump (LHD) Vehicles Others |

| By End-User | Mining Companies Construction Firms Government Projects Others |

| By Application | Surface Mining Underground Mining Quarrying Mineral Processing Others |

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Solid-State Batteries Others |

| By Charging Infrastructure | On-site Charging Stations Off-site Charging Solutions Mobile Charging Units Others |

| By Region | Abu Dhabi Dubai Sharjah Ras Al Khaimah Fujairah Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Mining Equipment Usage | 45 | Mining Operations Managers, Equipment Procurement Officers |

| Market Trends in Electric Equipment | 38 | Industry Analysts, Market Research Professionals |

| Regulatory Impact on Mining Equipment | 32 | Compliance Officers, Environmental Managers |

| Technological Innovations in Mining | 42 | R&D Managers, Technology Officers |

| Investment Trends in Electric Mining | 28 | Financial Analysts, Investment Managers |

The UAE Electric Mining Equipment Market is valued at approximately USD 430 million, driven by the increasing demand for sustainable mining practices and technological advancements in electric equipment.