Region:Middle East

Author(s):Dev

Product Code:KRAD7669

Pages:92

Published On:December 2025

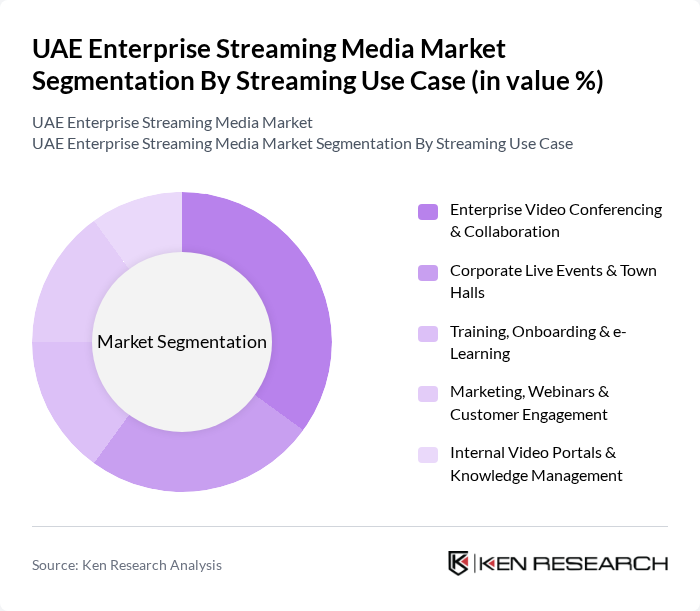

By Streaming Use Case:The streaming use case segmentation includes various applications such as enterprise video conferencing and collaboration, corporate live events and town halls, training, onboarding and e-learning, marketing, webinars and customer engagement, and internal video portals and knowledge management. This reflects global enterprise streaming usage patterns, where web conferencing, virtual meetings, and live corporate communications account for the largest share of activity. Among these, enterprise video conferencing and collaboration is the leading sub-segment, driven by the increasing need for remote and hybrid work communication solutions, cross?border project teams, and integration of video into daily workflows via tools such as unified communications platforms and team collaboration suites. Organizations are prioritizing seamless, secure collaboration tools with features like interactive webinars, screen sharing, and recording to enhance productivity, support distributed workforces, and maintain connectivity among teams.

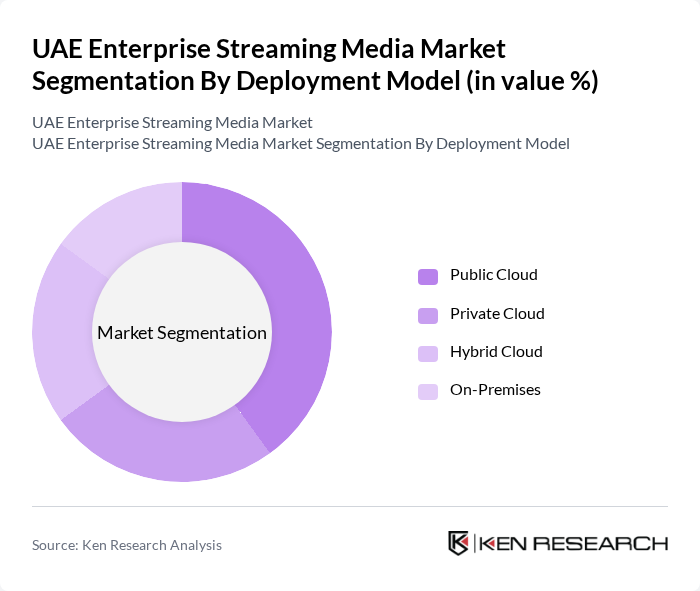

By Deployment Model:The deployment model segmentation encompasses public cloud, private cloud, hybrid cloud, and on-premises solutions. In line with broader streaming media and collaboration trends in the region, the public cloud segment is currently the most dominant for new deployments, as it offers scalability, pay?as?you?go economics, rapid provisioning, and ease of access for geographically distributed enterprises. Organizations are increasingly opting for public cloud and software?as?a?service streaming platforms to leverage reduced infrastructure costs, frequent feature updates, global content delivery networks, and better integration with productivity suites, making it a preferred choice for many businesses in the UAE, particularly outside of highly regulated or latency?sensitive use cases.

The UAE Enterprise Streaming Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Integrated Telecommunications Company PJSC (du), e& UAE (Emirates Telecommunications Group Company PJSC – e&), OSN (Orbit Showtime Network), Starzplay Arabia, Amazon Web Services (AWS) – AWS Elemental & CloudFront, Microsoft Corporation – Microsoft Teams & Microsoft Stream, Cisco Systems, Inc. – Cisco Webex, Zoom Video Communications, Inc., Google LLC – YouTube & Google Meet, Meta Platforms, Inc. – Workplace & Live Video, Kaltura Inc., Brightcove Inc., Vimeo.com, Inc., IBM Corporation – IBM Watson Media, Panopto, Inc. contribute to innovation, geographic expansion, and service delivery in this space, with strong emphasis on cloud?based delivery, security, analytics, and integration with broader enterprise IT and communication stacks.

The UAE enterprise streaming media market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As organizations increasingly embrace hybrid work models, the demand for interactive and engaging streaming solutions will rise. Furthermore, the integration of AI and machine learning will enhance content personalization, improving user experiences. Companies that adapt to these trends and invest in innovative streaming technologies will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Streaming Use Case | Enterprise Video Conferencing & Collaboration Corporate Live Events & Town Halls Training, Onboarding & e-Learning Marketing, Webinars & Customer Engagement Internal Video Portals & Knowledge Management |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Network & Delivery Architecture | CDN-Based Delivery Software-Defined Enterprise Content Delivery Network (eCDN) Peer-to-Peer (P2P) Streaming Multicast & Local Caching |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Government & Public Sector IT & Telecom Education & EdTech Healthcare Retail & E?commerce Oil & Gas and Industrial Media & Entertainment Enterprises |

| By Geographic Distribution (UAE) | Dubai Abu Dhabi Sharjah & Northern Emirates Others (Free Zones & Remote Sites) |

| By Commercial Model | Per-User Subscription (Seat-Based) Usage-Based / Consumption (Minutes, GB) Enterprise License / Site-Wide Agreements Embedded / OEM & Managed Service Bundles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Streaming Preferences | 120 | General Consumers, Streaming Service Subscribers |

| Content Creator Insights | 100 | Independent Filmmakers, Content Producers |

| Telecom Partnerships | 80 | Telecom Executives, Business Development Managers |

| Advertising Revenue Models | 70 | Marketing Directors, Ad Sales Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Legal Advisors in Media |

The UAE Enterprise Streaming Media Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, including government, telecom, and education.