Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1088

Pages:89

Published On:November 2025

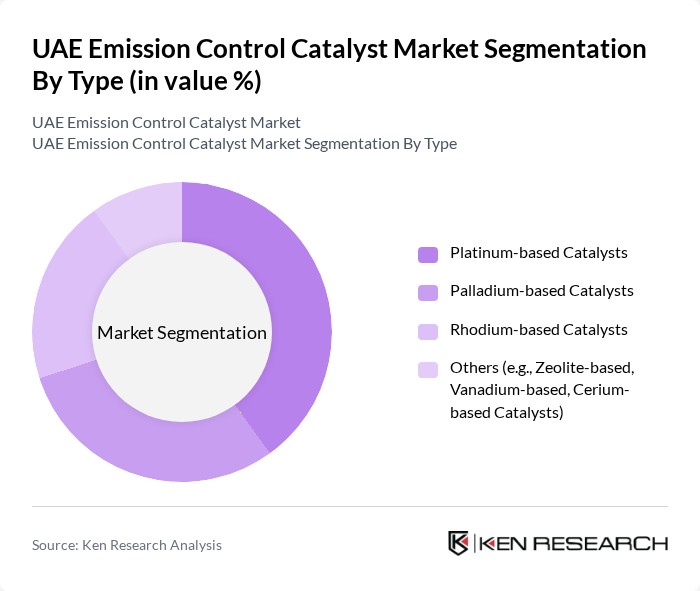

By Type:The segmentation of the market by type includes various catalyst formulations essential for controlling emissions from different sources. The subsegments are as follows:

The dominant subsegment in the market is the platinum-based catalysts, widely used in automotive applications due to their high efficiency in converting harmful emissions into less harmful substances. The adoption of stricter emission regulations has led to increased demand for these catalysts, particularly in passenger vehicles and commercial fleets. The high catalytic activity and durability of platinum-based catalysts continue to make them the preferred choice among manufacturers, reinforcing their market leadership .

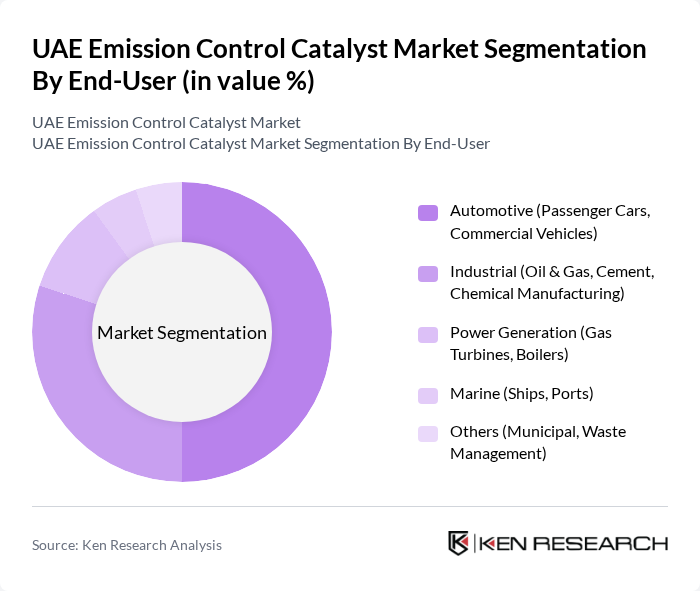

By End-User:The market is segmented based on the end-users who utilize emission control catalysts in their operations. The subsegments are as follows:

The automotive sector is the leading end-user of emission control catalysts, accounting for a significant portion of the market. This dominance is attributed to the increasing number of vehicles on UAE roads and the enforcement of stringent emission standards. Growing consumer awareness regarding environmental sustainability and the automotive industry's gradual shift towards electric and hybrid vehicles are also contributing factors. As a result, manufacturers are focusing on developing advanced catalysts to meet evolving regulatory and market demands .

The UAE Emission Control Catalyst Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Johnson Matthey, Umicore, Clariant AG, Haldor Topsoe, Albemarle Corporation, Honeywell UOP (Honeywell International Inc.), Tenneco Inc., Heraeus Group, Solvay SA, Cataler Corporation, Corning Incorporated, Mitsubishi Heavy Industries, Afton Chemical Corporation, and SABIC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE emission control catalyst market appears promising, driven by ongoing technological advancements and a strong regulatory framework. As the government continues to enforce stricter emission standards, the demand for innovative catalyst solutions is expected to rise. Additionally, the increasing focus on sustainability and the circular economy will likely encourage investments in cleaner technologies, fostering a competitive landscape that prioritizes environmental responsibility and efficiency in emissions management.

| Segment | Sub-Segments |

|---|---|

| By Type | Platinum-based Catalysts Palladium-based Catalysts Rhodium-based Catalysts Others (e.g., Zeolite-based, Vanadium-based, Cerium-based Catalysts) |

| By End-User | Automotive (Passenger Cars, Commercial Vehicles) Industrial (Oil & Gas, Cement, Chemical Manufacturing) Power Generation (Gas Turbines, Boilers) Marine (Ships, Ports) Others (Municipal, Waste Management) |

| By Application | Automotive Emission Control (Exhaust Aftertreatment) Industrial Emission Control (Flue Gas Treatment, Process Emissions) Power Generation (Stationary Source Emissions) Marine Emission Control Others |

| By Catalyst Formulation | Three-Way Catalysts (TWC) Selective Catalytic Reduction (SCR) Diesel Oxidation Catalysts (DOC) Lean NOx Trap (LNT) Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Regulatory Compliance Level | Euro 4 Standards Euro 5 Standards Euro 6 Standards UAE National Standards Others |

| By Market Maturity | Emerging Market Established Market Growth Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Emission Control Systems | 100 | Engine Manufacturers, Emission Control Engineers |

| Industrial Catalyst Applications | 80 | Plant Managers, Environmental Compliance Officers |

| Power Generation Emission Solutions | 70 | Energy Sector Executives, Regulatory Affairs Specialists |

| Research and Development in Catalysis | 50 | R&D Managers, Chemical Engineers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The UAE Emission Control Catalyst Market is valued at approximately USD 70 million, driven by stringent environmental regulations, rising vehicle emissions, and a focus on sustainable industrial practices across various sectors, including automotive and manufacturing.