Region:Middle East

Author(s):Dev

Product Code:KRAA4628

Pages:99

Published On:September 2025

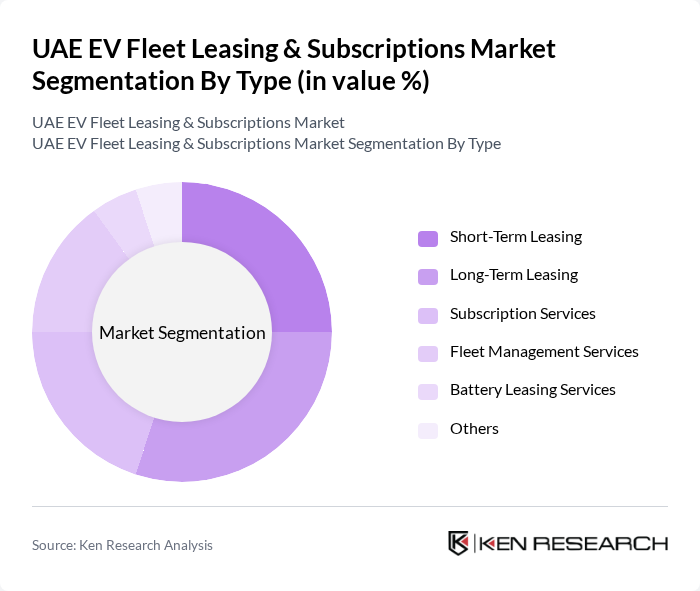

By Type:The market is segmented into Short-Term Leasing, Long-Term Leasing, Subscription Services, Fleet Management Services, Battery Leasing Services, and Others. Each of these segments addresses different consumer needs and preferences. Subscription services are gaining traction due to their flexibility, minimal commitment periods, and bundled maintenance offerings, while battery leasing services are emerging as a solution to reduce upfront costs for fleet operators .

The Long-Term Leasing segment is currently dominating the market due to its cost-effectiveness and the growing preference among businesses for stable, long-term contracts. Companies are increasingly opting for long-term leases to manage their fleets efficiently while minimizing upfront costs. This trend is further supported by the rising availability of electric vehicles, the expansion of charging infrastructure, and the integration of telematics and predictive maintenance, making long-term leasing a viable option for many organizations .

The UAE EV Fleet Leasing & Subscriptions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Transport, Al-Futtaim Automotive, Al Nabooda Automobiles, Al-Mazrouei Group, Al Jaber Group, Al-Futtaim Group, Al Ghandi Auto, Al Tayer Motors, Al Habtoor Motors, Al Qudra Holding, Al Ain Distribution Company, Emirates National Oil Company (ENOC), Dubai Investments, Abu Dhabi National Oil Company (ADNOC), Sharjah Investment and Development Authority (Shurooq), Dubai Roads and Transport Authority (RTA), Aramex, Careem, Amazon Middle East, and Sharjah Roads and Transport Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE EV fleet leasing and subscriptions market appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. As the infrastructure for EV charging continues to expand, more businesses are likely to consider transitioning their fleets to electric vehicles. Additionally, advancements in battery technology and the growing popularity of subscription models will further enhance the attractiveness of EV leasing, making it a viable option for both consumers and corporate clients in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Leasing Long-Term Leasing Subscription Services Fleet Management Services Battery Leasing Services Others |

| By End-User | Corporate Fleets Government Agencies Rental Services Logistics and Delivery Services Public Transport Operators Utilities and Real Estate Developers Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Light Trucks Heavy-Duty Trucks Electric Buses Electric Vans Others |

| By Subscription Model | Fixed Monthly Subscription Pay-Per-Use Subscription Flexible Subscription Plans Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Fleet Managers | 100 | Fleet Operations Managers, Procurement Officers |

| Leasing Companies | 80 | Business Development Managers, Sales Directors |

| EV Charging Infrastructure Providers | 60 | Technical Managers, Business Analysts |

| Corporate Sustainability Officers | 70 | Sustainability Managers, Environmental Compliance Officers |

| Ride-sharing Service Operators | 50 | Operations Managers, Fleet Coordinators |

The UAE EV Fleet Leasing & Subscriptions Market is valued at approximately USD 1.1 billion, driven by government initiatives, consumer awareness of sustainability, and the expansion of charging infrastructure.