Region:Middle East

Author(s):Rebecca

Product Code:KRAD4331

Pages:97

Published On:December 2025

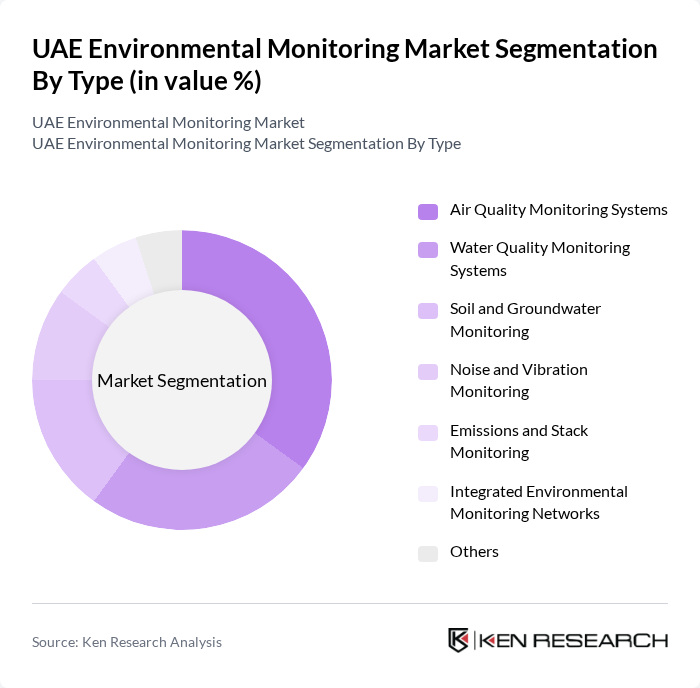

By Type:The market is segmented into various types of environmental monitoring systems, including Air Quality Monitoring Systems, Water Quality Monitoring Systems, Soil and Groundwater Monitoring, Noise and Vibration Monitoring, Emissions and Stack Monitoring, Integrated Environmental Monitoring Networks, and Others. Among these, Air Quality Monitoring Systems are currently leading the market due to increasing urban pollution levels and stringent regulations aimed at improving air quality. The growing public concern over health impacts related to air pollution has further accelerated the adoption of these systems.

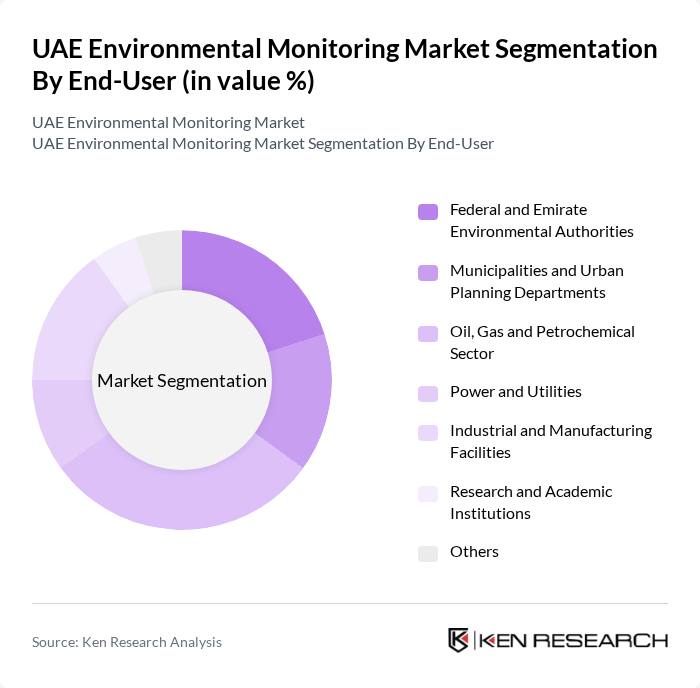

By End-User:The end-user segmentation includes Federal and Emirate Environmental Authorities, Municipalities and Urban Planning Departments, Oil, Gas and Petrochemical Sector, Power and Utilities, Industrial and Manufacturing Facilities, Research and Academic Institutions, and Others. The Oil, Gas, and Petrochemical Sector is the dominant end-user due to the stringent environmental regulations imposed on these industries, necessitating continuous monitoring of emissions and waste management practices. This sector's significant contribution to the UAE's economy further drives the demand for advanced monitoring solutions.

The UAE Environmental Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Environment Agency – Abu Dhabi (EAD), Dubai Municipality – Environment Department, UAE Ministry of Climate Change and Environment, Emirates Environmental Group (EEG), Dubai Electricity and Water Authority (DEWA), Abu Dhabi National Oil Company (ADNOC), SGS Gulf Limited, Intertek Testing Services UAE LLC, Bureau Veritas UAE, TÜV Rheinland Middle East, DNV AS (Middle East), AECOM Middle East, WSP Middle East, SUEZ Middle East Recycling LLC, Veolia Near & Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The UAE environmental monitoring market is poised for significant growth, driven by increasing government initiatives and technological advancements. As the nation strives to meet its Vision 2021 environmental goals, investments in smart technologies and sustainable practices will likely accelerate. Furthermore, the integration of AI and IoT in monitoring solutions will enhance data accuracy and real-time analysis, fostering a proactive approach to environmental management. This evolving landscape presents a promising future for stakeholders in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Quality Monitoring Systems Water Quality Monitoring Systems Soil and Groundwater Monitoring Noise and Vibration Monitoring Emissions and Stack Monitoring Integrated Environmental Monitoring Networks Others |

| By End-User | Federal and Emirate Environmental Authorities Municipalities and Urban Planning Departments Oil, Gas and Petrochemical Sector Power and Utilities Industrial and Manufacturing Facilities Research and Academic Institutions Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain and Others |

| By Technology | Fixed Station Monitoring Portable and Mobile Monitoring Devices Remote Sensing and Satellite-based Monitoring Sensor Networks and IoT-enabled Systems Data Management and Analytics Platforms Others |

| By Application | Ambient Air Quality Monitoring Industrial Emissions Monitoring Marine and Coastal Water Quality Monitoring Drinking Water and Wastewater Monitoring Construction and Infrastructure Project Monitoring Climate and Meteorological Monitoring Others |

| By Investment Source | Federal Government Budget Emirate and Municipal Government Funding Private Sector Capital Expenditure Public-Private Partnership (PPP) Programs Multilateral and International Funding |

| By Policy Support | National Climate and Sustainability Strategies Environmental Compliance and Enforcement Programs Incentives for Green Technology Adoption Standards and Guidelines for Environmental Monitoring Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Quality Monitoring Systems | 100 | Environmental Engineers, Compliance Managers |

| Water Quality Assessment Technologies | 80 | Water Resource Managers, Environmental Scientists |

| Waste Management Solutions | 70 | Waste Management Directors, Sustainability Officers |

| Soil Monitoring Technologies | 60 | Agricultural Scientists, Environmental Consultants |

| Regulatory Compliance Monitoring | 90 | Regulatory Affairs Managers, Policy Analysts |

The UAE Environmental Monitoring Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by regulatory requirements, public awareness of environmental issues, and investments in advanced monitoring technologies and infrastructure.